A lot of hopes have been riding on inflation pressures easing in 2022. That didn’t happen in January, however. It’s likely that rising inflation will continue to put pressure on SPAC redemptions and deSPAC financing.

CPI Shows Inflation is Surging

- Thursday’s Consumer Price Index (CPI) numbers show inflation increased 7.5% YoY in January, above consensus of 7.3% — representing the fastest rise since 1982 and an acceleration from 7.0% YoY in December.

- The Biden administration and the Federal Reserve have been betting on inflation to remain contained to a handful of industries — and decline over time. The 0.6% rise in the Consumer Price Index last month undermines this theory.

- The bright spot here is that high inflation coincides with a robust jobs recovery. The bad news is that wages are not keeping up.

- The important thing to look at here is the velocity of money, particularly for household income. Average hourly earnings rose 5.7% over the 12 months ended in January—but consumer prices rose 7.5%.

- Continued high inflation increases the risk of a virtuous cycle that could take more aggressive action to unwind and risk slowing the economy.

- Yield on two-year Treasuries up 0.13 percentage points

SPAC Impact: Rising inflation adds fuel to the redemption fire

- Rising inflation clearly raises the cost of financing for deSPACs.

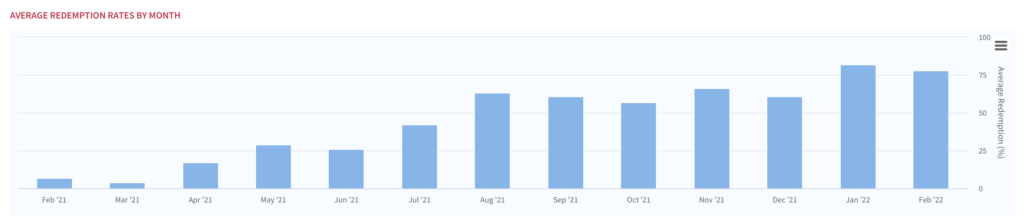

- A continued upward inflation trend will likely continue to fuel the already rising rate of redemptions as investors look for additional liquidity.

- Rising interest rates also doesn’t help already cooling sentiment around smaller, non-profitable deSPACs, which have already been hurt in a risk-off environment.

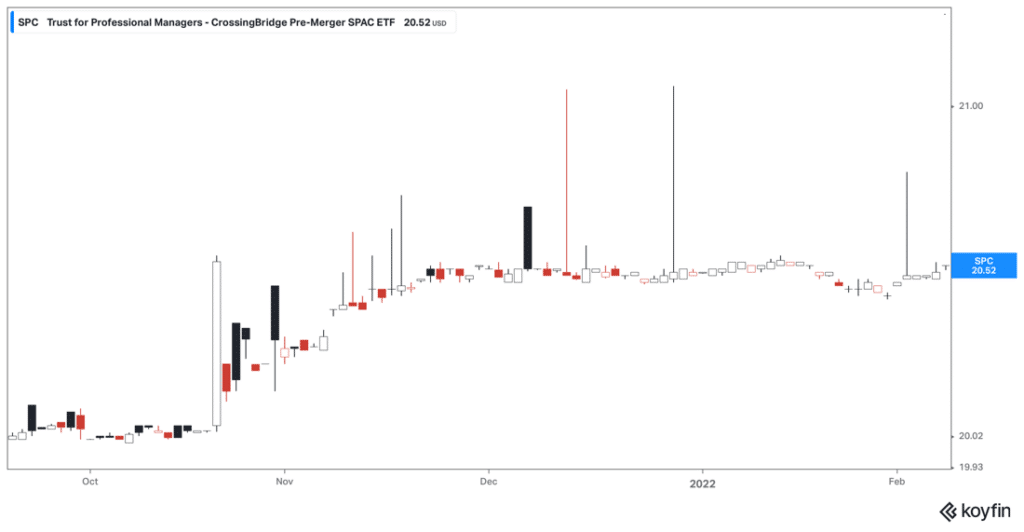

- SPAC returns have been generally weak since the start of the year. Defiance Next Gen SPAC Derived ETF (SPAK) is down 14% YTD versus a 5% decline for the S&P 500 over the same period.

- The bright spot here is that inflation’s impact to the pre-merger SPACs as an arb opportunity could be less meaningful.

“We expect spreads to stay wide in the new issue market. Yield-to-liquidation spreads have gone up”

David Sherman, Founder and Portfolio Manager of CrossingBridge Advisors Pre-Merger SPAC ETF (NASDAQ:SPC)