Elliott Investment Management has taken a bold $4 billion stake in PepsiCo (NASDAQ: PEP), calling for significant changes to unlock shareholder value. Based on Boardroom Alpha’s analysis, we believe Elliott is justified in pressing the company and its board for action. PepsiCo’s underperformance, governance concerns, and insider behavior all point to the need for stronger accountability and board refreshment. We also believe Elliott will be successful in their push for change given its long track record and recent wins at Hewlett Packard Enterprise (added Robert Calderoni to the board), Honeywell International (added Marc Steinberg to the board), and its successful proxy contest at Phillips 66 where they won two seats on the board (adding Signumd Cornelius and Michael Heim).

Quick Take: Elliott at PepsiCo

- $4B Stake – Elliott Investment Management has disclosed a major position in PepsiCo, pushing for changes to unlock shareholder value.

- Boardroom Alpha View – Our analysis supports Elliott’s campaign given PepsiCo’s weak TSR, pay-performance concerns, and entrenched governance.

- Underperformance – PEP shares are down 10% over 1 year vs. the S&P 500’s +16%; 3- and 5-year returns also trail benchmarks.

- Governance Red Flags – Long average director tenure (10 years), heavy insider selling, and a CEO also serving as Chair raise accountability concerns.

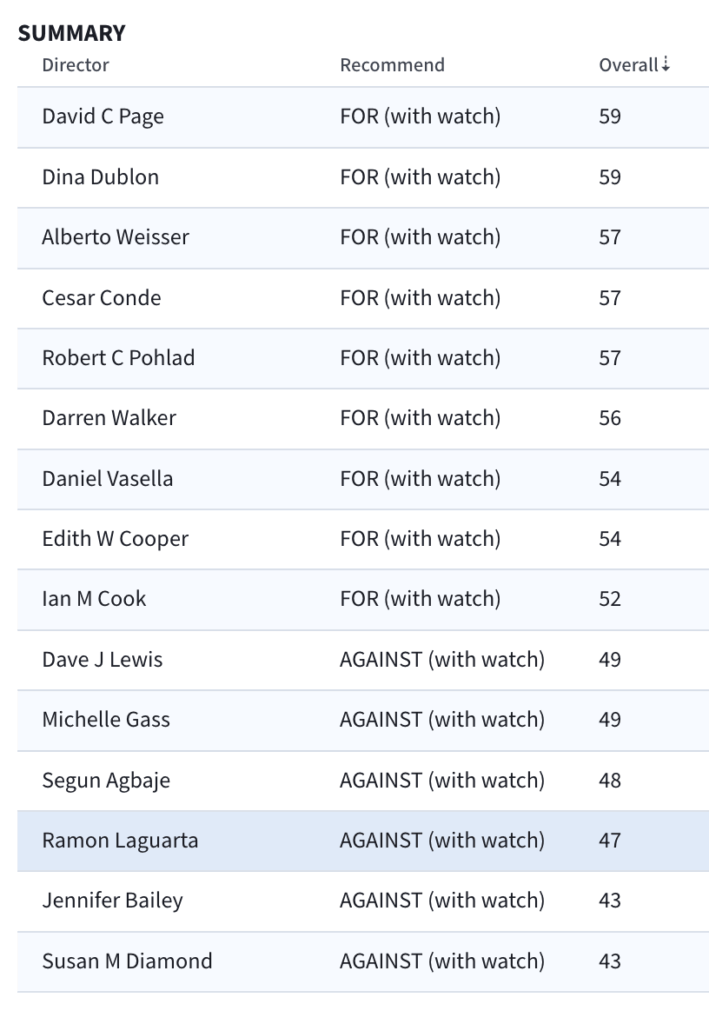

- Voting Guidance – Several directors, including CEO Ramon Laguarta, merit “AGAINST (with watch)” votes. The rest only qualify as “FOR (with watch)”—no director deserves full endorsement.

- Elliott’s Track Record – Builds on recent activism at HPE (board refresh, strategic review), Honeywell (breakup into 3 companies), and Phillips 66 (board fight, portfolio simplification).

- Bottom Line – Like at HPE, Honeywell, and Phillips 66, Elliott is targeting underperformance and stale governance. Boardroom Alpha agrees: PepsiCo needs change at the top.

Lagging Returns and Governance Problems at PepsiCo

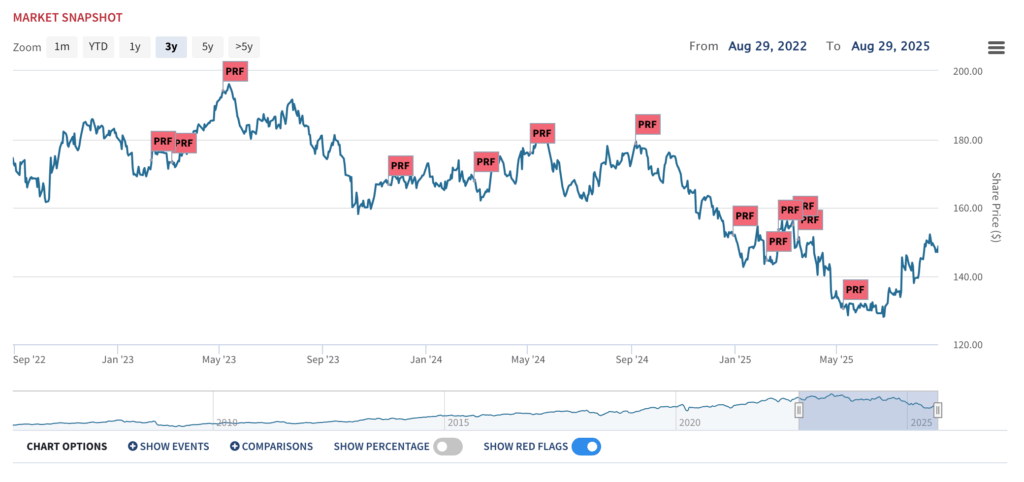

The top-line focus for PepsiCo shareholders will certainly be the continued persistent underperformance of shares relative to the broader market and its peers. PEP’s total shareholder return (TSR) is down 10% while the S&P 500 has gained 16% — a 27-point gap that shareholders will find tough to tolerate. Longer horizons aren’t much better: a -2% TSR over three years against the market’s +17%, and only 4% over five years versus +13% for the index.

Shareholders losing out at PEP

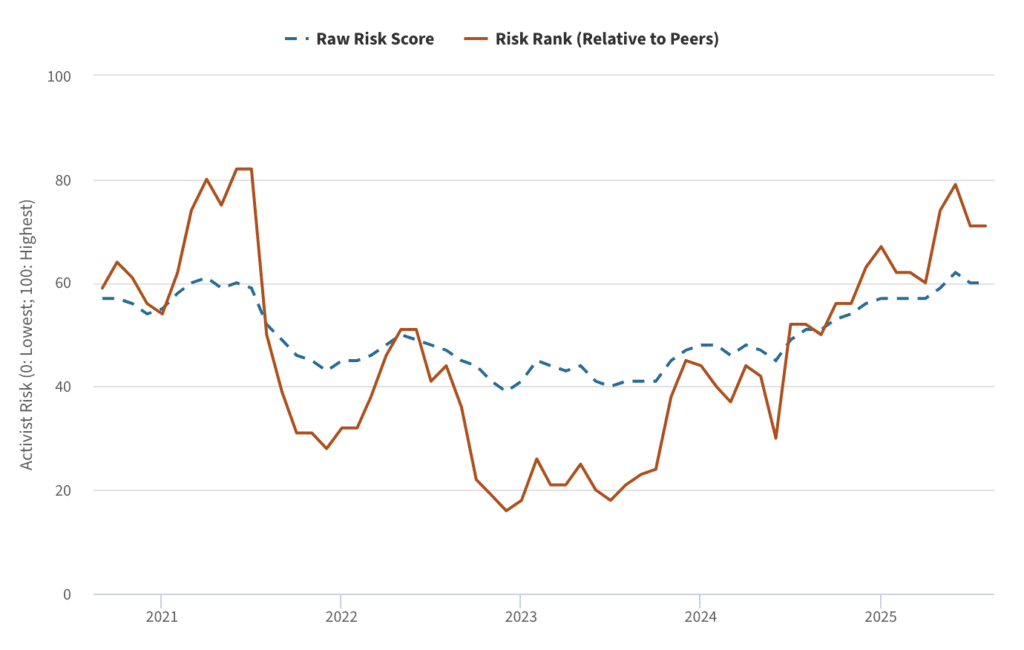

We weren’t surprised to see Elliott launch a campaign at PepsiCo given we’ve seen the Boardroom Alpha Activist Risk Score steadily rising into territories where we typically see activity happen. This signals long-standing underperformance relative to peers both on market-based metrics and fundamentals — in short, a company in need of a turn around.

BA’s Activist Vulnerability Score has spike as PEP performance continued to lag.

Despite this underperformance, CEO Ramon Laguarta received $28.8 million in 2024 compensation, with our analysis flagging high concern for pay-for-performance misalignment. While Say-on-Pay passed in 2025 with 86% support, that level represents an undercurrent of investor dissatisfaction for a company of PepsiCo’s size. PepsiCo has a track record of lower support for Say-on-Pay showing long-standing dissatisfaction with what shareholders are seeing.

At the board level, we’re seeing an entrenched board with weak board ratings. Six of the directors have now served well over 10 years and newer directors — though all on the job for 2+ years still — have only seen the company continue to underperform versus serving as catalysts for improvement. The board is also large compared to peers with 15 board members. Eight of those fifteen directors have ratings in the “C” range which is yet another measure showing how the company us underperformed under their stewardship. We’d like to see the board significantly refreshed and consolidated to to drive new ideas and streamline decision making.

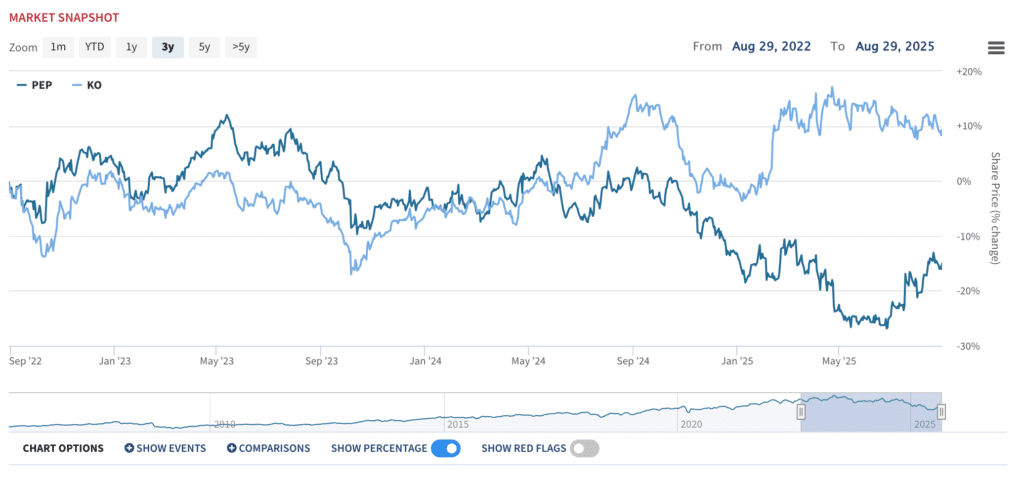

Diverging fortunes at KO and PEP

Voting Guidance: A Case for Change

We also looked at the directors using Boardroom Alpha’s Voting Guidance Engine which highlights issues at the board level and, if a vote were held today, would suggest that six of the current directors should be voted “Against (with watch)”. Those directors include CEO/Chair Ramon Laguarta, Jennifer Bailey, Susan M. Diamond, Michelle Gass, Segun Agbaje, and Dave J. Lewis. The remaining directors only warrant a “FOR (with watch)”. This pattern underscores the absence of standout board leadership and the resulting company underperformance.

To generate voting recommendations for PepsiCo’s board, we used Boardroom Alpha’s new Voting Guidance Engine. The model we applied put greater weight on company performance—asking whether directors were meeting their fiduciary duty to deliver positive outcomes for shareholders—than on governance mechanics. It did not take environmental or social issues into account.

Under this approach, directors at companies showing strong performance are generally supported, while those at companies with only “okay” performance face closer scrutiny. In cases where performance was middling and governance concerns were also present—such as overboarding, weak board independence, or entrenched structures—the model leans toward recommending votes against. This balance keeps the focus on shareholder outcomes while still flagging governance risks that could compromise long-term value.

Why Elliott Is Right to Push

Boardroom Alpha’s analysis aligns with Elliott’s view that PepsiCo requires change. Persistent underperformance, entrenched directors, pay-for-performance issues, and significant insider selling all contribute to a weak governance profile. PepsiCo’s peers, including Coca-Cola and Monster Beverage, are delivering stronger returns while paying executives less, highlighting the gap between PepsiCo’s results and its compensation practices.

Elliott’s activism could catalyze long-overdue governance and strategic changes. Shareholders should welcome this pressure as an opportunity to realign PepsiCo’s leadership with investor interests.