Speech recognition specialist Soundhound debuts today. Are we about to see more SPAC liquidations? And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

Soundhound (SOUN) deSPACs today

Voice artificial intelligence specialist Soundhound AI (SOUN) had its public debut today after deSPAC from Archimedes Tech SPAC Partners Co. (ATSPT). Shares closed at $7.50.

SPAC IPO: ClimateRock (CLRC)

ClimateRock Corp. (CLRC) prices a $75M offering. Details: 1/2W, 1R, $10.15 trust. 12mo (3+3 at 10c each). The SPAC’s mandate is within the sustainable energy industry in the Organization for Economic Co-operation and Development countries, including climate change, environment, renewable energy and emerging, clean technologies.

SPAC Deal: IGNY + Peak Bio Co.

Ignyte Acquisition Corp. (IGNY) announces DA with Peak Bio Co.Ltd. The transaction values Peak Bio Co., an oncology specialist, at an enterprise value of $278M and includes a $25M PIPE. Deal includes “leading healthcare institutional investor, Palo Alto Investors and insiders.” The transaction is expected to be completed during 3Q 2022 with the new company to be listed on NASDAQ as “PKBO.” No slide deck yet.

Elsewhere in SPACs

- Bull Horn Holdings Corp. (BHSE) extension approved with ~4.26M shares redeeming, leaving 3.2M public shares. At this level of redemptions, 2c / month will be deposited until DA closes (out until November).

- Liquidation alert: Mallard Acquisition Corp. (MACU) to liquidate 4/29. Currently ~500 SPACs outstanding (pre-deal or with a DA) with original deadlines upcoming through March-2023.

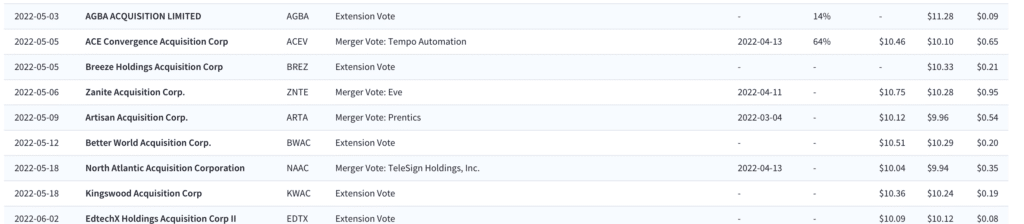

Upcoming Merger and Extension Votes

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.