Home Depot and Walmart told different tales, but we think there’s more upside than downside for LOW.

Lowe’s reports Q1 results tomorrow. Home improvement retailer Lowe’s (LOW) reports Q1 earnings tomorrow pre-market. Consensus estimates call for EPS of $3.22 on $23.8 billion (+12% QoQ, +0.9% YoY).

Home Depot is a good indicator of continued consumer demand. In another time and place, Home Depot (HD), which reported solid Q1 earnings today, would have had the market more enthusiastic about LOW going into the print. HD, whose shares have declined 28% YTD, reported its strongest Q1 sales ever and raised its full-year outlook (sales growth +3% YoY and EPS growth in the mid-single digits). Yet, shares closed up a mere 2% today.

Walmart’s miss has the market spooked about earnings growth. The retail macro is what it is: investors are rightly concerned about an economic slowdown and potential drop in housing prices. Walmart (WMT), which reported Q1 earnings today, reported an EPS miss and lower earnings. Net-net, investors are understandably worried about earnings growth this year.

LOW has outperformed HD and the S&P500 over the past 1, 3 and 5-year periods. LOW shares delivered TSR of +26% over the past 3 years– beating Home Depot (HD), at +19% over the same period. LOW has also outperformed the S&P500, which has delivered TSR of +13% for the S&P 500- over the 3-year period.

LOW: Market Snapshot

How sustainable is home improvement momentum? No doubt about it: Home Depot executed tremendously well in the quarter. The message is this: despite rising home prices and mortgage rates, many consumers are still doing home improvements over relocating. The Fed’s rate hike plans may lead to even higher mortgage rates– but that’s also offset by tight housing supply and a still healthy job market. The delay in warm weather this spring also bodes well for continued strength at both HD and LOW in Q2.

Datapoints from HD. Customer transactions fell 8.2% but were offset by higher sales amid inflationary pricing. HD’s average ticket price increased 11.4%, suggesting that customers were still willing to trade up for premium products. Transactions of $1,000 or greater increased 12.4% in the quarter. These data points bode very well for LOW, which currently derives ~75% of sales from DIY consumers (as opposed to professionals).

Earnings remain a worry for the entire sector. Lowe’s will be able to tell us if the strength we saw at Home Depot was down to good execution, or if we’re seeing a sustainable upturn in home improvement demand. (We think it’s a combination of both). As we’ve already noted, commentary from smaller retailers suggests that the underlying demand in the remodeling industry remains healthy. Many companies– e.g. Floor & Decor (FND) and Masco (MAS) — were able to raise prices in the quarter– resulting in revenue growth. Margins, however, remain a worry. Even though many companies are managing through supply-chain issues and rising costs mean that not all of their incremental growth will trickle down to the bottom line.

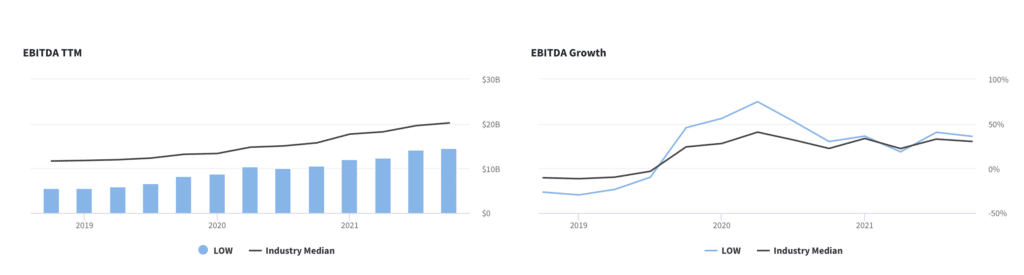

LOW: There’s a real earnings story here

Lowe’s has real earnings power as the pro business ramps. Lowe’s is currently generating operating margin of ~9%, below HD at ~11%. Roughly 25% of Lowe’s customer base consists of home professionals– well below ~45% at Home Depot. But there’s ample runway for growth and Lowe’s is putting a lot of effort into growing this businesss. Profitability should also improve as this segment continues to ramp.

Total Home strategy executing well. CEO Marvin Ellison has steadily increased productivity and built out the retailer’s integrated omni-channel shopping experience. The company is adding more brands and products to both its stores and website. Also, a strong (and growing) digital base bodes well for long-term sales growth. Management is focused on enhancing the omni-channel retailing capabilities in store operations, website and supply chain.

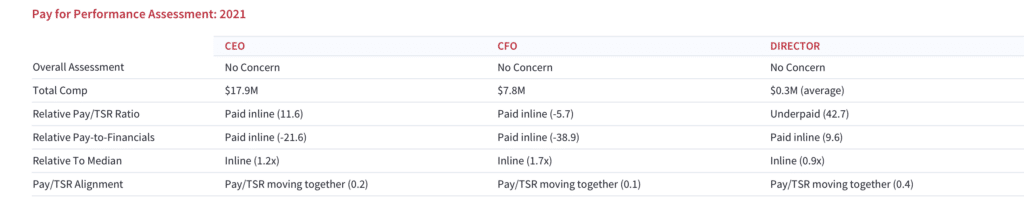

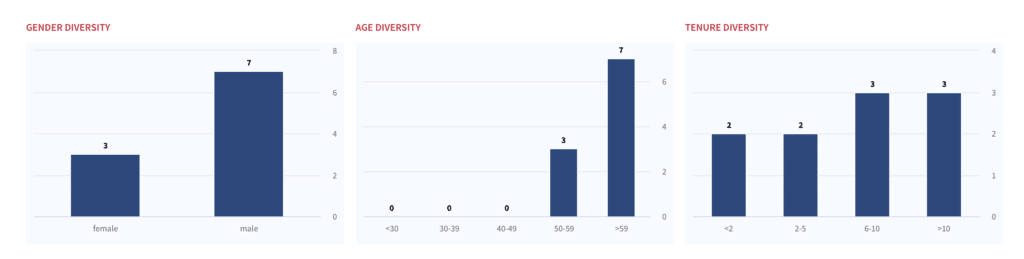

Governance looks very healthy. Executive and director compensation are in line with sector norms and financial performance. In terms of diversity, 30% of the board is comprised of women, slightly below peers– could use a few more.

LOW: Compensation is in-line with sector norms and financial performance

Source: Boardroom Alpha

LOW Diversity and Inclusion snapshot

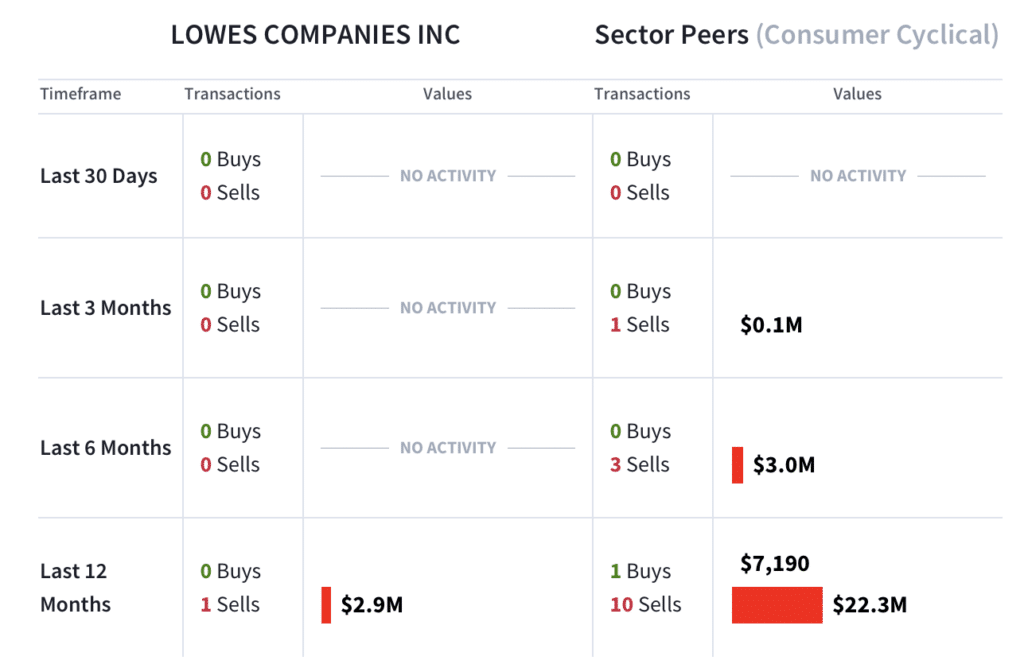

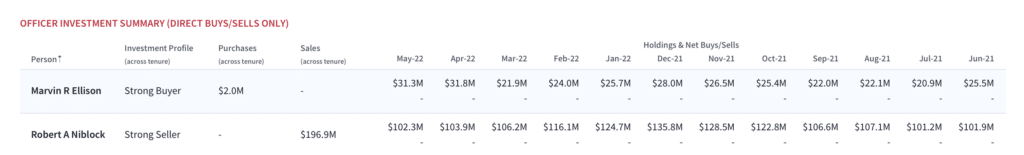

Unlike the pervasive insider selling we’ve seen among most retailers, insiders are holding here. Notably, CEO Marvin Ellison has purchased $2M of stock over this tenure.

CEO Marvin Ellison has been a buyer

Bar is set low– especially considering HD guided for 3% YoY revenue growth. For fiscal 2022, LOW’s prior guidance calls for revenue of $96 to $98 billion. Guidance represents YoY revenue growth of less than 1% at the midpoint of the range. With HD having guided to +3% YoY growth, estimates look achievable.

LOW trades at a slight discount to HD: long term tailwinds and attractive valuation. Given mixed messages between HD and WMT, investors are naturally waiting for more data points before they’re convinced of consumer demand. Retailer Target (TGT) also reports tomorrow, which should give us a clearer picture. We think this is as close as we get to a bottom on both HD and LOW. LOW shares trade at a very reasonable 11x forward EBITDA–a slight discount to HD, which trades at 13x forward EBITDA. HD historically garners a higher multiple, owing to execution and stronger profitability metrics. But we think LOW has the potential for more earnings growth this year.

Latest Podcast: NYC Pension Funds Want Amazon Accountable for Human Capital

Our latest podcast explores the ESG situation at Amazon (AMZN), which is facing activist pressure as employees demand better working conditions. The tech giant has drawn increasing criticism for its treatment of workers, including claims of poor working conditions at its warehouses and attempts to block unionization. To dive into the details on why Amazon is failing in human capital management, Boardroom Alpha sat down with Michael Garland, Assistant Comptroller for Corporate Governance and Responsible Investment at the New York City Office of the Comptroller. Garland details the NYC Pension Funds’ campaign– along with New York State Comptroller Thomas DiNapoli and trustees of all five of the New York City Retirement Systems– to unseat two Amazon board members responsible for human capital management– Daniel Huttenlocher and Judith McGrath. Amazon’s annual shareholder meeting is coming up on May 25th.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.