Shareholder vote: January 14, 2022 for GMII shareholders of record at November 30, 2021

For the latest Know Who Drives Return episode, we sat down with Francis Davidson, the founder and CEO of Sonder, a hospitality company that leases and manages travel properties. Sonder is valued at nearly $2B and is going public through Gores Metropolous II. Francis, at just 29 years old, has been able to rapidly scale the company that he founded 8 years ago as a student at McGill University in Quebec. Will Sonder succeed in grabbing a larger share of the lodging space?

Have a listen and read the full report below.

Table of contents

Key Points / Questions

- Rapidly-growing, modern hospitality company capitalizing on Gen-Z trends

- Sleek, easy to use app with a focus on quality and guest experience in their rooms

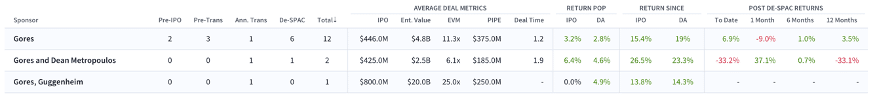

- SPAC sponsor Gores + Metropolous have a strong track record with de-SPAC returns and low SPAC redemptions

- Founder-led

- First-time public company CEO at age 29

- Long-term viability of the lease business model and potential lease lockups

- Crowded space with a lot of competition and choices for consumers

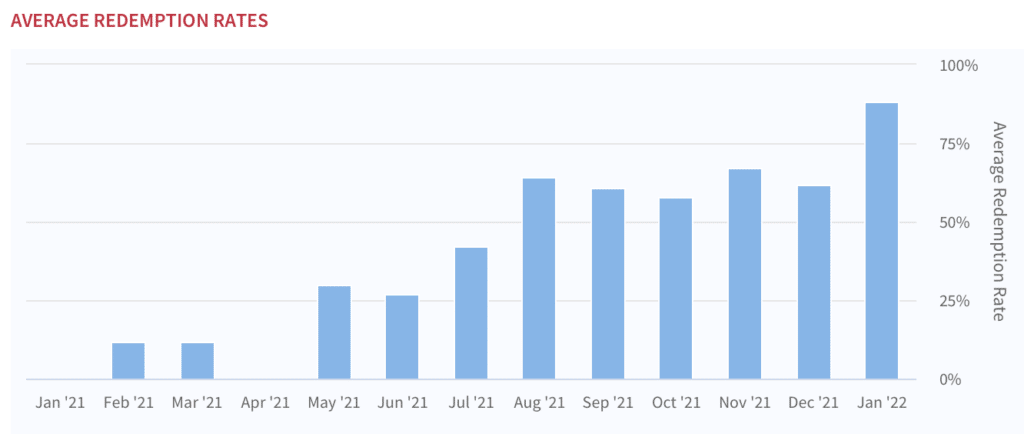

- What will post-closing cash be? SPAC redemptions out of control – last 6 deals were 88%, 99%, 91%, 82%, 80%, 93%

Sonder Overview

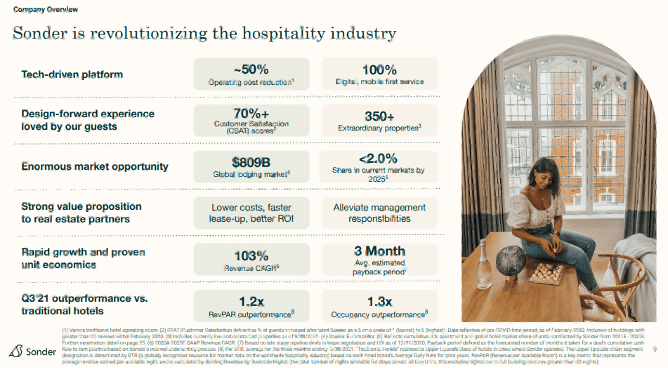

Francis Davidson founded Sonder in a similar fashion to another popular tech-focused lodging company when, while in college, he was looking for a little side hustle to earn some money on his empty campus apartment in the summer. Since then he’s grown that into a tech and design-focused hospitality company that leases its properties and manages them under the Sonder umbrella.

Customers who utilize the Sonder platform (and app) enjoy a seamless technology experience that allows them to check in and out, order room service, and even seamlessly connect to WiFi all with the tap of the app. Stays can be booked through traditional OTAs like Booking (BKNG), marketplaces such as Airbnb (ABNB) or its own Sonder platform. Francis told us they want to be everywhere a customer could be.

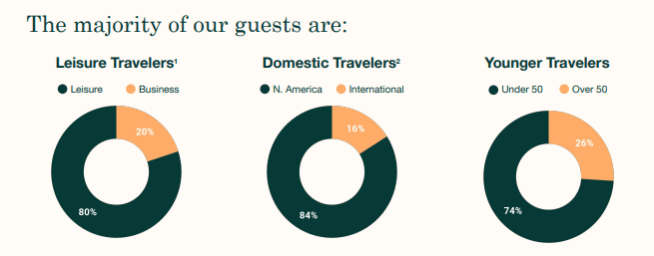

The majority of Sonder’s business is leisure travel, but the company leases all different types of properties from a few units in an apartment building to fully-licensed hotels. Given its low portion of the business, Francis said that corporate travel could be a growth driver in the future.

Sonder expects to grow revenues to nearly $4B by 2025 and is looking to take a bigger bite out of the $800B+ TAM that the Global Lodging Market represents. Areas of growth include further expansion into newer markets such as Latin America and Asia.

Sonder’s Recent Performance

Francis declined to get into the weeds on future financial projections (referring to the investor materials), however, the company recently put out a release touting a RevPAR jump of +10% compared to pre-COVID 2019 levels over the New Year’s Eve weekend. They’ve experienced massive revenue growth over the past few years and expect to continue that in the next few years. You can see a more detailed breakdown of their financial projections in the latest deck:

Latest Investor Presentation – November 2021

Competitive Landscape + Valuation

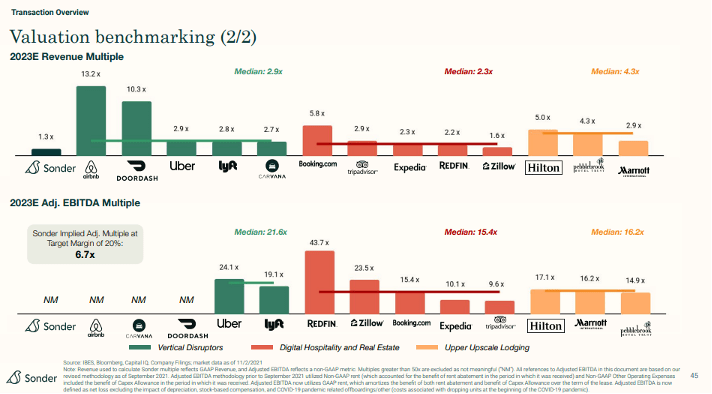

Sonder’s peer set is broad as you can comp them to several different industries including traditional lodging companies, digital hospitality and real estate, and more general high-growth vertically integrated technology companies.

Its $1.925B enterprise value translates into a 1.3x 2023E revenue multiple which certainly puts it at the low end of peers’ range. High end of the range Airbnb clocks in at 13.2x whereas some of the more mature hotel brands Hilton and Marriott come in at 5.0x and 2.9x, respectively.

In addition, in terms of projected revenue CAGR, Sonder is projecting >130% Revenue CAGR out to 2023 which would trump the existing peer set. Its 117% rev CAGR from 2017-2019 is really only matched by Airbnb.

That being said, the growth is off a much lower base, the company has yet to turn a profit, and doesn’t expect to do so on an adjusted EBITDA perspective until 2024.

Sonder / GMII Deal Details

Originally struck at a valuation of $2.2B when the deal was announced in April 2021, Sonder and GMII reduced the valuation to $1.925B back in November, along with the announcement of an additional $110M in financing, which supplements the existing $200M PIPE. This additional financing, coupled with up to $450M in GMII’s trust account and $165M of delayed draw notes should set the company up with a significant cash hoard to meet its goals.

While SPAC redemptions are certainly on the rise (the last 6 deSPACs have all been over 80% and Capstar / CPSR set a new record of 98.8% with its Gelesis deal), Gores has a history of low redemptions (more below), and GMII’s stock price currently trading near NAV might point to a lower-than-average redemption on this one. That could all change very rapidly, however, as ex-redemption approaches here very shortly.

About the SPAC Sponsor

Gores Metropolous II is co-sponsored by both The Gores Group (Alec Gores) and Metropolous (Dean Metropolous). Gores is one of the most prolific SPAC sponsors in the entire asset class having sponsored or co-sponsored over 10 SPACs. Gores Metropolous I took Luminar Technologies (LAZR). LAZR completed their SPAC transaction in December 2020, and is up over 50% from is SPAC IPO.

Gores Track Record

Gores deSPACs

The Gores deSPACs have largely done well relative their IPO (see highlighted column). TWNK, MTTR, LAZR, and VRRM all trade materially higher than the SPAC IPO price and only UWMC stands out as a negative.

Redemptions for Gores sponsored SPACs have been incredibly low with most at 0% (or effectively 0) and only the AMBP deal having higher redemptions. Though, as noted in their investor deck (see slide 6), the redemption falls to 24% when the backstop is netted out.

SPAC Redemptions Out of Control

The SPAC market is suffering from an acute epidemic of high redemptions at deal closings. This has put incredible pressure on the SPAC sponsor and target to find ways to deliver cash post closing and has resulted in more backstops, debt, and more. Unfortunately for the average investor these tend to be poor deals given they came in somewhere around $10 (ideally) and these funds are priced much lower (e.g. $6 backstop for $DCRN).

Similar deSPACs

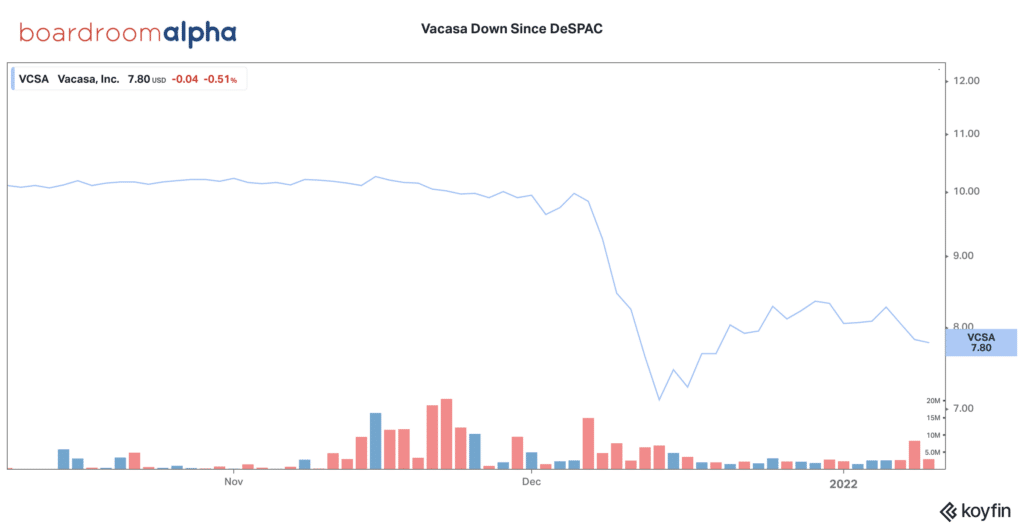

The most similar deSPAC in terms of sector and timing is Vacasa which deSPAC’d in early December 2021. Shareholders redeemed about 50% of the trust and the price dropped quickly from just below $10 to around $7. It has since traded up slightly and is currently hovering around $8.

About Francis Davidson – Sonder Co-Founder and CEO

Francis Davidson is one of Sonder’s founders and has served as its Chief Executive Officer and as one of its directors since January 2014. Mr. Davidson attended McGill University where he studied Philosophy and Economics. In the summer of 2012, after his first year at McGill University, Mr. Davidson sublet his college apartment to vacationers in Montreal. Over the next two years, he went on to manage the empty apartments of other students in many different cities, ultimately leaving McGill to pursue Sonder full-time with a vision to redefine hospitality by bringing exceptional stays everywhere.

Topics On the Podcast

- Intro to Francis and founding of Sonder

- Economic look into the company’s leases

- Marketing strategy and customer booking experience

- Professional vs. leisure travel breakdown

- Sonder’s focus on design and experience

- Technology stack and differentiation

- Downside protections for future recessions

- Growth, organic, expansion and plans

- Why SPAC and why now? And more info on the SPAC deal