With XOM shares hitting a new 52-week high and Big Oil criticized for massive profits in the wake of Russia’s invasion of Ukraine, we take a closer look at financials and governance

Exxon hits a new 52-week high. Now at a $408 billion valuation, shares of oil & gas ExxonMobil (XOM) rank tenth in the S&P 500 index. In October 2020, Exxon stock traded at a third of its current price and was valued at less than pandemic favorite Zoom (ZM). XOM shares have run 61% this year, versus a 9% decline for the S&P 500 over the same period. The biggest driver of Exxon’s strong performance: strong demand for oil and gas and a surge in crude prices since Russia’s invasion of Ukraine.

XOM: Market Snapshot

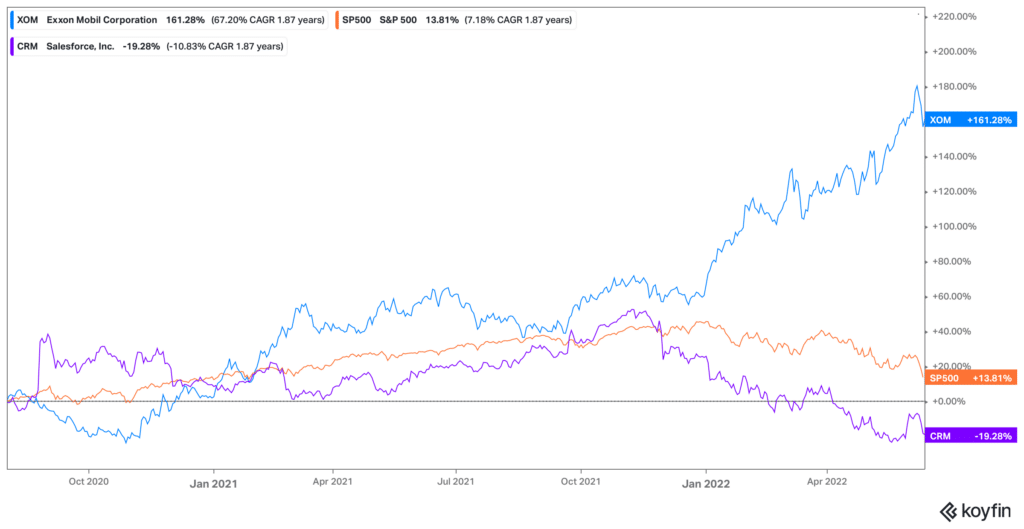

Exxon’s recent highs mark a comeback for the stock since it was booted from the Dow Jones Industrial Average in August 2020 and replaced with Salesforce (CRM). Since then, XOM shares are up over 180%; CRM shares have declined ~40%.

XOM versus CRM performance: August 2020 to present

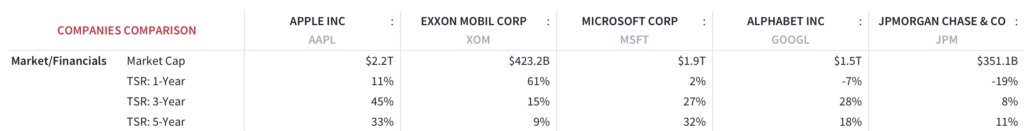

Making “more than God”…but less than Apple. With gasoline prices now at $5 a gallon and inflation running at over 8%, energy companies are taking the heat– with the possibility of a U.K.-style windfall profits tax. To quote President Joe Biden, ExxonMobil is making “more than God this year.” Specifically, Exxon is expected to generate ~$41B of net income in 2022, up from $23B last year. That said, the energy giant is actually expected to earn less than Apple (AAPL), at $100B this fiscal year; Google (GOOG, GOOGL), at $73B; Microsoft (MSFT), at $70B; and JP Morgan (JPM) at $60 billion.

Highest earners: A performance comparison

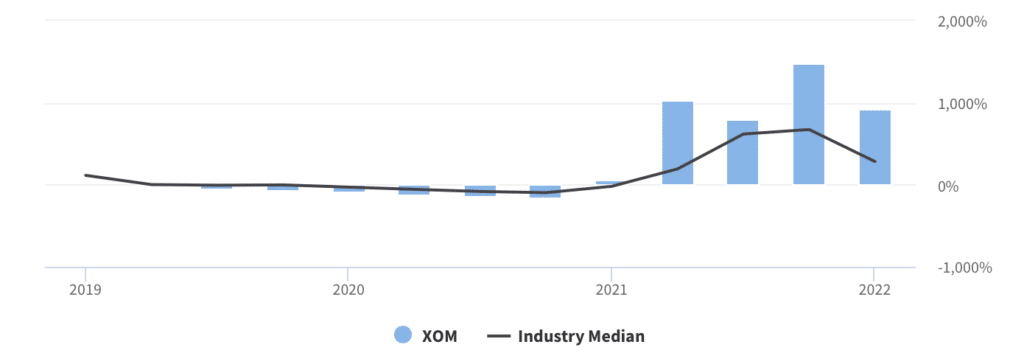

President Joe Biden to Exxon: “Start investing. Start paying your taxes.” The reality is that energy giant plans to spend $21B – $24 B on capital expenditures this year—one of the highest expenditures in the global energy industry—and $20B to $25B annually from 2023 to 2027. In the most recently reported Q1, Exxon generated FCF growth of 922% YoY– well above the industry median of 283% YoY.

XOM FCF Growth

Another win for climate campaigners: fossil fuel transition audit. A year after activist hedge fund engine No. 1 won three seats on Exxon’s board, evidence of positive change toward more climate-related disclosure is underway. Earlier this month, shareholders voted 52% in favor of a measure calling for Exxon to provide an audited report on how the International Energy Agency’s modeling for a net zero economy by 2050 would impact the “assumptions, costs, estimates, and valuations” underpinning Exxon’s financial statements. The move toward environmental disclosure follows on the heels of a controversial rebalancing of the S&P 500 ESG Index, which removed electric vehicle maker Tesla (TSLA) from its listing. With respect to climate disclosures, Exxon continues to remain under scrutiny. A Massachusetts court earlier this month rejected a bid by ExxonMobil to dismiss a lawsuit brought by the state that accuses the company of misleading the public about the role its fossil fuels play in causing climate change. The lawsuit says Exxon undertook “greenwashing campaigns” in an effort to portray itself as environmentally responsible.

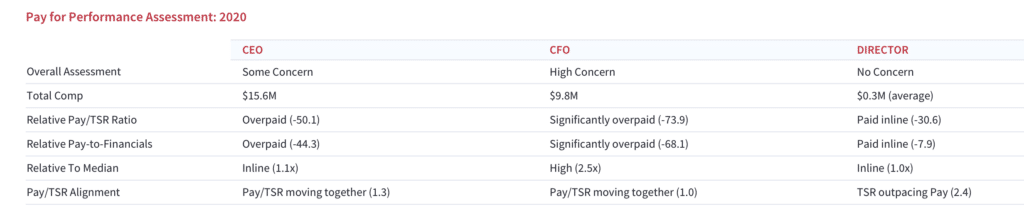

Red flag: Executive compensation. CFO Kathryn Mikell’s compensation is trending significantly above peer norms and financial metrics. That said, shareholders voted 91% in favor of the company’s executive compensation plan in the most recent Say-on-Pay vote.

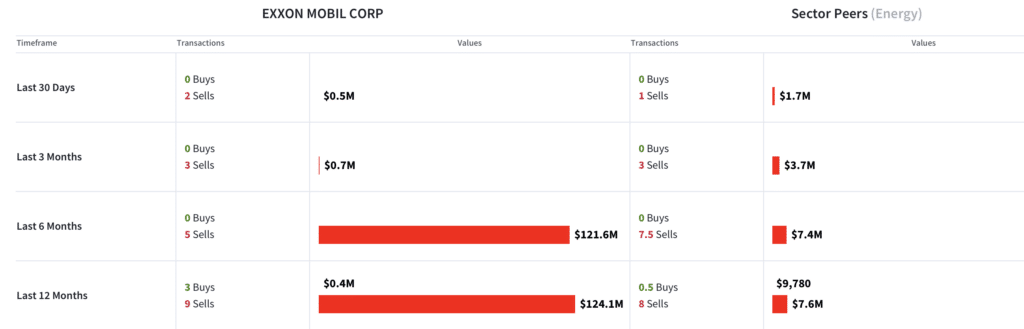

Insider trading. Insiders sold $124.1M in stock over the past 12 months, well above the peer average. Board members have been largely inactive. Only one Board member, Michael Angelakis, has been a strong buyer of XOM stock.

XOM: Insider trading snapshot

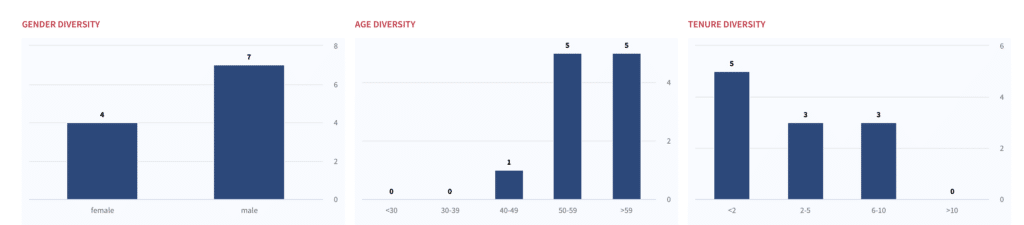

Red flag: Governance. Board Chair Darren W. Woods, also Exxon’s CEO, is not independent. In terms of diversity, 36% of the Board is female, above the peer average.

XOM: Current Board

XOM: Board Diversity and Inclusion Snapshot

Is the party over? With XOM shares now worth 10 times as much as Zoom, the question is just how much momentum is left in the stock. Even after the energy sector’s massive two gains, energy remains the cheapest sector in the S&P 500, trading below 10x earnings. It’s also the only sector in the S&P below 10x. XOM trades at ~11x forward EPS- versus 18x for the S&P 500.