Shareholder vote: January 25, 2022 for YSAC shareholders as of record December 22, 2021

Tal Keinan, a former Israeli Military pilot and the CEO of Sky Harbour, got the idea to start Sky when he couldn’t find a spot to park his plane. While this might be the ultimate “first world problem,” there exists a real gap in the private aviation industry of available hangars to park planes versus the growing private jet fleet.

This is where Sky Harbour comes into play, developing and leasing private aviation hangars at airports in the US.

Have a listen to the latest episode of Know Who Drives Return to hear Tal Keinan describe the business and its prospects.

Report Quick Links

Key Points

- Growing private business jet fleet and booming private aviation market, unlike shrinking commercial business travel

- Lack of available hangar space to house the newer, bigger jets coming to market

- Private, premium offering that’s more costly than a traditional FBO (fixed-base operator)

- Targeting over 50+ airfields for development

- Able to fund through long term debt, as revenue is from long-term rent contracts and not tied to short and medium-term volatility in fuel

- Not a tech-like VC investment, low revenue volatility and capital flexibility, think of it as a yield investment / real estate company

- Highly capital intensive on a project-by-project basis

Sky Harbour Overview

Latest Investor Presentation – January, 2022

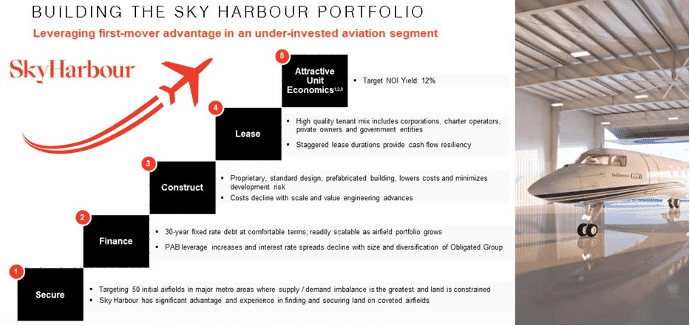

Sky develops and leases private aviation hangars within the US. The advantages to the aircraft owners to using a Sky Harbour hangar include privacy, convenience, service, and better aircraft value preservation. Albeit it comes at a pretty significant higher cost.

Their model differs from the traditional FBO model where the primary driver of traffic is transient traffic; meaning the planes don’t live at the airport, and whose business model relies largely on fuel costs. Sky’s “Home-Basing Solution” model is almost exclusively based on long-term hangar rent. Its tenants typically sign 5-10 year leases which are staggered, to lower vacancy.

The company is currently in development for 5 airfields: Houston, Nashville, Miami, Denver and Phoenix with a sixth, Houston, recently announced. Tal mentions that not all airport sponsors make a strategic fit, particularly ones that are primarily vacation-home destinations such as Aspen.

Current aspirations call for over 50 airfields, though company management is confident that number could grow given financing and demand.

While project up front capital cost is intensive, the company can pause development if need be. They don’t burn cash, and conversely, Tal mentions if they do need to pause on growth (not base case), cash flow will be robust. This provides a cost of capital advantage to the company.

Competitive Landscape and Valuation

The private aviation market has been beaming recently. Recent FBO acquisitions of KKR + Atlantic Aviation ($4.475B) and Blackstone/GIP + Signature ($4.7B) highlight the momentum in the industry, although there is some public debate at the elevated levels of those transaction values.

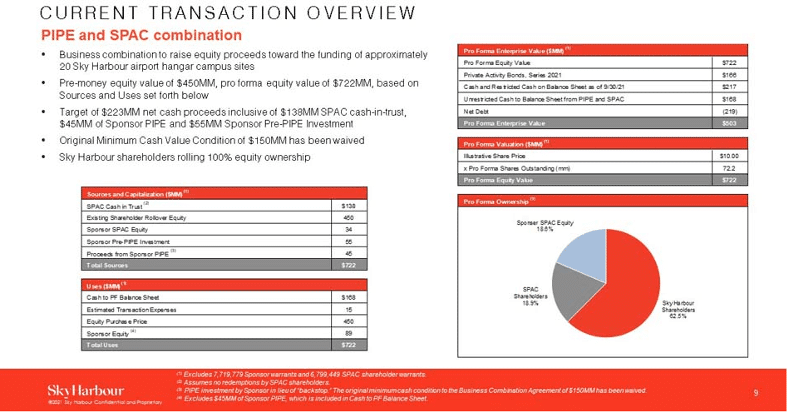

Sky, while not a behemoth FBO, is valued at pre-money equity value of $450M and PF post-money of $722M. There are no direct public comps for Sky, their mentioned valuation peers range across industrial real estate, public storage, and specialty real estate spaces (though they cite 2026E multiples).

Tal points out that while Sky had explored private equity investment offers they ultimately decided to go via the SPAC route to have access to both the debt and equity public capital markets, and the long-term alignment with Boston Omaha and Yellowstone (see below).

Capital Structure & Financing

As Tal points out, Sky Harbour is able to fund themselves via the public bond market, and have achieved attractive long-term debt rates. In August, Sky Harbour priced $166.3M of fixed-rate long term bonds (blended 4.28% rate) that will fund their airfield projects.

Sky Harbour & Yellowstone also announced a $70M FPA with Atalaya to (predominantly) backstop potential public shareholder redemptions at the merger vote on 1/25. The Yellowstone SPAC has $138M in its trust, though given where redemptions have been shaking out, and the signing of the FPA – don’t be shocked if that number goes lower.

The deal sources also include a significant $100M investment by the Sponsor in the form of a $55M Pre-PIPE investment (at cost) and an additional $45M PIPE (that was originally a backstop). The original minimum PF cash balance of $150M was waived.

SPAC Sponsor: Yellowstone Acquisition Corp (YSAC)

Yellowstone is led by Adam Peterson and Alex Rozek who are co-CEOs and co-Chairs of sponsor Boston Omaha Corporation’s (NYSE: BOMN) board of directors. The SPAC has $138M in its trust account after an October-2020 IPO, and marks the first SPAC from Peterson, Rozek and BOC.

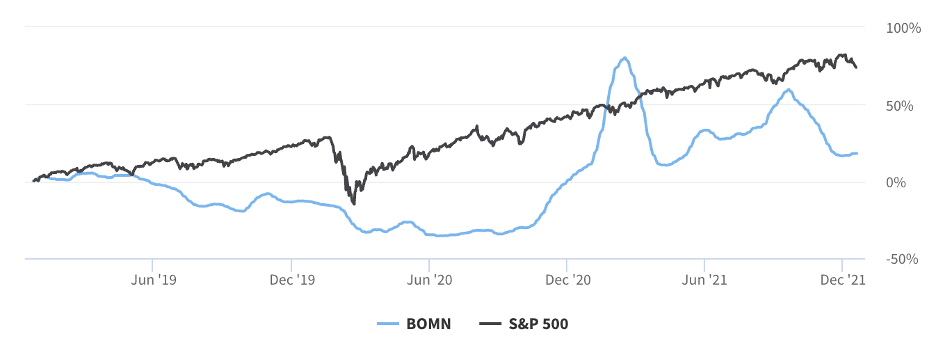

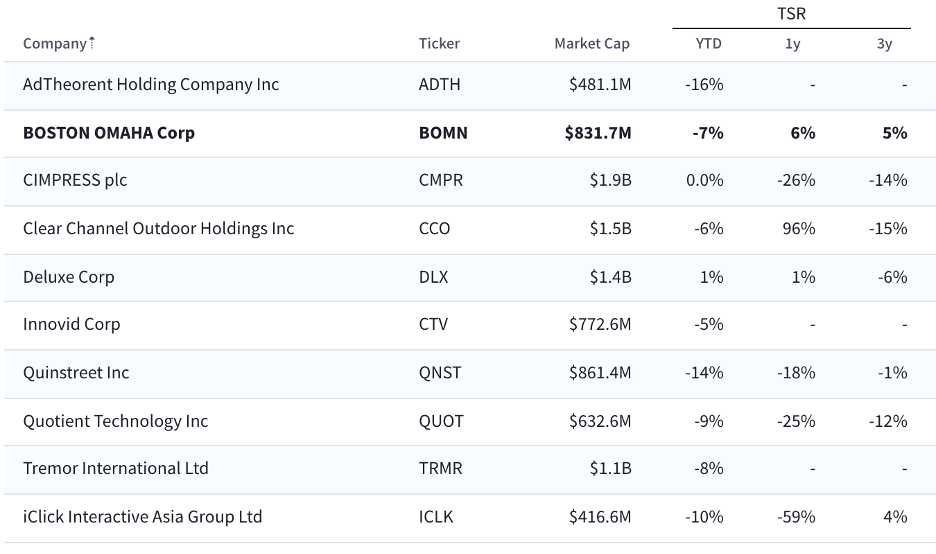

Peterson and Rozek led the IPO of Boston Omaha in June 2016 and have delivered annualized returns of around 15% since. The last three years have seen BOMN’s stock sagging and eventually coming back positive. While it is lagging the broader market, over the past year they’ve been one of the better performers in their industry.

BOMN vs SP500

BOMN vs Peers (Advertising Agencies – Small)

Related DeSPACs

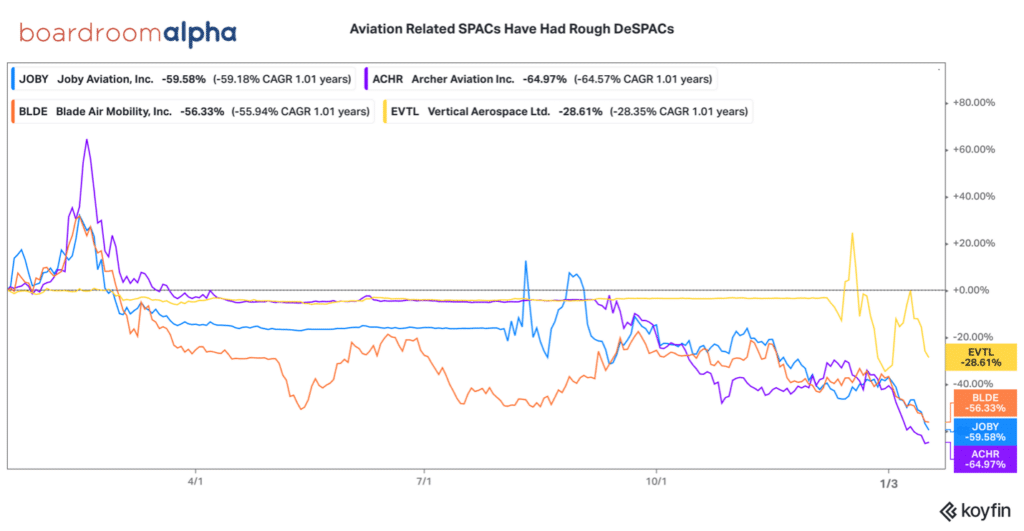

Again, not too much by the way of “direct” competition, but there certainly have been a number of aerospace/aviation related companies that have taken advantage of the SPAC vehicle such as JOBY, ACHR, EVTL, and BLDE. Though the majority of them might be categorized as more venture-like given the industries tend in the eVTOL space. Recent performance has struggled along with a lot of other early (or pre-revenue) tech-like venture SPACs.

About Tal Keinan

Mr. Keinan assembled and has led the Sky team since its inception in October 2017. Mr. Keinan has served as Co-Founder and Executive Chairman of Clarity Capital KCPS Ltd., a global asset-management firm, since September 2005. He has served as the chairman of Koret Israel Economic Development Funds, Israel’s largest nonprofit lender to small and micro businesses, since 2010.

Mr. Keinan is a veteran of the Israel Air Force, where he served for eighteen years, as an operational F-16 pilot and an air combat instructor, retiring with the rank of Lieutenant Colonel. He remains a licensed commercial pilot. Mr. Keinan holds a master’s degree in Business Administration from the Harvard Business School and is a graduate of The Israel Air Force Academy.

Podcast Topics

- Intro to Tal and history

- Background on the founding of Sky Harbour

- Why is there a supply / demand imbalance in hangars?

- Current market headwinds and impact of COVID on private travel

- Differentiated service of Sky vs. FBO model, and cost differences

- Lease characteristics and customers

- Airfield plans and current / future markets

- Funding characteristics for Sky Harbour’s model

- Why SPAC and why Yellowstone

- Future business opportunities away from business travel