Ahead of GGPI / Polestar merger vote, Musk talks hiring freeze and staff cuts– fueling concerns around China deliveries.

Polestar deSPAC on deck. GGPI shareholders will vote on the merger with electric vehicle (EV) maker Polestar on June 22. The company’s Form F-4 was also approved by the SEC. The transaction is projected to close in 1H22…the clock is ticking.

A potential pause in hiring amidst Tesla’s rapid growth sends a strong message. In an already uncertain market, Polestar’s debut comes as industry bellwether Tesla has reportedly ordered a hiring freeze and staff cuts. The news may have many investors questioning the viability of Tesla’s (and Polestar’s) delivery projections. TSLA stock is down 6% intraday on the news. According to Reuters, Elon Musk, in an email to executives, said he has a “super bad feeling” about the economy and is calling on Tesla to “pause all hiring worldwide” and cut staff by 10%. In 2021, the world’s largest EV maker grew its worldwide staff by ~ 30,000 as vehicle deliveries hit a record 936,000–up from about 500,000 in 2020. It’s difficult to imagine that Tesla could end this year with fewer employees– particularly as consensus estimates call for ~1.4 million vehicle deliveries (+50% YoY growth). Moreover, a big chunk of deliveries this year is expected to come from two new Gigafactories in Germany and Texas. Musk has also demanded that staff return to the office. “Everyone at Tesla is required to spend a minimum of 40 hours in the office per week,” Musk wrote in an email. “If you don’t show up, we will assume you have resigned.”

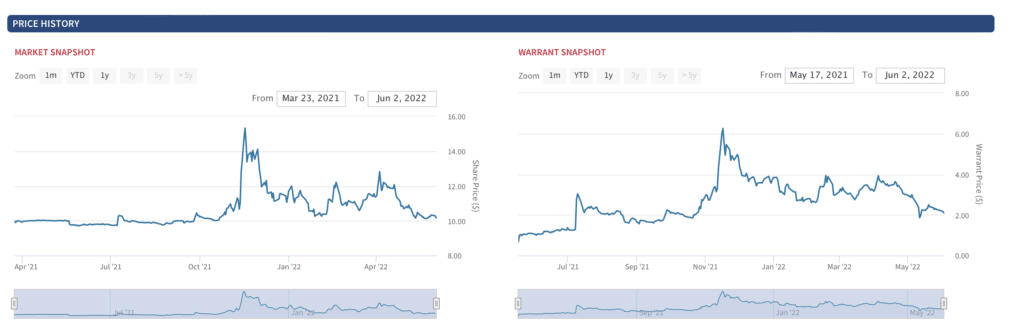

TSLA: Market Snapshot

COVID lockdowns in China will pressure Q2 deliveries– for Tesla and Polestar (and everyone else). COVID-19 lockdowns in China have materially constrained all auto production in that country. For Tesla, whose largest assembly plant is located near Shanghai, lockdowns have already forced outages at the plant. Tesla Q2 deliveries are expected at ~270,000 units. Consensus estimates are modeling a strong snap back (~ 400,000 units in Q3 and ~450,000 units in Q4), lending some concern over whether these numbers are achievable in the wake of Elon’s hiring freeze and staff cuts.

Polestar has already reduced guidance for China; we like the realistic re-set. Earlier this month, Polestar reported record sales for the first four months of 2022 with vehicle sales more than doubling to approximately 13,600. Order take more than tripled to nearly 23,000 YoY. Echoing China-related concerns, Polestar reduced its 2022 vehicle delivery forecast from 65,000 to 50,000 due to “prolonged government COVID-19 lockdowns in China during the first half of 2022.” Polestar says it is actively managing through these challenges– as it did in 2021 when the company delivered ~29,000 vehicles. “Through an implementation of a rapid response plan, including an accelerated introduction of a second production shift at the factory, Polestar plans to recover some of the production loss it has suffered later in the year and remains confident it will deliver its targeted sales volumes for 2023 through 2025,” the company stated. The bottom line is that these are still strong numbers despite the challenges– which in addition to lockdowns include supply chain constraints that continue to plague the entire auto industry.

Importantly, Polestar isn’t backing down from long-term guidance. “Any short- to medium-term economic effects have not dented our goal of selling 290,000 cars in 2025 – 10 times more than we sold in 2021,” said CEO Thomas Ingenlath. Polestar’s growth will be further accelerated by its entry into the lucrative SUV market with the Polestar 3, which also remains on track for October release. Since the beginning of the year, Polestar has expanded to 4 new markets increasing its global presence to 23 markets– seven away from its target of 30 total markets by the end of 2023.

After hitting a 52-week high of $16.41, GGPI shares have retraced to ~$10. Since Gores first announced the combination in Sept of last year, shares have been on a wild ride. As of today’s writing, GGPI shares trade at $10.06- down 39% from a 52-week high of $16.41.

GGPI: Stock and warrant snapshot

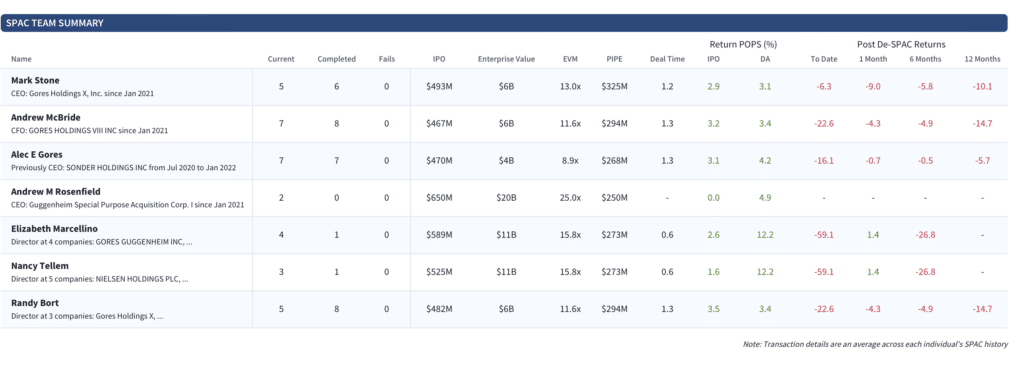

GGPI: SPAC team summary

Realistic delivery guidance and re-affirmed long term roadmap. Based on Musk’s comment “recessions serve a vital economic cleansing function”– for Tesla, the return-to-work directive looks more to us like a catalyst for natural attrition as opposed to a true layoff. Accordingly, we don’t see any negative read-through to Polestar’s forward projections (or Tesla’s, for that matter). On GGPI, we remain long the stock while maintaining realistic expectations. This story (and the stock price) would have been very different if Polestar had Lucid’s timing. We continue to focus on fundamentals. Polestar has delivered 13,600 EVs so far this year. Even on lowered production guidance, the company is the second largest domestic EV maker– ahead of Ford (F), Rivian (RIVN), and Lucid Group (LCID). In terms of valuation, based on 2.1253 billion shares and at the current price of $10.06, Polestar’s implied valuation is $21.4 billion. Assuming $1.6B in projected sales this year, shares implicitly trade at a more reasonable ~13x sales.

To dive deeper into the Polestar story, check out our podcast with Thomas Ingenlath back in February.