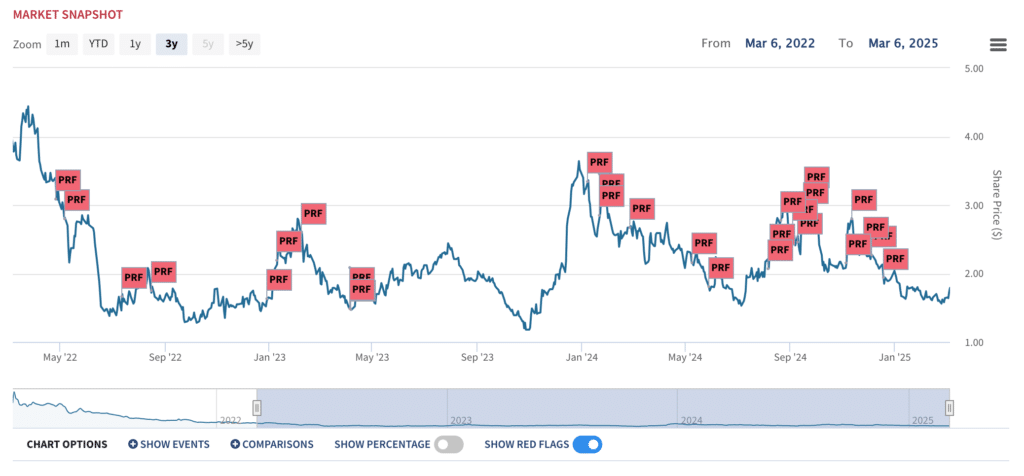

loanDepot, Inc. (NYSE: LDI) has extended its cooperation agreement with company founder Anthony Hsieh, strengthening his leadership role amid a CEO transition and Board restructuring. The Amended and Restated Settlement and Cooperation Agreement, signed on March 6, 2025, builds on a prior agreement from April 2023, while introducing key governance and executive changes. LDI’s shareholders continue to suffer as the stock is down -29% over the past year and -23% over the past three years.

Anthony Hsieh: A Founder Reasserting Leadership

Anthony Hsieh is a pioneer in the mortgage lending industry with over 30 years of experience. He founded loanDepot in 2009, growing it into one of the largest non-bank lenders in the U.S. Hsieh has served as Chair of the Board since 2021, previously holding roles as CEO (2021–2022) and Executive Chairman (2022–2023).

Before founding loanDepot, Hsieh:

- Founded Home Loan Center, Inc. (2002), the first national online lender offering full-spectrum mortgage products with live rate quotes.

- Led Home Loan Center after its 2004 merger with LendingTree (IAC subsidiary).

- Transformed LoansDirect.com from a small brokerage into an innovative mortgage lender in 1989.

With expertise in executive leadership, technology, lending, and corporate strategy, Hsieh’s return to an active leadership role marks a critical shift for loanDepot’s future.

Background: The April 2023 Cooperation Agreement

loanDepot and the Hsieh group of stockholders entered into a settlement and cooperation agreement in April 2023 to stabilize governance. Key terms included:

Board Composition Changes

- Hsieh withdrew his director nomination for the 2023 annual meeting.

- The Board expanded from eight to nine members, appointing Steven Ozonian as a Class II director.

- Andrew Dodson, Ozonian, and Pamela Hughes Patenaude were nominated for election as Class II directors (terms expiring 2026).

- If Ozonian left before 2024, the Board would revert to eight directors.

- If the Hsieh Stockholders retained 95% of their holdings, the Board would:

- Reduce to eight directors in 2024.

- Nominate Anthony Hsieh and Brian Golson (or a Parthenon Stockholders designee) as Class III directors for terms expiring 2027.

Standstill and Voting Commitments

- The Hsieh Stockholders agreed to support Board-nominated directors in 2023 and 2024 and committed to certain voting and standstill restrictions until 30 days before the 2025 nomination deadline.

Financial Settlement

- loanDepot paid Hsieh $857,000, with additional amounts contingent on a general release of claims.

The 2025 Agreement: Hsieh Strengthens Control

The Amended and Restated Cooperation Agreement extends key governance commitments while introducing leadership changes.

CEO Transition: Frank Martell to Step Down

- The Board approved Frank Martell’s resignation as President & CEO, effective June 4, 2025 (or the 2025 Annual Meeting).

- Martell has been CEO for just under 3 years during which time loanDepot stock has dropped over 40% and revenue dropped by almost 60%.

- If a permanent CEO is not appointed by then, Anthony Hsieh will serve as interim CEO.

- Martell’s exit package includes:

- Severance payments in June and December 2025.

- A 60% pro-rated 2025 annual bonus.

- Up to $25,000 in legal fees.

- Martell will act as a Board Advisor until a permanent CEO is appointed, receiving:

- $75,000 in consulting fees.

- A restricted stock award of at least $75,000, vesting quarterly over a year.

Anthony Hsieh Becomes Executive Chairman, Mortgage Operations

- Effective March 6, 2025, Hsieh will take on the title of Executive Chairman, Mortgage Operations.

- His compensation package includes:

- $1 annual base salary.

- $75,000 monthly expense reimbursement.

- 1.5 million performance stock units, vesting at stock prices of $3, $5, and $7 within two years. Note that LDI’s stock is currently ~$1.80.

- If he remains interim CEO until March 1, 2026, he earns another 1.5 million stock units under the same terms.

Board Changes & Governance Updates

- The Hsieh Stockholders extended their standstill and voting obligations until 30 days before the 2026 nomination deadline.

- Board Composition Adjustments:

- Dawn Lepore and John Lee nominated for re-election as Class I directors in 2025.

- Nikul Patel appointed as an advisor to the Board.

- Frank Martell will step down from the Board at the 2025 Annual Meeting.

- The Board will shrink from eight to seven directors after the meeting.

Who Is Nikul Patel?

Patel is a FinTech executive with expertise in product and technology innovation:

- Founder & CEO of LoanGlide Inc., a point-of-sale financing platform.

- Former Chief Product & Strategy Officer and COO at LendingTree.

- Previous President of Home-Account.com and executive at Intel Corporation.

- Co-founded Movoto.com, an online real estate marketplace.

What’s Next for loanDepot?

With Hsieh taking on a stronger leadership role, key areas to watch include:

- Permanent CEO search and transition plan.

- Mortgage operations performance under Hsieh’s leadership.

- Stock performance and incentive targets (Hsieh’s $3, $5, and $7 stock hurdles — LDI is currently well under $2).

- Governance stability and Board composition heading into 2026.

loanDepot’s leadership is at a critical turning point, with Hsieh reasserting control over the company’s future. Boardroom Alpha will continue to track these developments as they unfold.

Supporting Teams

- loanDeport was supported by the team at Gibson, Dunn & Crutcher for the latest agreement after using Skadden, Arps, Slate, Meagher & Flom on the initial 2023 cooperation agreement.

- Hsieh was supported in both agreements by Covington & Burling