Medicare/Medicaid secondary payer reimbursement recovery specialist trades tomorrow. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

LCAP /MSP Recovery closes; MSPR trades tomorrow

Lionheart Acquisition Corporation II (LCAP) completes combination Medicare and Medicaid secondary payer reimbursement recovery leader MSP Recovery. MSPR begins trading tomorrow, 5/24.

Tigra Acquisition Corp. (TINV) / Grindr extends

Tigra Acquisition Corp. (TINV) confirms funding extension deadline to 11/27. SPAC adds another $2.76M / $0.10 to trust. The SPAC has a pending DA with Grindr.

OTEC extends deadline

OceanTech Acquisitions I Corp. (OTEC) uses its sole 6 month extension to extend to 12/2/2022. The SPAC will add $1.5M to trust, or $0.15 – bringing current NAV to ~$10.25. OTEC intends to focus its search on target businesses in the leisure marine, yachting and superyachting industries, and with enterprise values of approximately $250 million to $1.0 billion.

Elsewhere in SPACs

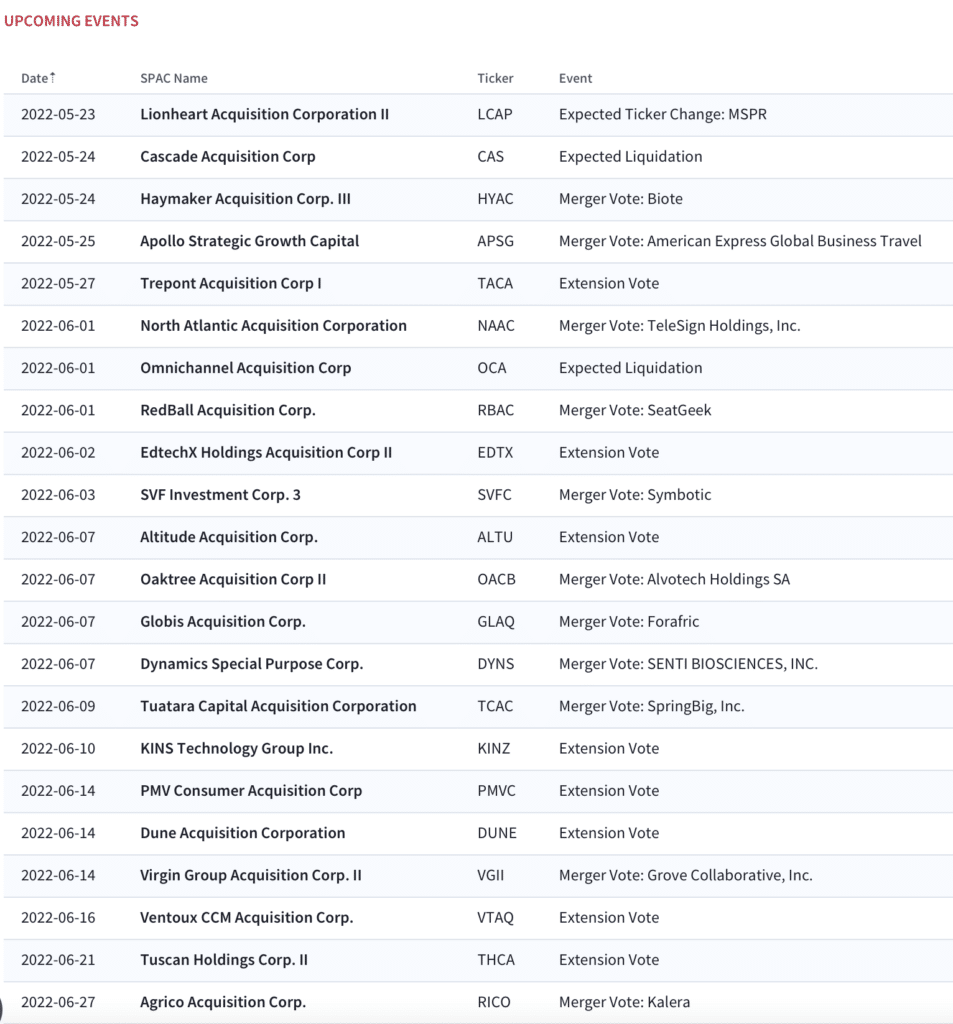

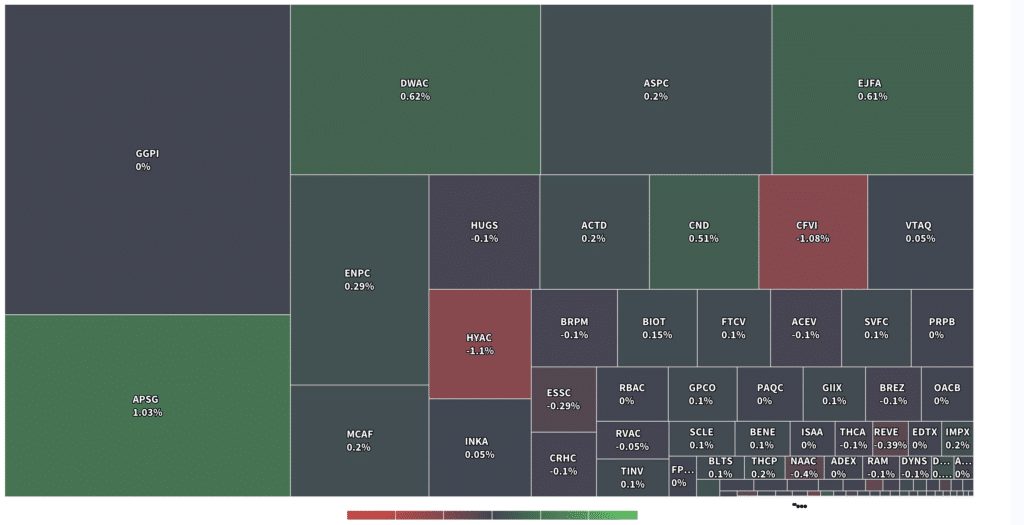

Heat Map: SPACs with Announced Transactions

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.