Narrow approval for Amazon’s compensation package indicates increasing disapproval over executive pay. Social issues fail to get majority-buy in, but environmentalists win big as plastics resolution garners a near majority vote. Momentum is building.

Razor-thin approvals at Amazon shareholder meeting suggest momentum is building for more accountability. Amazon held its annual meeting of shareholders on May 26th. Amazon’s 15 shareholder proposal were the largest number facing any U.S. company during this year’s proxy season. The proposals also received the closest votes than at any other point in Amazon’s recent history. Net-net, the undercurrent of shareholder opposition is very obvious– particularly on issues including executive pay, the environment, and working conditions. Importantly, 13 of the shareholder proposals concerned social policies.

- Amazon’s executive compensation plan passes, but with only 56% support

- 49% support for a proposal calling on a detailed report on plastic consumption

- 47% vote in favor of a resolution seeking a detailed report on Amazon’s lobbying activity and spending

- 44% vote in favor of a resolution seeking an independent audit and report on warehouse working conditions

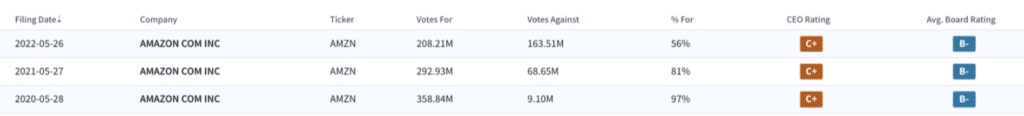

Worsening Say-on-Pay trend. Shareholders came within 6 percentage points of a majority vote opposing compensation packages for Amazon’s top executives. Although shareholders voted to support the company’s compensation packages, they are overall voicing increasing disapproval over executive pay. A $212.7 million payout for CEO Andy Jassy received only 56% support– down from 81% Say-on-Pay approval a year ago.

Worsening Say-on-Pay vote

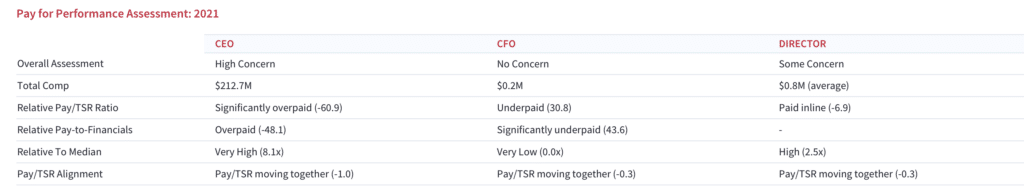

Critics want more alignment with financial performance. Almost the entirety of Jassy‘s 2021 compensation is in the form of stock awards connected to his promotion in July from head of Amazon Web Services to CEO. Most of those stock awards vest over the next 10 years. Looking more closely at executive compensation relative to performance, Jassy’s relative pay to total shareholder return (TSR) is well above comparables. For 2021, the peer median CEO compensation was $26.1 million. Amazon says it doesn’t tie pay to short-term goals, in order to encourage more long-term thinking and innovation.

2021 Pay for Performance assessment

Amazon board gets approval, despite criticism of human capital-related policies. Amazon has drawn increasing criticism for its treatment of workers, including claims of poor working conditions at its warehouses and attempts to block unionization. Despite an ongoing campaign led by the NYC Pension Funds and all five of the New York City Retirement Systems to unseat two long-standing Amazon board members, shareholders voted to approve all 11 nominees for Amazon’s board of directors. As background, NYC pension campaign had accused Daniel Huttenlocher and Judith McGrath of being “unresponsive” and providing “insufficient oversight” over Amazon’s human capital challenges– including the high rate of injury, high turnover and concerns about labor rights violations.

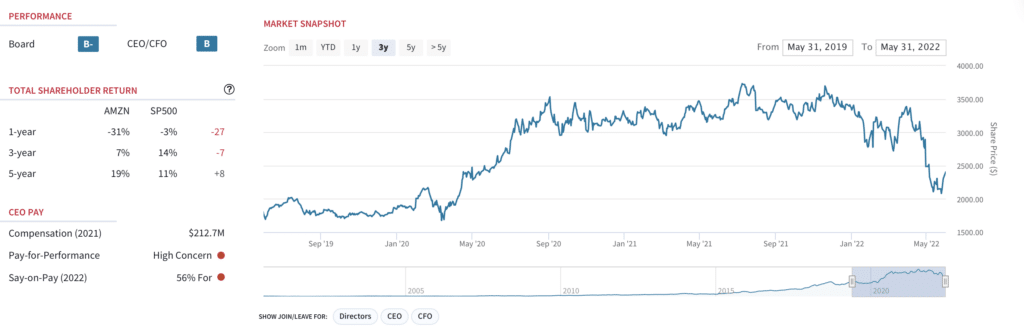

AMZN: Shares down 28% YTD

Strong support for worker safety proposal. A proposal seeking an independent audit and report on Amazon warehouse working conditions received 44% approval. Safety in Amazon warehouses has been the subject of media scrutiny in recent months– particularly the interactions between humans and machines. Amazon shareholders voted on two proposals that would require the company to report on injury rates at its warehouses, as well as one proposal requesting Amazon eliminate its quota system that holds workers to strict expectations of how many packages they should move in a shift. “Would you want to work in a place where you’re constantly watched through surveillance, where you have physically unsustainable quotas or where you’re punished for not working fast enough? This is what it’s like to work for Amazon,” said Isaiah Thomas, a warehouse worker. Amazon has denied these allegations, stating in its proxy statement that less than 0.4% of employees have been “separated” from the company due to their inability to perform their job. To improve worker safety, Amazon is piloting new technologies like wearable devices that use sensory feedback to alert workers of poor body posture or to alert robots that a human is nearby.

Human capital concerns surrounding race and gender. Shareholders voted on a resolution to launch an independent audit on potential racial and gender disparities in workplace injuries. Amazon has launched a racial equity audit to evaluate any disparate racial impacts on the company’s hourly employees. Despite criticism of Amazon’s surveillance and face recognition technology (which critics say could potentially violate civil rights or contribute to human rights violations), shareholders voted against two proposals which would provide more disclosure around how customers are using Amazon’s surveillance technology.

Plastic proposal gets near-majority vote. A resolution that would require Amazon to report on its use of plastic garnered approval by 49% of shareholders– a near-majority vote which confirms that an increasing portion of mainstream investors are challenging Amazon to elevate the issue of plastic pollution and develop more environmentally focused business practices. For its part, Amazon launched a “Frustration-Free Packaging” program that offers financial incentives to encourage manufacturers to use 100% recyclable packaging. Amazon has also set a goal to package all of its Alexa devices and other tech products in 100% curbside recyclable packaging by 2023. Finally, the company says it is working on creating “right-sized boxes” that eliminate the need for extra plastic cushioning inside the package.

This isn’t a win or lose game. And the numbers suggest the conversation is far from over. There are two important takeaways here. First, the fact that these proposals are on the ballot in the first place suggests that shareholders view these issues as important part of Amazon’s corporate agenda. Second, looking more closely at the voting results and the significant level of support, it’s clear that the momentum is building around social, environmental and governance concerns – which means for Amazon shareholders, this conversation is far from over.

For more background on the human capital situation at Amazon, check out our recent conversation with Assistant NYC Comptroller Michael Garland: NYC Pension Funds Want Amazon Accountable for Human Capital.