GGPI / Polestar gets a bump on a 65,000 unit order from HTZ. DWAC / Truth Social slammed by 2 executive departures and Elon’s disclosed TWTR stake. And the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

GGPI / Polestar trades higher on HTZ deal

Share of GGPI closed up 12% today on news that the company has a deal with Hertz (HTZ) for 65,000 electric vehicles (EVs)– specifically the Polestar 2. GGPI shares have been trading sideways ahead of this announcement. No news on merger vote — yet. Shares closed at $12.82. See our complete analysis here.

Deal Announcement for ISAA /HYPEBEAST

Iron Spark I (ISSA) is taking digital media / e-commerce company HYPEBEAST public in a deal which values the company at an EV of $353M. Deal includes a $13.3M PIPE, consisting of investors including Naomi Osaka, Kevin Durant, Rich Kleiman, Tony Hawk, Joe Gebbia, Jonah Hill, Adam Levine, Electric Feel Ventures, THEBLACKLABEL, and IRONGREY. The company generated $112M in fiscal year ended March 31, 2022 and a revenue CAGR of 34% from 2015 to 2021. Slide deck here.

Deal Announcement for RVAC / Westrock Coffee

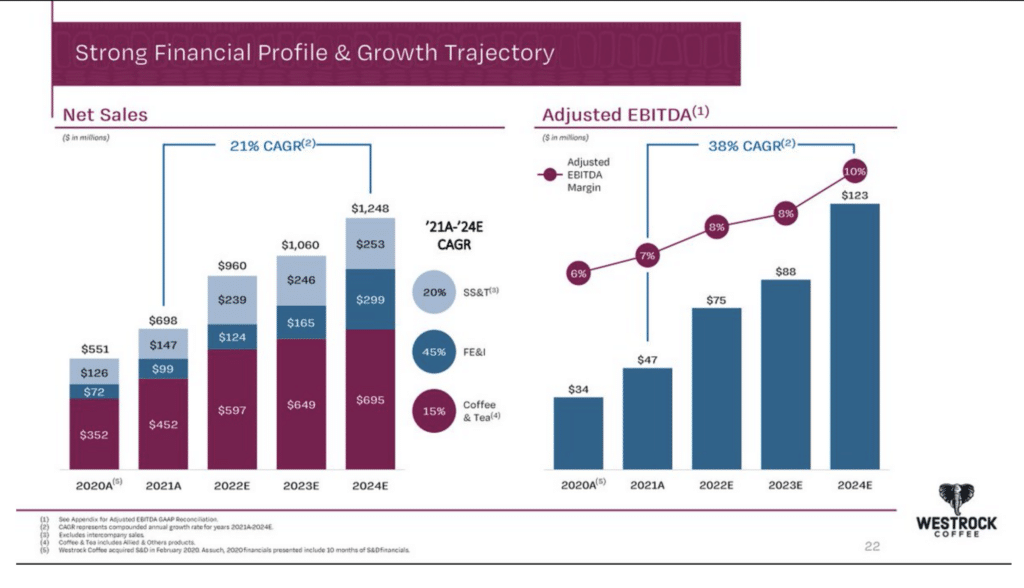

Riverview Acquisition Corp. (RVAC) announced a deal with Westrock Coffee Company which values the company at an EV of $1.2B. Transaction includes a $250M PIPE. Slide deck here.

DWAC Slammed by Executive Departures, Elon’s Twitter Stake

Digital World Acquisition Corp. (DWAC) got hit on a double whammy of 1) two executive departures and 2) Elon Musk’s disclosed 9.2% stake in Twitter (TWTR). Truth Social’s chiefs of technology and product development Josh Adams and Billy Boozer are leaving the company after joining it last year. The two execs were considered pivotal figures in the former President’s attempt to offer an alternative to Twitter and that many conservatives accuse of being pro-Left and indulging in ‘cancel culture’ censorship.

As for Musk, his TWTR position is worth $2.89 billion, based on Friday’s market close. Recall that last month, Musk polled his >80 million followers on Twitter, asking them whether TWTR adheres to the principles of free speech. After more than 70% said no, he asked whether a new platform was needed and said he was giving “serious thought” to starting his own. DWAC shares closed down 10% at $56.94. See our detailed analysis on DWAC here.

Elsewhere in SPACs

- Virgin Group Acquisition Corp. II (VGII) / sustainable consumer products company Grove Collaborative gets $50M financing. Terms consist of $27.5M at signing and a $22.5M redemption backstop commitment.

- Biotech Acquisition Company (BIOT) files S-4 for merger with Blade Therapeutics (BBTX). Transaction is expected to be completed in the second quarter of 2022.

- Ventoux CCM Acquisition Corp. (VTAQ) extends vote date until June and adds $0.10 to trust. Also lowers minimum cash condition from $85M to $65M for merger.

Today’s Price Action

Biggest Gainers

11.87% ~ $ 12.82 | GGPI – Gores Guggenheim, Inc (Announced)

6.93% ~ $ 11.05 | HLXA – HELIX ACQUISITION CORP (Announced)

1.70% ~ $ 10.17 | ISAA – Iron Spark I Inc. (Announced)

1.42% ~ $ 10.36 | GGGV – G3 VRM Acquisition Corp. (Pre-Deal)

1.40% ~ $ 10.15 | ESAC – ESGEN Acquisition Corp (Pre-Deal)

1.35% ~ $ 10.51 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

1.31% ~ $ 10.20 | LCAP – Lionheart Acquisition Corporation II (Announced)

1.24% ~ $ 10.23 | HUGS – USHG Acquisition Corp. (Announced)

1.01% ~ $ 9.97 | HCMA – HCM Acquisition Corp (Pre-Deal)

.87% ~ $ 9.88 | RVAC – Riverview Acquisition Corp. (Announced)

.82% ~ $ 9.89 | THCP – Thunder Bridge Capital Partners IV, Inc. (Announced)

.71% ~ $ 9.96 | SRSA – Sarissa Capital Acquisition Corp (Pre-Deal)

.61% ~ $ 9.87 | ROSS – Ross Acquisition Corp II (Pre-Deal)

.52% ~ $ 9.68 | CDAQ – Compass Digital Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.76 | DALS – DA32 Life Science Tech Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.78 | PEGR – Project Energy Reimagined Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.82 | GHAC – Gaming & Hospitality Acquisition Corp. (Pre-Deal)

.51% ~ $ 9.90 | POND – Angel Pond Holdings Corp (Announced)

.51% ~ $ 9.91 | VGII – Virgin Group Acquisition Corp. II (Announced)

.51% ~ $ 9.92 | BPAC – Bullpen Parlay Acquisition Co (Pre-Deal)

Biggest Losers

-9.98% ~ $ 56.94 | DWAC – Digital World Acquisition Corp. (Announced)

-3.49% ~ $ 9.95 | LIVB – LIV Capital Acquisition Corp. II (Pre-Deal)

-2.17% ~ $ 10.35 | SV – Spring Valley Acquisition Corp (Announced)

-2.07% ~ $ 11.36 | THCA – Tuscan Holdings Corp. II (Pre-Deal)

-1.28% ~ $ 10.03 | OXUS – Oxus Acquisition Corp. (Pre-Deal)

-.95% ~ $ 11.48 | CFVI – CF Acquisition Corp. VI (Announced)

-.70% ~ $ 9.90 | LATG – LatAmGrowth SPAC (Pre-Deal)

-.61% ~ $ 9.70 | PSPC – Post Holdings Partnering Corporation (Pre-Deal)

-.58% ~ $ 10.27 | AMAO – American Acquisition Opportunity Inc (Pre-Deal)

-.51% ~ $ 9.70 | GHIX – Gores Holdings IX, Inc. (Pre-Deal)

-.50% ~ $ 9.90 | TGVC – TG Venture Acquisition Corp. (Pre-Deal)

-.50% ~ $ 9.96 | APCA – AP Acquisition Corp (Pre-Deal)

-.41% ~ $ 9.65 | HWEL – Healthwell Acquisition Corp. I (Pre-Deal)

-.41% ~ $ 9.73 | HCNE – Jaws Hurricane Acquisition Corporation (Pre-Deal)

-.40% ~ $ 9.91 | OACB – Oaktree Acquisition Corp II (Announced)

-.40% ~ $ 9.91 | DPCS – DP Cap Acquisition Corp I (Pre-Deal)

-.40% ~ $ 9.94 | IVCB – Investcorp Europe Acquisition Corp I (Pre-Deal)

-.40% ~ $ 9.96 | ICNC – Iconic Sports Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.97 | AFAC – Arena Fortify Acquisition Corp. (Pre-Deal)

-.39% ~ $ 10.14 | IPOF – Social Capital Hedosophia Holdings Corp VI (Pre-Deal)

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.