Spotify rival Deezer said to be close to a DA. A $100M IPO for Southeast Asia-focused Aura FAT Projects Acquisition Corp. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

Spotify Rival to go Public via SPAC merger with I2PO

French streaming provider Deezer is said to be nearing a deal to go public via a merger with I2PO (I2PO), a European SPAC backed by France’s Pinault family, controlling shareholder of Gucci-owner Kering, and Centerview Partners banker Matthieu Pigasse. The company, a rival to Spotify Technology SA (SPOT), claims 16 million active users and is available in more than 180 countries. This is the second time the company is back at the deal table since it was founded in 2007. Deezer previously scrapped IPO plans after a decline in active listeners at internet radio operator Pandora Media Inc. triggered concerns about the outlook for streaming services. Pandora was subsequently acquired by Sirius in 2018 for $3 billion.

SPAC IPO: Aura Fat Projects Acquisition Corp. (AFARU) Prices $100M IPO

Aura Fat Projects Acquisition Corp. (AFARU) priced a $100M IPO today. The SPAC says it will target “new emerging technology companies with an acute growth potential in Southeast Asia and Australasia in sectors such as the Web 3.0, blockchain, cryptocurrency, digital ledger, e-gaming and other new financial technology and services sectors.”

Zanite Acquisition Corp. (ZNTE) / Eve Holding Sets Merger Date

Zanite Acquisition Corp. (ZNTE) / sets 5/6 to vote on merger with Eve Holding. EVE is the urban air mobility business created by Embraer S.A.(ERJ). Embraer, through its subsidiary Embraer Aircraft Holding, will hold an approximately 82% equity stake in Eve Holding following the closing of the business combination, including its investment in the PIPE.

Elsewhere in SPACs

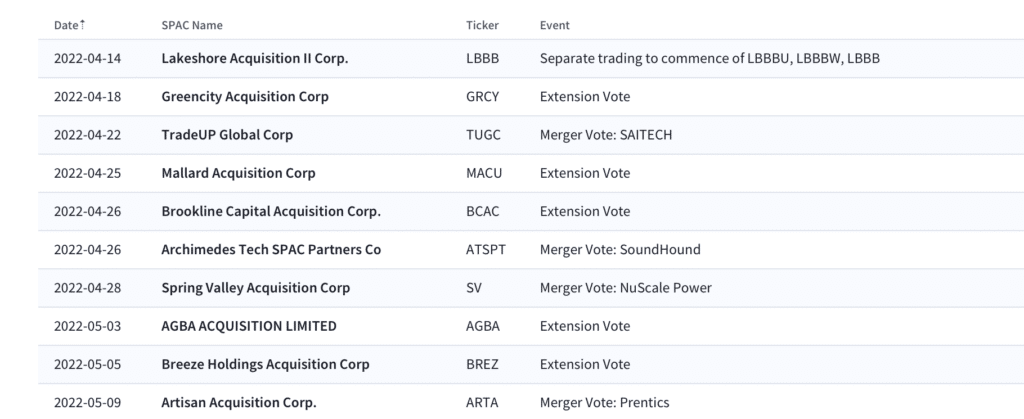

Upcoming Merger and Extension Votes

Today’s Price Movement

Biggest Gainers

2.87% ~ $ 11.10 | SV – Spring Valley Acquisition Corp (Announced)

2.13% ~ $ 10.08 | MEAC – Mercury Ecommerce Acquisition Corp (Pre-Deal)

1.89% ~ $ 49.04 | DWAC – Digital World Acquisition Corp. (Announced)

1.37% ~ $ 10.01 | BMAQ – Blockchain Moon Acquisition Corp. (Pre-Deal)

1.11% ~ $ 10.03 | TGAA – Target Global Acquisition I Corp. (Pre-Deal)

1.02% ~ $ 9.88 | ATAQ – Altimar Acquisition Corp. III (Pre-Deal)

.80% ~ $ 10.08 | APXI – APx Acquisition Corp. I (Pre-Deal)

.77% ~ $ 9.85 | JUGG – Jaws Juggernaut Acquisition Corporation (Pre-Deal)

.72% ~ $ 9.80 | DNAD – Social Capital Suvretta Holdings Corp. IV (Pre-Deal)

.72% ~ $ 9.80 | ARYE – ARYA Sciences Acquisition Corp V (Pre-Deal)

.72% ~ $ 9.82 | KYCH – Keyarch Acquisition Corp (Pre-Deal)

.71% ~ $ 9.89 | KRNL – Kernel Group Holdings, Inc. (Pre-Deal)

.71% ~ $ 9.95 | PACI – PROOF Acquisition Corp I (Pre-Deal)

.69% ~ $ 10.22 | UTAA – UTA Acquisition Corporation (Pre-Deal)

.62% ~ $ 9.75 | ALPA – ALPHA HEALTHCARE ACQUISITION CORP III (Pre-Deal)

.61% ~ $ 9.82 | DALS – DA32 Life Science Tech Acquisition Corp. (Pre-Deal)

.61% ~ $ 9.85 | FACA – Figure Acquisition Corp. I (Pre-Deal)

.61% ~ $ 9.87 | AURC – Aurora Acquisition Corp. (Announced)

.61% ~ $ 9.97 | DPCS – DP Cap Acquisition Corp I (Pre-Deal)

.61% ~ $ 9.97 | SVNA – 7 Acquisition Corp (Pre-Deal)

Biggest Losers

-.96% ~ $ 10.37 | IPOF – Social Capital Hedosophia Holdings Corp VI (Pre-Deal)

-.84% ~ $ 10.66 | THCA – Tuscan Holdings Corp. II (Pre-Deal)

-.80% ~ $ 9.90 | CFFS – CF Acquisition Corp. VII (Pre-Deal)

-.70% ~ $ 9.88 | DNAA – Social Capital Suvretta Holdings Corp. I (Announced)

-.46% ~ $ 9.80 | SPKB – Silver Spike Acquisition Corp II (Announced)

-.41% ~ $ 9.73 | SCAQ – Stratim Cloud Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.86 | ROCL – Roth CH Acquisition V Co. (Pre-Deal)

-.40% ~ $ 9.94 | SCUA – Sculptor Acquisition Corp I (Pre-Deal)

-.39% ~ $ 10.10 | LCAP – Lionheart Acquisition Corporation II (Announced)

-.35% ~ $ 9.94 | WNNR – Andretti Acquisition Corp. (Pre-Deal)

-.30% ~ $ 9.81 | GLBL – Cartesian Growth Corporation (Announced)

-.30% ~ $ 9.86 | WTMA – Welsbach Technology Metals Acquisition Corp. (Pre-Deal)

-.30% ~ $ 9.88 | JGGC – Jaguar Global Growth Corp I (Pre-Deal)

-.30% ~ $ 10.07 | AHPA – Avista Public Acquisition Corp. II (Announced)

-.29% ~ $ 10.14 | NLIT – Northern Lights Acquisition Corp. (Announced)

-.29% ~ $ 10.25 | ATA – AMERICAS TECHNOLOGY ACQUISITION CORP. (Pre-Deal)

-.26% ~ $ 11.30 | CFVI – CF Acquisition Corp. VI (Announced)

-.21% ~ $ 9.65 | CDAQ – Compass Digital Acquisition Corp. (Pre-Deal)

-.21% ~ $ 9.70 | TPBA – TPB Acquisition Corporation I (Pre-Deal)

-.20% ~ $ 9.75 | GLHA – Glass Houses Acquisition Corp. (Pre-Deal)

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.