DeSPAC PGY Falls on Day 1, with Polestar Next to Debut

EJF Acquisition (EJFA) officially closed and began trading as Pagaya (PGY) today, as shares swiftly dropped another (15)% to close at $5.95. It’s been the norm for DeSPACs to get hit in this market as overall DeSPAC sentiment remains muted.

Will things change tomorrow? Gores Guggenheim (GGPI) shares jumped today, their last day trading as a SPAC, to close at $11.23. The company announced low redemptions of 20% (the low for 2022), and it seems as if investors are excited about Polestar’s prospects. Can one good SPAC story help restore the market?

Adara Acquisition Corp (ADRA) had the sole deal announcement of the day, a $480M EV pact for entertainment distributor Alliance Entertainment. ADRA is led by Thomas Finke, former Barings Chairman and CEO. Warrants jumped a cool +100% to 26c (all warrant prices are very depressed right now), with not much action in the commons.

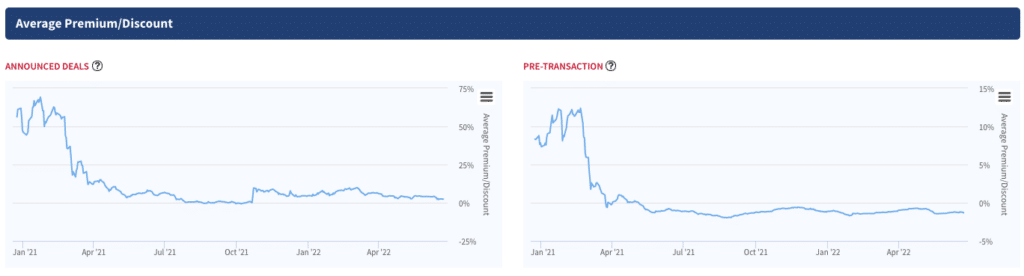

And alas, with issuance at the lows (just two IPOs in June) and sentiment not much higher, we reiterate that SPACs are trading at their biggest discount on record. Likely not many DWAC / LCID / CFIV pre-close jumps out there in the near term, but still a solid risk-free return (with upside) to be had.

Elsewhere in SPACs

Grove Collaborative (GROV) filed its long awaited redemption figures, clocking in at over 39M shares or 99% of trust. Its combination with Virgin Group Acquisition II (VGII) closed last week.

SPAC votes for the week wrap tomorrow with Northern Light’s (NLIT) vote on Safe Harbour. 3 Votes are currently on tap for next week:

- Agrico Acquisition Corp (RICO) vote on Kalera

- E. Merge Technology Acquisition Corp. (ETAC), looking to extend 3 months from August to November

- Vickers Vantage I (VCKA), looking to extend up to 6 months from July to January, depositing $0.033 per share, per month past September the SPAC takes to consummate a business combination.

Biggest Daily Movers

Biggest Gainers

1.61% ~ $ 10.12 | CBRG – Chain Bridge I (Pre-Deal)

1.48% ~ $ 8.90 | NLIT – Northern Lights Acquisition Corp. (Announced)

1.27% ~ $ 10.34 | ESSC – East Stone Acquisition Corporation (Announced)

1.11% ~ $ 9.99 | FHLT – Future Health ESG Corp. (Announced)

.92% ~ $ 9.88 | AGGR – Agile Growth Corp. (Pre-Deal)

.81% ~ $ 10.01 | ROCG – Roth CH Acquisition IV Co. (Pre-Deal)

.80% ~ $ 10.10 | IFIN – InFinT Acquisition Corporation (Pre-Deal)

.62% ~ $ 9.69 | IPAX – Inflection Point Acquisition Corp. (Pre-Deal)

.62% ~ $ 9.78 | TCVA – TCV Acquisition Corp. (Pre-Deal)

.61% ~ $ 9.86 | WALD – Waldencast Acquisition Corp. (Announced)

.61% ~ $ 9.93 | CLRC – ClimateRock (Pre-Deal)

.55% ~ $ 10.07 | DHAC – Digital Health Acquisition Corp. (Announced)

.51% ~ $ 9.80 | TIOA – Tio Tech A (Pre-Deal)

.51% ~ $ 9.80 | GXII – GX Acquisition Corp. II (Pre-Deal)

.51% ~ $ 10.04 | TETE – Technology Telecommunication Acquisition Corp (Pre-Deal)

.51% ~ $ 9.94 | SAGA – Sagaliam Acquisition Corp (Pre-Deal)

.50% ~ $ 9.97 | DECA – Denali Capital Acquisition Corp. (Pre-Deal)

.50% ~ $ 9.97 | SMAP – Sportsmap Tech Acquisition Corp. (Pre-Deal)

.50% ~ $ 10.04 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

.46% ~ $ 9.84 | PNTM – Pontem Corp (Pre-Deal)

Biggest Losers

-2.53% ~ $ 9.65 | GHIX – Gores Holdings IX, Inc. (Pre-Deal)

-2.28% ~ $ 9.02 | RICO – Agrico Acquisition Corp. (Announced)

-.90% ~ $ 9.87 | NPAB – New Providence Acquisition Corp. II (Pre-Deal)

-.71% ~ $ 9.75 | DISA – Disruptive Acquisition Corp I (Pre-Deal)

-.71% ~ $ 9.77 | GTPA – Gores Technology Partners, Inc (Pre-Deal)

-.70% ~ $ 9.92 | SGHL – Signal Hill Acquisition Corp. (Pre-Deal)

-.70% ~ $ 9.98 | MNTN – Everest Consolidator Acquisition Corp (Pre-Deal)

-.63% ~ $ 9.88 | GIAC – Gesher I Acquisition Corp. (Announced)

-.62% ~ $ 9.68 | CORS – Corsair Partnering Corporation (Pre-Deal)

-.51% ~ $ 9.75 | BGSX – Build Acquisition Corp. (Pre-Deal)

-.50% ~ $ 9.94 | SVNA – 7 Acquisition Corp (Pre-Deal)

-.50% ~ $ 10.02 | KINZ – KINS Technology Group Inc. (Pre-Deal)

-.48% ~ $ 9.86 | PRLH – Pearl Holdings Acquisition Corp (Pre-Deal)

-.41% ~ $ 9.74 | AFAQ – AF Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.85 | ZING – FTAC Zeus Acquisition Corp. (Pre-Deal)

-.40% ~ $ 10.05 | CFVI – CF Acquisition Corp. VI (Announced)

-.35% ~ $ 9.92 | GLTA – Galata Acquisition Corp (Pre-Deal)

-.31% ~ $ 9.66 | HWEL – Healthwell Acquisition Corp. I (Pre-Deal)

-.31% ~ $ 9.66 | WAVC – Waverley Capital Acquisition Corp. 1 (Pre-Deal)

-.31% ~ $ 9.70 | JUGG – Jaws Juggernaut Acquisition Corporation (Pre-Deal)

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.