“Gamma squeeze” has been a popular term thrown around in the mainstream over the past year, really kicking off with the GME and AMC mania of late 2020 / early 2021. This trend spilled over into SPACs as well, predominantly in the form of heavily redeemed (i.e. low float) SPACs. This post is aimed to, in plain English, explain the concept of a gamma squeeze, where they happen in SPACs and how you can be on the lookout for them.

What is a Gamma Squeeze?

In very simple terms, an option’s delta represents the amount that option’s price will move relative to a move in the underlying share price. A high delta means that a given option’s price will move a lot if the stock moves, and likely means the stock is trading higher than or very near that option’s call price.

Gamma represents the change in delta resulting from the underlying security change. As a result, as a stock price rises, so does its delta (the amount it rises varies on where the given option was struck). Market makers, those who sell options to the investors, often need to hedge, or cover, their synthetic short positions by buying common shares.

This circular effect, the sale of call options and subsequent purchase of stock, results in an increased stock price that can be quite pronounced, and is often referred to as a gamma squeeze given a sharp rise in gamma.

How do they happen in SPACs?

This dynamic in SPACs results from high public shareholder redemptions at the time of the merger vote resulting in a very low tradeable float immediately following the business combination, causing wild price action in the remaining shares available to trade.

The low float is due to the fact that SPAC founder shares, PIPE investors, and existing company shareholders are all (usually) locked up from trading for a certain period of time following a DeSPAC. So, for example, if 95% of a $200M SPAC trust redeems at vote that leaves just $10M in the trust, or 1M shares available to trade in the open market at the time of DeSPAC.

Oftentimes, SPACs with pending deals have large amounts of call options purchased, whether it be from retail or institutional investors. The resulting low public float from shareholders who redeemed causes an even further scarcity of available to trade shares, and can skyrocket those shares much higher, much quicker.

How can I spot an opportunity in the future?

As SPACs head towards their merger votes those with high option volume and trading sub-NAV are at the biggest risk of experiencing a gamma squeeze. This is due to the possibility that 1) brokers may need to further hedge their derivative positions and 2) the SPAC faces the possibility of a high redemption situation.

Now, many other factors come into play including the size of the SPAC (75% redemptions of a $1B SPAC is a lot different than on a $100M SPAC), trading volume and the volatility.

But, Beware as Gamma Squeezes are Fast and Sharp Drops Follow

The squeeze rallies are often very short lived and can cause massive (even intra-day) volatility in these names that, as a reminder, may not be very liquid at all. In addition, the market and market-makers have recently been much more attune to the dynamic and have been better able to position themselves heading into these situations.

Example High Redemption DeSPACs

| Redem % | SPAC Ticker | SPAC | DeSPAC Ticker | DeSPAC Company | DeSPAC Date | Close on 5-Jan-2022 | 52 Week High | % Off High |

|---|---|---|---|---|---|---|---|---|

| 97% | THMA | Thimble Point Acquisition Corp. | PEAR | Pear Therapeutics Inc | 3-Dec-21 | $6.42 | $10.52 | -39% |

| 97% | LWAC | Locust Walk Acquisition Corp. | EFTR | eFFECTOR Therapeutics Inc | 25-Aug-21 | $7.47 | $27.17 | -73% |

| 95% | BSN | Broadstone Acquisition Corp. | EVTL | Vertical Aerospace Ltd | 16-Dec-21 | $9.05 | $12.84 | -30% |

| 95% | GRNV | GreenVision Acquisition Corp. | HLBZ | Helbiz Inc | 13-Aug-21 | $5.47 | $28.23 | -81% |

| 94% | ENFA | 890 5th Avenue Partners, Inc. | BZFD | BuzzFeed Inc | 3-Dec-21 | $5.21 | $10.66 | -51% |

| 94% | LIII | Leo Holdings III Corp | LOCL | Local Bounti Corporation | 22-Nov-21 | $6.66 | $10.62 | -37% |

| 93% | LIVK | LIV Capital Acquisition Corp. | AGIL | AgileThought Inc | 23-Aug-21 | $5.57 | $23.53 | -76% |

| 93% | ATMR | Altimar Acquisition Corp. II | FATH | Fathom Digital Manufacturing | 27-Dec-21 | $6.15 | $10.60 | -42% |

| 93% | MAAC | Montes Archimedes Acquisition Corp | ROIV | Roivant Sciences Ltd | 30-Sep-21 | $8.89 | $13.52 | -34% |

| 93% | AMHC | Amplitude Healthcare Acquisition Corporation | JSPR | Jasper Therapeutics Inc | 24-Sep-21 | $7.69 | $16.42 | -53% |

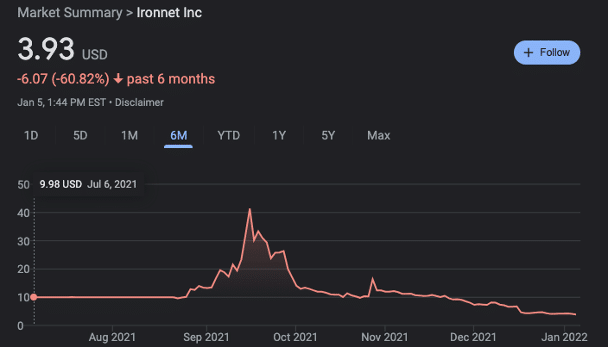

| 93% | DFNS | LGL Systems Acquisition Corp | IRNT | IronNet Inc | 26-Aug-21 | $3.82 | $41.40 | -91% |

| 92% | YAC | Yucaipa Acquisition Corporation | SSU | SIGNA Sports United NV | 14-Dec-21 | $8.90 | $11.19 | -20% |

| 91% | SPNV | Supernova Partners Acquisition Company Inc | OPAD | Offerpad Solutions Inc | 1-Sep-21 | $6.07 | $19.97 | -70% |

| 91% | NSH | NavSight Holdings, Inc | SPIR | Spire Global Inc | 16-Aug-21 | $3.15 | $18.45 | -83% |

| 91% | SOAC | Sustainable Opportunities Acquisition Corp. | TMC | TMC the metals Co Inc | 9-Sep-21 | $1.86 | $12.45 | -85% |

| 91% | ATHN | Athena Technology Acquisition Corp. | HLGN | Heliogen Inc | 30-Dec-21 | $9.76 | $15.52 | -37% |

| 90% | SCPE | SC Health Corporation | RKLY | Rockley Photonics Holdings Ltd | 11-Aug-21 | $4.38 | $16.00 | -73% |

| 89% | KURI | Alkuri Global Acquisition Corp. | BBLN | Babylon Holdings Ltd | 21-Oct-21 | $6.30 | $11.71 | -46% |

| 89% | CTAC | Cerberus Telecom Acquisition Corp | KORE | KORE Group Holdings Inc | 30-Sep-21 | $6.96 | $11.00 | -37% |

| 89% | SGAM | Seaport Global Acquisition Corp | RDBX | Redbox Entertainment Inc | 22-Oct-21 | $6.92 | $17.93 | -61% |

| 88% | GNRS | GREENROSE ACQUISITION CORP | GNRS | Greenrose Holding Co Inc | 29-Nov-21 | $4.20 | $11.13 | -62% |

| 88% | TWCT | TWC Tech Holdings II Corp | CLBT | Cellebrite DI Ltd | 30-Aug-21 | $7.22 | $12.15 | -41% |

| 88% | FORE | Foresight Acquisition Corp. | PIII | P3 Health Partners Inc | 3-Dec-21 | $5.72 | $11.44 | -50% |

| 87% | TMTS | Spartacus Acquisition Corporation | NN | Nextnav Inc | 28-Oct-21 | $8.83 | $12.78 | -31% |

| 87% | CENH | Centricus Acquisition Corp. | ARQQ | Arqit Quantum Inc | 3-Sep-21 | $18.37 | $38.06 | -52% |

| 87% | KSMT | KISMET ACQ ONE | GDEV | Nexters Inc | 24-Aug-21 | $8.00 | $10.90 | -27% |

| 87% | NBA | New Beginnings Acquisition Corp | MIMO | Airspan Networks Holdings Inc | 13-Aug-21 | $3.95 | $10.80 | -63% |

| 85% | MRAC | Marquee Raine Acquisition Corp. | ENJY | Enjoy Technology Inc | 15-Oct-21 | $3.90 | $11.18 | -65% |

| 85% | ROT | Rotor Acquisition Corp | STRC | Sarcos Technology & Robotics Corp | 24-Sep-21 | $8.92 | $11.12 | -20% |

| 84% | CFAC | CF Finance Acquisition Corp. III | LIDR | AEye Inc | 16-Aug-21 | $4.89 | $13.71 | -64% |

| 84% | RTPZ | Reinvent Technology Partners Z | HIPO | Hippo Holdings Inc | 2-Aug-21 | $2.61 | $14.24 | -82% |

| 84% | MCAD | Mountain Crest Acquisition Corp. II | BTTX | Better Therapeutics Inc | 28-Oct-21 | $4.88 | $17.14 | -72% |

| 84% | DGNS | DRAGONEER GR OP | CVT | Cvent Holding Corp | 8-Dec-21 | $8.08 | $13.29 | -39% |

| 84% | CHFW | Consonance-HFW Acquisition Corp | SRZN | Surrozen Inc | 11-Aug-21 | $5.32 | $12.03 | -56% |

| 83% | STWO | ACON S2 Acquisition Corp | GWH | ESS Tech Inc | 11-Oct-21 | $10.60 | $23.80 | -55% |

| 83% | HCAQ | HealthCor Catalio Acquisition Corp. | HYPR | Hyperfine Inc | 22-Dec-21 | $7.20 | $10.92 | -34% |

| 82% | NGCA | NextGen Acquisition Corp. II | VORB | Virgin Orbit Holdings Inc | 29-Dec-21 | $6.29 | $10.47 | -40% |

| 80% | DBDR | Roman DBDR Tech Acquisition Corp. | CMPO | CompoSecure Inc | 27-Dec-21 | $7.23 | $10.64 | -32% |

| 80% | NGAC | NextGen Acquisition Corp | XOS | Xos Inc | 19-Aug-21 | $2.69 | $13.89 | -81% |

| 80% | GLEO | Galileo Acquisition Corp. | SHPW | Shapeways Holdings Inc | 29-Sep-21 | $3.13 | $10.83 | -71% |

| 80% | MACQ | MCAP Acquisition Corporation | ADTH | AdTheorent Holding Company Inc | 22-Dec-21 | $6.05 | $10.21 | -41% |