Tesla’s Pay Package Showdown: Tesla’s recent $1 trillion peak-value pay package proposal for CEO Elon Musk has sparked another public fight with the powerful proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis. Both advisors urged Tesla shareholders to vote against Musk’s $55 billion stock award at the Thursday, November 6, 2025 meeting, deeming it excessive, dilutive to shareholders, and misaligned with long-term investor interests. In response, Elon Musk has blasted these firms in no uncertain terms – even likening them to “corporate terrorists” that wield outsized influence over corporate elections. To us, this clash isn’t just about one pay package; it underscores a deeper debate about who really holds the reins in corporate governance.

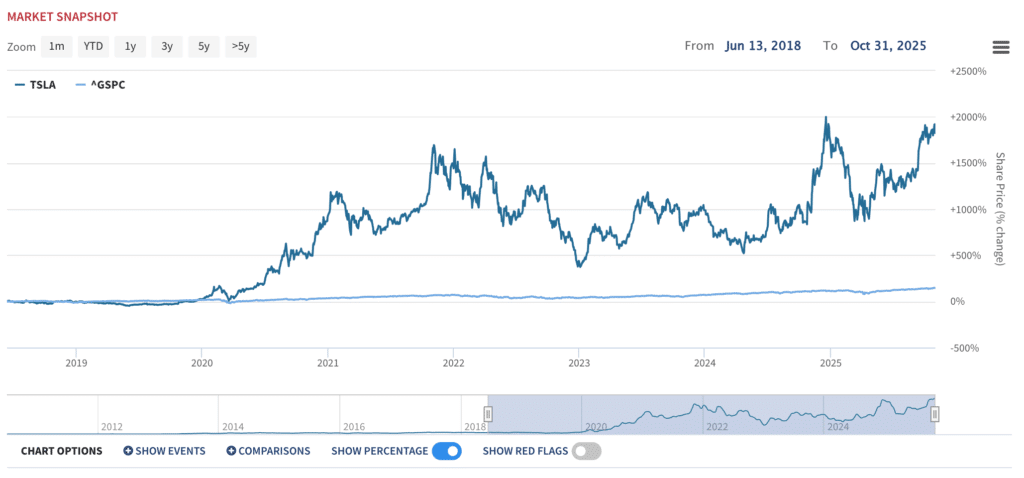

TSLA shareholders have done pretty well since they first approved Musk’s 2018 pay vote.

Musk: “It’s Not About the Money, It’s About Control”

Musk contends that his fight with ISS and Glass Lewis has little to do with personal greed and everything to do with Tesla’s future autonomy. On an October analyst call, he clarified, “It’s not like I’m going to go spend the money. There needs to be enough voting control to give me a strong influence – but not so much that I can’t be fired if I go insane.” In other words, Musk insists his enormous compensation package is meant to secure a stake large enough to steer Tesla’s ambitious projects without interference – while still allowing a mechanism for removal in an extreme scenario.

“It’s not like I’m going to go spend the money. There needs to be enough voting control to give me a strong influence – but not so much that I can’t be fired if I go insane.” – Elon Musk

From Musk’s perspective, and that of his many supporters, the real risk isn’t him cashing out to buy yachts; it’s that activist-influenced proxy advisors could strip away his control. “Glass Lewis and ISS control the vote of half the stock market. They own no stock in any of these companies,” Musk said during an appearance on the All-In Podcast. He argues that these firms, which advise index funds on how to vote their shares, have been “infiltrated by far-left activists” pursuing political agendas. By effectively controlling the vote of passive investors, ISS and Glass Lewis have the power to decide boardroom fates despite “having no skin in the game”. Musk’s fear is that they might one day help oust him for ideological or nonsensical reasons – derailing Tesla’s mission even if he “does everything right.”

In the All-In Podcast discussion, Musk stressed that Tesla’s proposed plan is about safeguarding Tesla’s vision. He’s driving groundbreaking endeavors like humanoid robots (“Optimus”) and autonomous vehicles, which could take years to bear fruit. Musk and the board want to ensure he won’t be terminated mid-project due to the whims of proxy advisors or short-term stock fluctuations. This approach aligns founder conviction with shareholder interests: investors who believe in Tesla’s long-term vision gain protection from the leadership instability that has derailed other innovative companies, while Musk remains accountable to the same shareholders who have seen extraordinary returns under his stewardship.

Tesla’s Complexity: More Than a Car Company

Another point raised in Musk’s defense is the sheer complexity of Tesla’s business, which goes far beyond manufacturing cars. Even critics of the pay package concede that finding a substitute for Musk would be extraordinarily difficult. Jason Calacanis on the All-In Podcast observed, Tesla is “a very complex business… It’s not just a car company. You got batteries, you got trucks, you got the self-driving group, this is a very complex business you’ve built over decades now.” The company spans multiple cutting-edge industries – from energy storage to robotics – all integrated under one vision.

Over nearly two decades, Musk has built Tesla into a multidimensional tech conglomerate, not a traditional automaker. This breadth makes standard benchmarks for CEO pay less straightforward. Musk’s supporters argue that Tesla’s scale of innovation justifies bold incentives, and that losing Musk (if he were to quit or be fired) would be far more damaging than the dilution from his stock grant.

Tesla is “a very complex business… It’s not just a car company. You got batteries, you got trucks, you got the self-driving group, this is a very complex business you’ve built over decades now.” – Jason Calacanis, All-In Podcast

It’s also notable that Musk’s 2018 compensation plan, which was similarly massive and received significant pushback from non-shareholders, ultimately helped Tesla skyrocket in value, turning that pay package into a lucrative bargain for investors. Those sympathetic to the company’s view point out that Tesla’s success has rewarded shareholders immensely, and keeping Musk invested in Tesla’s long-term outcome aligns his interests with investors. Thus, they argue, proxy advisors’ one-size-fits-all models may not account for Tesla’s unique leadership demands and exponential growth potential.

Proxy Advisors Under Fire

The Musk saga comes amid growing backlash against ISS and Glass Lewis in executive suites, investor circles, and even Washington. These two firms dominate the proxy advisory industry with an estimated 97% market share effectively gatekeeping corporate governance decisions across the market. Critics rightly point out that this duopoly has outsized and inappropriate influence on the millions of passive investors voting shares and driving outcomes not actually aligned with shareholder interests.

Lawmakers and regulators are now fully scrutinizing this concentration of power. U.S. Senator Bill Hagerty, for instance, has called out ISS and Glass Lewis as a “duopoly” that has “hijacked corporate governance” and suggested an antitrust investigation into their “anti-competitive and abusive practices” is long overdue. Likewise, some state officials like the Texas attorney general have launched probes into whether these firms’ recommendations are swayed by political biases rather than financial merits. The concern is that if proxy advisors use their clout to push non-financial or activist agendas, they could undermine companies’ duty to maximize shareholder value.

ISS and Glass Lewis dominate the proxy advisory market. They suppress competition, dictate policies to public companies, impose left-wing agendas, and harm U.S. investors and consumers.

I’m calling on @TheJusticeDept and @FTC to investigate their anticompetitive practices. pic.twitter.com/zK61eUHg3w

— Senator Bill Hagerty (@SenatorHagerty) June 26, 2025

The backlash is broad and growing as other prominent investors have echoed these sentiments. Bill Gurley and Brad Gerstner, in their BG2 podcast, argue that ISS and Glass Lewis often follow rigid checklists or ideological leanings, rather than first-principles thinking about what drives shareholder value. Gurley recounted reaching out to ISS about their philosophy on stock-based compensation and finding “no one there thinking from a first principles perspective” about aligning management and shareholder interests.

This reflects a broader concern that proxy advisors may push generic “good governance” rules or trendy ESG agendas without appreciating company-specific contexts. “Fiduciary duty is the number one responsibility of all board members… and we’ve clearly crept away from that in the past 10 or 20 years,” Gurley observed, lamenting how other considerations have overtaken pure shareholder interest.

There’s also a significant degree of confusion and inconsistency around proxy advisor guidance. In the case of this year’s Tesla vote, Glass Lewis’s tells shareholders to reject the board-sponsored compensation plan while saying a separate proposal about a potential Tesla investment in xAI is a matter “to be fully considered and ultimately decided by the board, not shareholders.” So, when exactly should the shareholders who own the company have a say at vote and when should they not?

Does the Duopoly Incentivize “Bad” Governance?

Ironically, undue influence of proxy advisors may be encouraging the opposite of their intended governance best practices. Many advocates of shareholder rights usually dislike dual-class or super-voting stock structures (which give founders or insiders extra voting power) as entrenchment tools. But as Gurley notes, “one of the key reasons so many companies have super voting is so that these two companies can’t tell them what to do.” In other words, if ISS and Glass Lewis are perceived as pushing policies misaligned with long-term value, companies will increasingly respond by insulating their control through weighted voting rights. It’s a defensive measure born directly of the proxy advisors’ clout – an unintended consequence in the governance debate.

On the flip side, large asset managers are exploring ways to better empower shareholders and thereby diluting proxy advisors’ influence by giving voting power back to end investors. BlackRock and Vanguard have started offering “pass-through voting” or client-directed voting programs, letting their ETF and index fund investors voice preferences on proxy matters rather than automatically following ISS/GL. This could democratize and diversify the vote, reducing the one-size-fits-all effect and with easier than ever ways to assess the board and management’s track records, the power would flow back to shareholders. This is an important step forward for governance and should see the rise in the ability of shareholders to affect the boardroom.

While there’s growing consensus that proxy advisors like ISS and Glass Lewis wield too much power, recent actions by companies like ExxonMobil show that solutions must be carefully designed. Exxon has been pressuring shareholders—particularly retail investors—to vote early and directly through the company’s platform, a move many see as an attempt to sidestep proxy advisor influence. On one hand, this reduces ISS and Glass Lewis’s stranglehold over votes. On the other, it raises a red flag: could companies now centralize control over shareholder input just as tightly as the advisors once did? If proxy advisors’ dominance is replaced by company-driven voting capture, we’ve simply swapped one version of unaccountable power for another. The right solution is not to shift control, but to return it to the shareholders—through better data, greater transparency, and decentralized, informed decision-making. Cooley provides a useful alert that provides a balanced view of these latest developments.

Boardroom Alpha’s Take

It’s clear that what began as a dispute over one man’s pay package has evolved into a broader referendum on proxy advisory power. In our view, the Musk vs. ISS/Glass Lewis clash shines a needed spotlight on an often-overlooked corner of Wall Street. Who should ultimately call the shots in a public company — teams that are delivering for shareholders and that all have skin in the game, or advisory firms with checklists and no ownership stake? And when does protecting shareholders from outlandish pay cross into stifling a company’s long-term boldness? Ultimately, who has the power to hold the board accountable and what are they accountable for?

At Boardroom Alpha, we have tracked how proxy advisor recommendations can dramatically sway votes, sometimes against even high-performing executives or sensible board moves. We share the concern voiced by Jamie Dimon, Bill Gurley, Brad Gerstner and others that an entrenched duopoly in proxy advice may not serve investors’ best interests. The Tesla episode vividly illustrates the tension: ISS and Glass Lewis cast Musk’s pay plan as value-destructive, yet Tesla’s extraordinary growth under Musk suggests a more nuanced calculus of value creation. Such decisions cannot be judged purely by a template and they should be judged by those with incentives that are truly aligned.

It’s time for investors to reclaim their voting responsibility instead of outsourcing it wholesale. Proxy advisors can provide research, but investors must apply judgment and consider company-specific context rather than following blindly. Likewise, proxy firms themselves should heed the criticism and strive to refocus on shareholder value above all else, avoiding the appearance of political or one-size-fits-all motivations. Healthy skepticism toward powerful gatekeepers is warranted – but so is measured analysis of each situation. Musk’s fight with ISS and Glass Lewis ultimately reminds us that good governance is not just about checking boxes; it’s about balancing accountability with enabling visionary leadership that drives return for shareholders.

Tesla’s governance drama has provided another necessary kick to the hornet’s nest of proxy advisory influence. We can disagree on Elon Musk’s pay magnitude, but still agree that the current proxy advisory regime needs more transparency, competition, and alignment with investors’ true interests. Tesla’s meeting has further opened the door for a long-overdue look at these firms’ role. Shareholders, boards, and regulators should walk through that door – because ensuring the right balance of power in boardrooms will shape the innovation and prosperity of companies for decades to come.

Frequently Asked Questions (FAQs)

1. What is Elon Musk’s 2025 Tesla pay package proposal?

Elon Musk’s 2025 pay package is a performance-based compensation plan that would award him stock options if Tesla hits ambitious milestones, including up to an $8.5 trillion market cap and $400 billion in adjusted EBITDA. He receives nothing unless these targets are met.

2. Why are ISS and Glass Lewis against Elon Musk’s compensation plan?

Proxy advisors ISS and Glass Lewis oppose the plan due to its size, potential shareholder dilution, and perceived misalignment with governance best practices. They argue the package is excessive, even if based on performance.

3. What is Elon Musk’s argument in favor of the pay package?

Musk claims the issue isn’t about money, but control. He wants a level of voting power that allows him to continue leading Tesla’s complex initiatives—like robotics, AI, and autonomy—without the risk of being removed by activists or proxy advisors for non-performance reasons.

4. How much influence do ISS and Glass Lewis have on shareholder votes?

Together, ISS and Glass Lewis control over 95% of the proxy advisory market. Many institutional investors follow their recommendations, meaning these firms can sway shareholder votes at thousands of public companies without owning stock themselves.

5. Why is Tesla’s board supporting the pay package?

Tesla’s board, led by Chair Robyn Denholm, supports the package as a retention tool. They argue that Musk is essential to Tesla’s success and that the structure directly ties his compensation to shareholder value creation.

6. What’s the controversy over the xAI shareholder proposal?

Glass Lewis opposed allowing shareholders to vote on Tesla’s potential investment in Elon Musk’s AI venture, xAI—stating that such decisions should be left to the board. Yet they also recommend shareholders override the board’s approved pay package. Critics call this position inconsistent and hypocritical.

7. What major investors support or oppose Musk’s pay plan?

Supporters include Florida’s State Board of Administration (SBA), ARK Invest, and Michael Dell. Opponents include CalPERS, Norges Bank, and the New York City Comptroller’s office. Large index funds like BlackRock and Vanguard have not publicly disclosed their positions yet.

8. How is Tesla different from a traditional car company?

Tesla operates across electric vehicles, energy storage, solar, AI, and robotics. Its integrated strategy and innovation pace make it more akin to a deep-tech conglomerate than a conventional automaker—fueling arguments that traditional governance standards may not apply.

9. Why are proxy advisory firms under growing criticism?

Business leaders like Elon Musk, Jamie Dimon, and Bill Gurley argue that ISS and Glass Lewis are unelected gatekeepers applying rigid, ideological checklists without accountability or economic interest in the companies they influence.

10. How can shareholders make informed voting decisions beyond proxy advisor recommendations?

Platforms like Boardroom Alpha provide quantitative, data-driven tools to assess executive performance, board accountability, and pay-for-performance alignment—empowering investors to make decisions based on facts, not one-size-fits-all opinions.

11. How can shareholders use Boardroom Alpha to make better proxy voting decisions?

Boardroom Alpha’s Voting Guidance Engine helps investors analyze proxy votes with objectivity and flexibility. Investors can tailor their models to prioritize what matters most to them, such as financial results, governance quality, or leadership accountability. The engine allows users to compare scenarios, flag concerns like overboarding or weak independence, and generate consistent, data-driven recommendations across all meetings. It’s a powerful way to cut through noise and make smart, aligned voting decisions—especially in a proxy environment dominated by conflicting advice and generic templates.