DA for Legato and Southland Holdings. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

Social Platform Uplive in SPAC Discussions

Asia Innovations Group, a startup that operates social platform Uplive, is said to be in discussions to go public through a deal with E. Merge Technology Acquisition (ETAC).The transaction is said to value the combined company at $2 billion. 2021 revenue was ~$300 million.

SPAC Deal: Legato Merger Corp. II + Southland Holdings

Legato Merger Corp. II (LGTO) announces DA with Southland Holdings. Southland Holdings provides specialized infrastructure construction services across North America including bridges, tunneling, transportation and facilities, marine, hydroelectric structures, water and sewer treatment, and water pipeline end markets.The transaction values the company at an enterprise value of $810M. No PIPE. Slide deck here.

Approved: APSG / American Express Global Business Travel

Apollo Strategic Growth Capital (APSG) approved its merger with American Express Global Business Travel. Expected close 5/27. No redemptions mentioned in the filing.

Elsewhere in SPACs

Today’s Movers

Biggest Gainers

5.11% ~ $ 10.50 | UPTD – TradeUP Acquisition Corp (Pre-Deal)

4.34% ~ $ 7.94 | APSG – Apollo Strategic Growth Capital (Announced)

1.12% ~ $ 9.90 | RJAC – Jackson Acquisition Co (Pre-Deal)

.82% ~ $ 9.89 | WWAC – Worldwide Webb Acquisition Corp. (Pre-Deal)

.79% ~ $ 10.18 | REVE – Alpine Acquisition Corp. (Announced)

.72% ~ $ 9.84 | POND – Angel Pond Holdings Corp (Announced)

.71% ~ $ 9.97 | CNDB – Concord Acquisition Corp III (Pre-Deal)

.71% ~ $ 9.99 | FRBN – Forbion European Acquisition Corp. (Pre-Deal)

.70% ~ $ 10.07 | TACA – Trepont Acquisition Corp I (Pre-Deal)

.62% ~ $ 9.80 | REVH – Revolution Healthcare Acquisition Corp. (Pre-Deal)

.62% ~ $ 9.81 | RKTA – Rocket Internet Growth Opportunities Corp. (Pre-Deal)

.61% ~ $ 9.83 | APGB – Apollo Strategic Growth Capital II (Pre-Deal)

.61% ~ $ 9.89 | STET – ST Energy Transition I Ltd. (Pre-Deal)

.60% ~ $ 45.14 | DWAC – Digital World Acquisition Corp. (Announced)

.60% ~ $ 10.10 | OCAX – OCA Acquisition Corp (Pre-Deal)

.59% ~ $ 10.24 | GGPI – Gores Guggenheim, Inc (Announced)

.54% ~ $ 9.67 | TRTL – TortoiseEcofin Acquisition Corp. III (Pre-Deal)

.51% ~ $ 9.92 | CHWA – CHW Acquisition Corp (Announced)

.42% ~ $ 9.95 | WINV – WinVest Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.76 | HWKZ – Hawks Acquisition Corp (Pre-Deal)

Biggest Losers

-1.40% ~ $ 9.92 | HYAC – Haymaker Acquisition Corp. III (Announced)

-1.00% ~ $ 9.86 | AHRN – Ahren Acquisition Corp. (Pre-Deal)

-.82% ~ $ 9.70 | BRIV – B. Riley Principal 250 Merger Corp. (Pre-Deal)

-.81% ~ $ 9.82 | GIAC – Gesher I Acquisition Corp. (Pre-Deal)

-.60% ~ $ 9.95 | LVAC – LAVA Medtech Acquisition Corp. (Pre-Deal)

-.58% ~ $ 10.31 | KWAC – Kingswood Acquisition Corp (Pre-Deal)

-.56% ~ $ 9.75 | TETC – Tech and Energy Transition Corporation (Pre-Deal)

-.52% ~ $ 9.62 | WAVC – Waverley Capital Acquisition Corp. 1 (Pre-Deal)

-.51% ~ $ 9.80 | GAQ – Generation Asia I Acquisition Ltd (Pre-Deal)

-.51% ~ $ 9.84 | CIIG – CIIG Capital Partners II, Inc. (Pre-Deal)

-.50% ~ $ 9.90 | LAAA – Lakeshore Acquisition I Corp. (Announced)

-.50% ~ $ 9.94 | CPAQ – Counter Press Acquisition Corp (Pre-Deal)

-.41% ~ $ 9.62 | CNDA – Concord Acquisition Corp II (Pre-Deal)

-.41% ~ $ 9.76 | CRZN – Corazon Capital V838 Monoceros Corp (Pre-Deal)

-.41% ~ $ 9.77 | LCAA – L Catterton Asia Acquisition Corp (Pre-Deal)

-.41% ~ $ 9.78 | ZWRK – Z-Work Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.93 | ROC – ROC Energy Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.98 | PLAO – Patria Acquisition Corp. (Pre-Deal)

-.40% ~ $ 10.02 | JMAC – Maxpro Capital Acquisition Corp. (Pre-Deal)

-.35% ~ $ 9.97 | ARTE – Artemis Strategic Investment Corporation (Announced)

SPAC Podcast: Pet Care in a Post-Pandemic World

Our latest podcast is an up-close look at pet service provider Wag Labs, which has a combination pending with SPAC CHW Acquisition Corp.(CHWA).

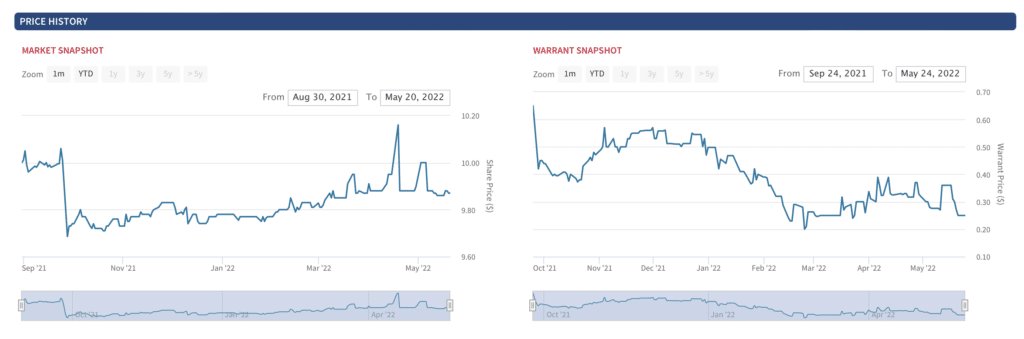

Wag! Sponsor CHWA: Market Snapshot

Wag! CEO Garrett Smallwood explains why pet care is an area of consumer spending that could be a pocket of strength coming out of the pandemic. Also read our overview here.

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.