We talk to Assistant NYC Comptroller Michael Garland on the NYC Pension Funds’ move to unseat 2 Amazon board members responsible for human capital management

Research supports the idea that diverse boards are more transparent and accountable than boards that lack diversity. But shareholders don’t just want an acknowledgment that boards are being more transparent– they want to see the proof.

Nowhere is this tension more apparent than at tech giant Amazon (AMZN), which is facing activist pressure as employees demand better working conditions. Amazon has drawn increasing criticism for its treatment of workers, including claims of poor working conditions at its warehouses and attempts to block unionization.

In December 2021, NYC Pension Funds filed a shareholder proposal that called on the tech giant to assess whether its health and safety practices are leading to racial and gender disparities in workplace injury rates among its warehouse workers. Amazon ignored the shareholder proposal, but the SEC stepped in to rule that shareholders should be allowed to vote on it at the company’s May 25th annual meeting.

The NYC Pension Funds have launched a campaign along with New York State Comptroller Thomas DiNapoli and trustees of all five of the New York City Retirement Systems to unseat two Amazon board members responsible for human capital management– Daniel Huttenlocher and Judith McGrath. The funds represent an institutional investor group with 1.7 million combined shares valued at approximately $5.3 billion.

While a shareholder proposal urging better workplace conditions for employees isn’t anything new, it’s unusual for an investor to urge other shareholders to vote directors out over the issue. In a letter to shareholders filed last month, Comptrollers Lander and DiNapoli detailed concerns regarding the unresponsiveness and insufficient oversight by the board of Amazon’s human capital management challenges.

To dive into the details on why Amazon is failing in human capital management, Boardroom Alpha sat down with Michael Garland, Assistant Comptroller for Corporate Governance and Responsible Investment at the New York City Office of the Comptroller. Garland works with NYC Comptroller Brad Lander to manage the New York City Pension Funds, the fourth largest public pension system in the United States with ~ $260 billion in AUM.

NYC Pension funds have a long history of active ownership on issues of corporate governance and sustainability. Garland shared the five basic principles which form the basis of the funds’ ESG focus:

- Accountability: Portfolio companies should adopt policies and practices by which the board of directors is accountable to shareowners.

- Investor Rights: Shareowners should have strong investor rights and protections.

- Aligned Interests: Directors and executives should have incentives that align their interests with those of shareowners.

- Transparency: Financial markets work more efficiently when companies provide shareowners with accurate, thorough, and timely information on material matters.

- Sustainability: Companies should effectively manage financial, governance, social, environmental, and other material risks to long-term performance and advance policies and practices that create sustainable shareowner value.

Amazon: Can shareholder returns coincide with a healthier workforce?

Worker safety concerns. In a recent interview with the WSJ, Comptroller Lander noted that Amazon’s directors repeatedly declined requests to meet and discuss Amazon’s treatment of its workers, which the groups say “violate state and federal law and also conflict with Amazon’s own human-rights policy.” Amazon’s latest 10-K notes that the company has added more than 400,000 workers since February 2020 to increase its fulfillment center capacity– largely in response to skyrocketing demand during the COVID-19 pandemic. That growth has put an increased focus on worker safety in its fulfillment and distribution centers. NYC Pension funds has underscored “serious workforce concerns” at Amazon. Critics say that Amazon pushes workers past the breaking point. For example, employees and contractors at the Illinois warehouse that collapsed during a deadly tornado last year were reportedly pressured to keep working despite the extreme danger. Workers last year suffered serious injury at twice the rate of non-Amazon warehouses, according to a study published by the Strategic Organizing Center, a coalition of four labor unions. Turnover rates among warehouse employees are reported to be as high as 150%. The pressure from the pension funds also coincides with a burgeoning union movement among Amazon workers.

Racial equity audit. Garland highlights the need for greater transparency into Amazon’s workforce. For its part, Amazon announced last month it has commissioned an independent racial equity audit led by former US Attorney General Loretta Lynch. Amazon says it plans to release this information, which will measure any disparate racial impacts on Amazon’s U.S. hourly employees resulting from policies, programs and practices. Last year, a proposal pushing for more information on racial justice and equity filed by The New York State Common Retirement Fund and comptroller DiNapoli garnered 44% shareholder support.

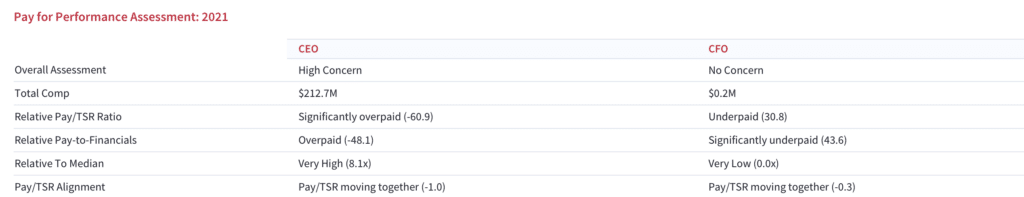

Red flag: Executive compensation. While this campaign is focussed on human capital issues, it’s important to note that executive compensation at Amazon is another key concern. Amazon CEO Andrew Jassy was paid $212.77M in 2021– significantly overpaid relative to both peers and financial performance metrics. 81% of shareholders voted in favor of last year’s compensation package.

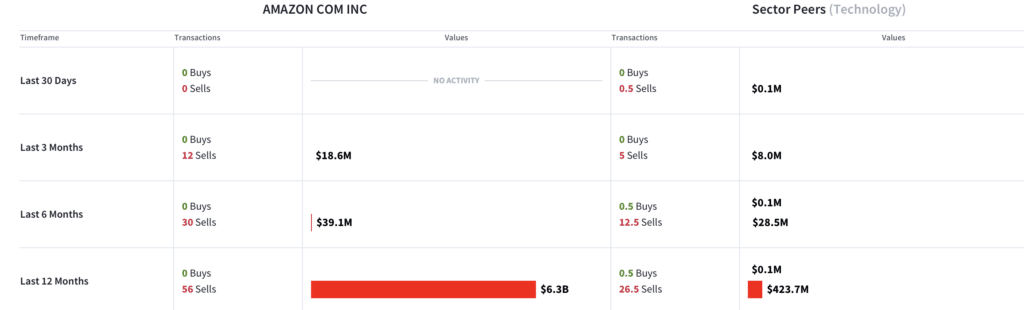

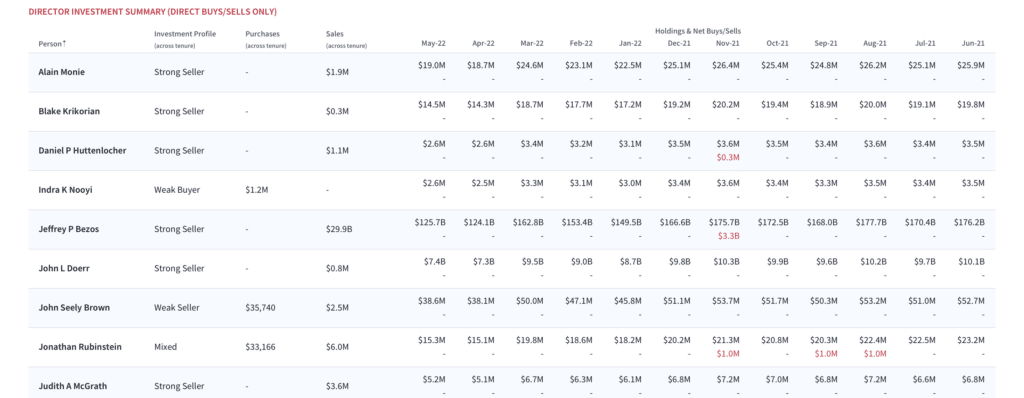

Red flag: insider trading. Insiders sold $6.3B worth of stock over the past 12 months, well above peers. Over the past six months, insiders sold $39.1M worth of AMZN stock; AMZN shares declined 34% over this period.

The two board members in question have been strong sellers. The two board members in question by the NYC Pension Funds are Daniel Huttenlocher, Dean of MIT Schwarzman College of Computing, and Judith McGrath, former Chair and CEO of MTV Networks. Both have been strong sellers of AMZN stock, with sales of $1.1M and $3.6M respectively across their board tenures.

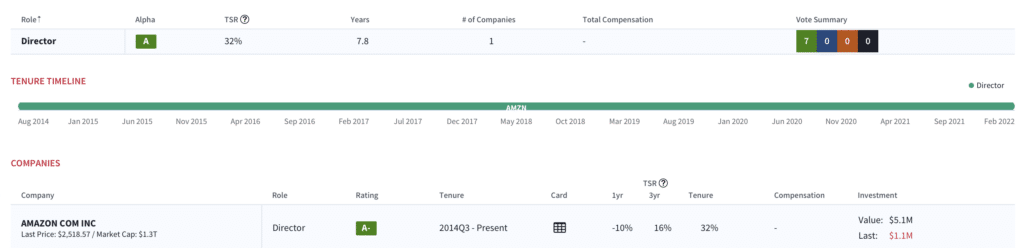

AMZN board closeup: Daniel Huttenlocher

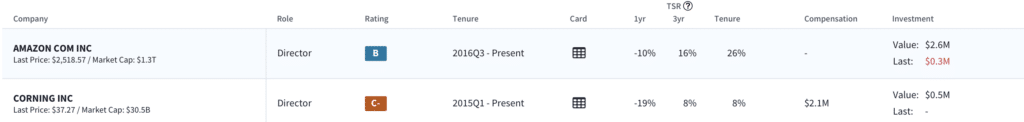

AMZN board closeup: Judith McGrath

Investment Summary: Huttenlocher and McGrath have been strong sellers

Next catalyst: May 25th annual meeting. Meeting information and proxy overview here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.

More from Boardroom Alpha

To learn more about how investors are moving the needle toward corporate transparency and accountability, listen to our recent podcast with Andrew Behar, CEO of non-profit shareholder advocacy group As You Sow.