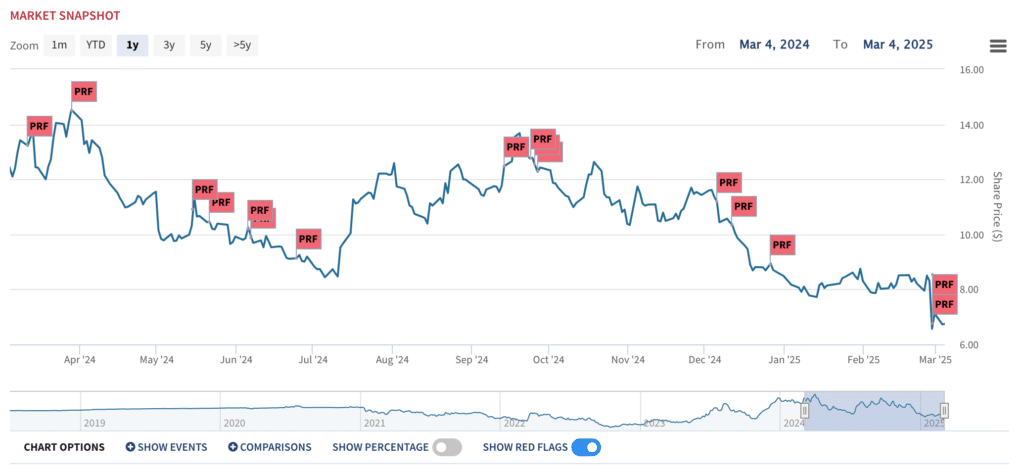

Landsea Homes Corporation (NASDAQ: LSEA), a DeSPAC from 2021, is facing pressure from activist investor Mill Road Capital, which announced its intent to nominate three directors to Landsea’s board at the upcoming Annual Meeting. Mill Road, which owns 6.5% of Landsea’s outstanding shares, argues that the company is significantly undervalued and that the best path forward is a sale to a well-capitalized buyer. Mill Road Capital filed its initial 13D in late December of 2024.

Mill Road’s Case for a Sale

Mill Road asserts that Landsea is currently trading at just 0.48x its tangible book value, representing a steep discount relative to publicly traded and private market homebuilders. The firm believes that Landsea’s board has a fiduciary duty to explore strategic alternatives, particularly a sale, which it believes could deliver a price of approximately $14 per share—a 108% premium to the current valuation.

Concerns About Landsea’s Financial Position

Mill Road highlights several challenges facing Landsea, including:

- Lack of cash to execute a meaningful share buyback or acquire sufficient assets to achieve scale.

- A highly leveraged balance sheet that continues to depress valuation and create financial risk.

- Limited alternative pathways to meaningful shareholder value creation.

Mill Road Capital’s Nominees: Who Are They?

To drive change and ensure shareholder interests are represented, Mill Road has put forward three nominees for election to Landsea’s board — Thomas E. Lynch, Deven Petito, and Donald J. Tringali:

Thomas E. Lynch

- Founder and Senior Managing Director of Mill Road Capital.

- Currently a director at Noodles & Co.where Mill Road Capital is the largest institutional shareholder.

- Previously served on the boards of Golub Capital, Physicians Formula Holdings, and Panera Bread.

Deven Petito

- Management Committee Director at Mill Road Capital Management LLC, where he has worked since 2014.

- Leads public and private equity investments for Mill Road’s funds, which manage approximately $1.0 billion in assets.

- Formerly worked in private equity at Kohlberg Kravis Roberts & Co. (KKR) and in investment banking at Morgan Stanley.

- Holds degrees from Princeton University (AB in Economics) and Harvard Business School (MBA).

- Currently a director at Superior Industries International, where he was appointed based on a cooperation agreement between the company and Mill Road Capital. The the stock price has declined -44% (annualized) during his tenure.

Donald J. Tringali

- CEO of Augusta Advisory Group, a financial and business consulting firm.

- Former Executive Vice President of Telemundo Group, Inc.

- Serves on the board of Natural Gas Services Group Inc., where total shareholder return has been 54% (annualized) since his appointment as part of an agreement with Mill Road Capital.

A Proxy Fight or a Compromise?

Mill Road’s previous success at landing board members through agreements with targets suggests that a deal will get struck here. Adding to Mill Road Capital’s track record, Landsea’s dismal performance since its DeSPAC in 2021, lack of shareholder support for directors (Bruce Frank, Elias Farhat, Mollie Fadule, and Qun Zhou all received ~80% or less at 2024’s meeting), and its position as the largest institutional holder of Landsea stock put it in a powerful position.