FDX announces some important shareholder-friendly actions. With a new CEO and refreshed board, now’s the time for FDX to start delivering operational efficiency.

Dividend increases and important governance changes at FedEx. FedEx (FDX) announced some important shareholder-friendly updates, including increasing its dividend by more than 50%; adding two independent directors to its board as part of an agreement with long-time shareholder D. E. Shaw; and adding a Total Shareholder Return (TSR)-based performance metric to executive compensation program. D.E. Shaw holds ~1 million FDX shares (35th largest holder).

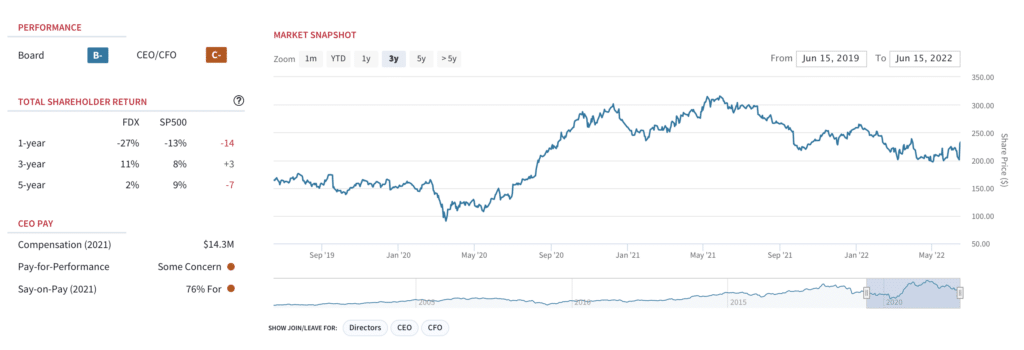

FDX shares have struggled in 2022 owing to margin pressures. FDX shares have declined 27% in the past year — versus a 13% decline for the S&P 500 over the same period. The company has been impacted by supply chain disruptions and tight labor market conditions. High transportation and labor costs have pressured FDX’s operating margins, which have been stuck below 7% since 2017.

FDX: Market Snapshot

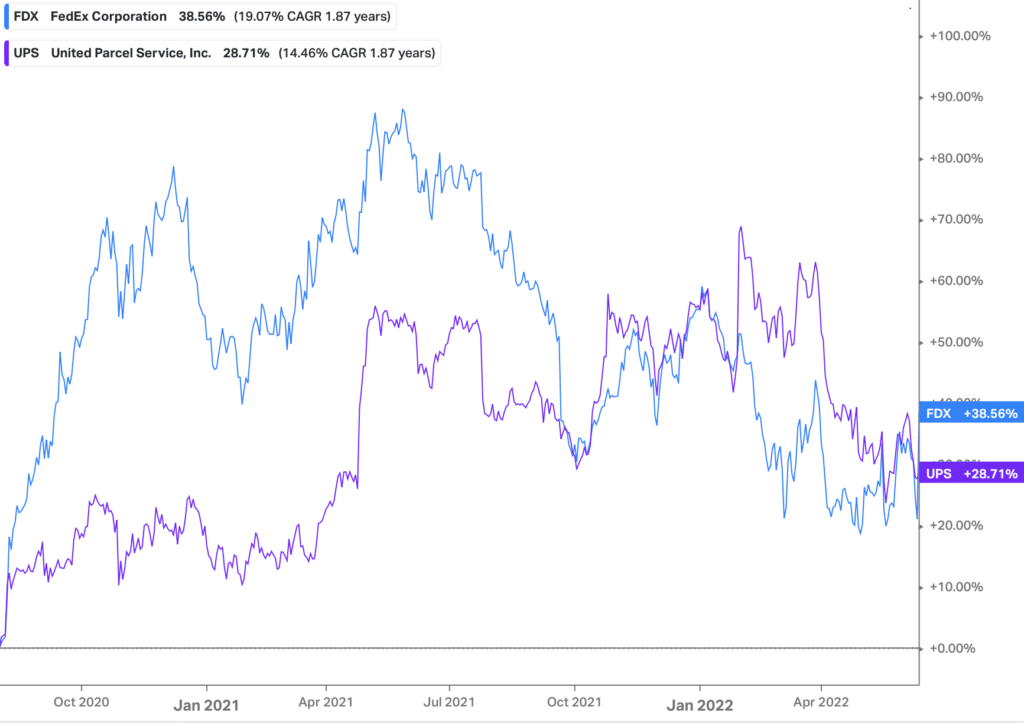

FDX shares have underperformed relative to the company’s larger rival, UPS. Reduced capital spending should help. Higher operating expenses, owing to wage pressures, coupled with increased costs related to network expansion have affected FedEx’s Ground segment, the company’s second largest business segment. More recently, the company has struggled to hire enough workers for its sorting hubs, hurting its on-time delivery performance. While FedEx’s operating margin hovers below 7%, the company’s larger rival, UPS– which hired former Home Depot CFO Carol Tome as CEO in June 2020– generated 2021 operating margin of 13.2% (up from 9.1% in 2020) while maintaining its on-time service.

FDX versus UPS Performance: August 2020 to Present

TSR performance metric added to executive compensation program; another incentive to reduce CAPEX. FedEX announced that its cash-based long-term incentive (LTI) program for F2023 – F2025 includes an additional performance metric tied to FedEx’s TSR relative to a broad market index. The LTI program also includes a CAPEX /Revenue performance metric. The CapEx/Revenue target metric in the new LTI program is lower than prior years to align with FedEx’s capital plans , and is expected to reduce CAPEX in out years. We applaud the alignment of management compensation with TSR and long-term value creation.

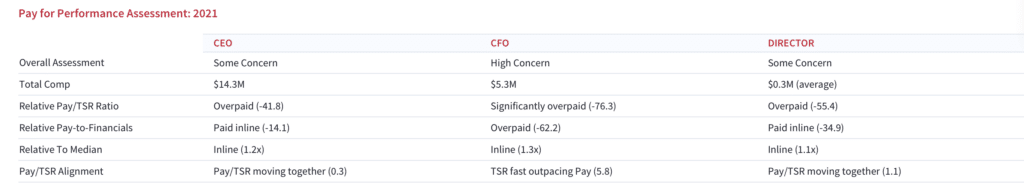

Compensation still a concern. 76% voted in favor of the company’s 2021 executive compensation plan. Notably, CEO, CFO and directors all paid above TSR, overall financial performance, and above peers.

FDX: 2021 Pay-for-Performance Assessment

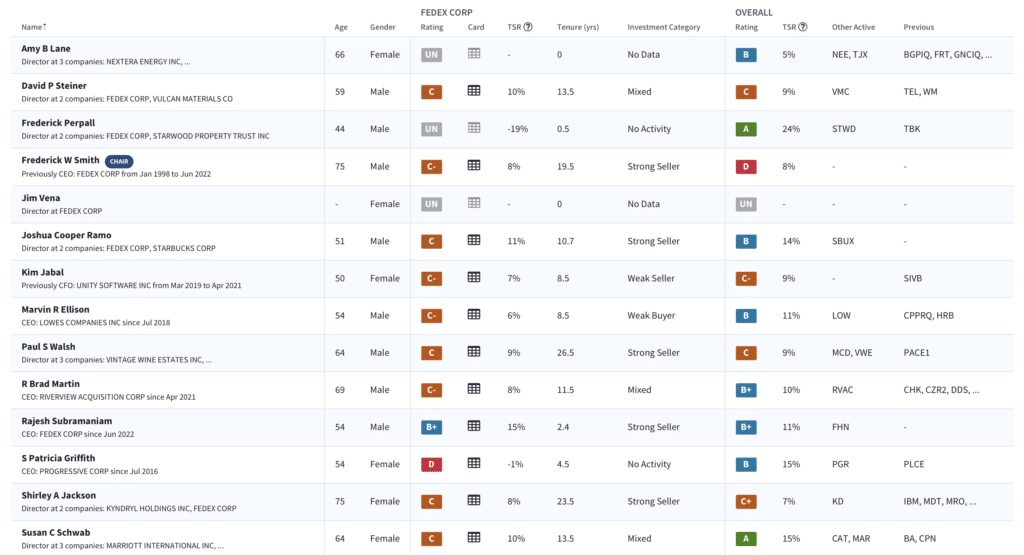

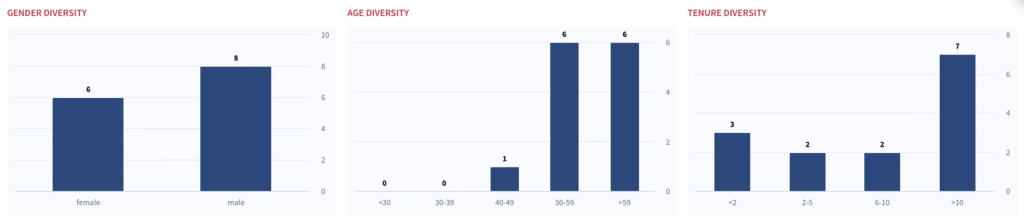

Two new independent directors on the heels of new CEO. FedEx added two independent directors, Amy Lane and Jim Vena, to its board, effective immediately, in coordination with activist investor, D. E. Shaw. A third independent director will be added to the board in consultation with D. E. Shaw group. Lane brings retail expertise while Vena spent over 40 years in the railroad industry at both Union Pacific (UNP) and Canadian National Railway Company (CNI) as Chief Operating Officer. These board changes come close on the heels of the June 1 appointment of Raj Subramaniam as CEO from founder and former-CEO Frederick W. Smith (who becomes executive chairman of the board). The two additions plus one retirement will leave FedEx with a 14-person board.

FDX: Board Snapshot

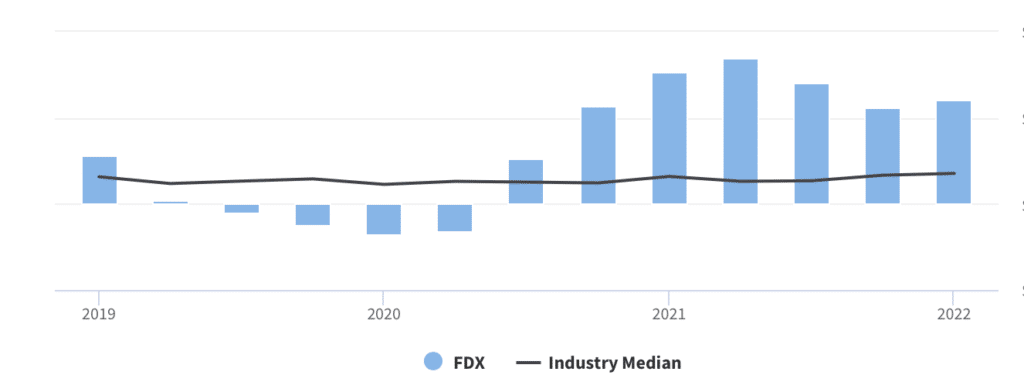

FDX: A history of strong free cash flow

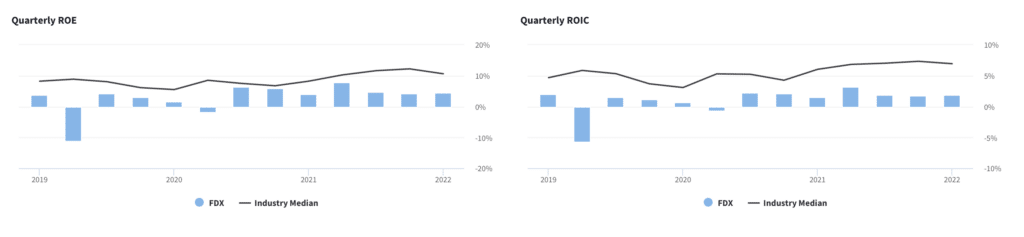

A tale of reduced operating efficiency: FDX ROE and ROIC trending below peers

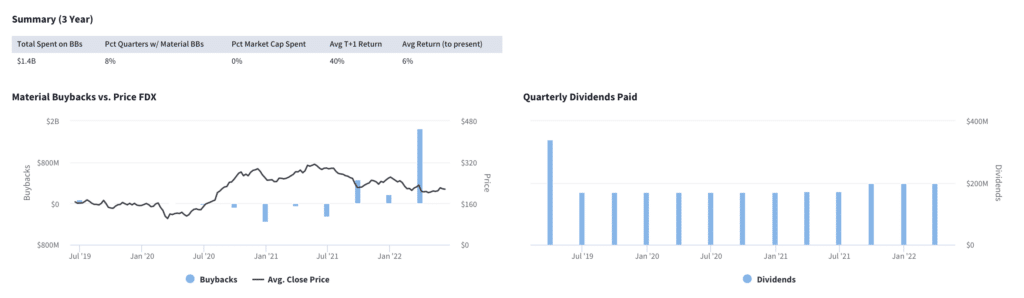

53% dividend hike. FedEx raised its dividend by 53% to $1.15 /share ($4.60 annually, bringing dividend yield to 2.04%. The move underscores the company’s sound financial health as it utilizes free cash flow for enhancing shareholders’ returns. We think FedEx will revert to its historical policy of revisiting the dividend each year for a potential increase. Notably, from 2012 to 2018 the company increased its dividend annually before it peaked at $0.65/share for three years. In 2021, FDX paid a quarterly dividend of $0.75/share. In December 2021, FDX’s initiated a $5 billion share buyback (completed in May of this year).

FDX: Dividend and buyback overview

FDX: Diversity & Inclusion Snapshot

Competitive pressures are intensifying. Competition is changing for FedEx as more retailers ship directly from the store. Additionally, the US Postal Service is expanding its operations. The big one to watch is Amazon (AMZN), which is exploring extending its logistics service to also pick up packages. These changes would put Amazon in direct competition with FedEx and UPS.

Investor day will need to deliver evidence of strategic changes. FDX reports FQ4 earnings June 23rd. The company is hosting analyst and investor days June 28-29 (the first in over a decade). Expectations are running high into both as investors will looking at whether the recent changes represent a short-term boost to the stock or whether there is a longer-term growth story related to the recent CEO change. One of the most important changes will be for FedEx to unify the operations of its Express and Ground businesses, which are still run separately (and often overlap, creating excess costs). This won’t be an easy task, given that the Ground business is operated by independent contractors while the Express business owns aircraft and vehicles and has employees directly on payroll.

Still more work to do. Cutting back on CapEx spending while increasing the dividend rate are good short-term improvements for FedEx, but the real work lies ahead. Improving operating efficiency is key to this story, coupled with a strategy shift to address the changing competitive landscape. FDX shares trade at 8.4x EV-to-forward EBITDA and 6.7x forward cash flow– a discount to UPS, which trades at 9.7x and 10.5x, respectively. Given the recent move, we think there is some built-in expectation heading into both the quarter and the investor day. This is a ‘show me’ story until we see a path to margin improvement. We’re on the sidelines for now.