Third automotive DA of the week. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

Two new SPAC S-1s filed

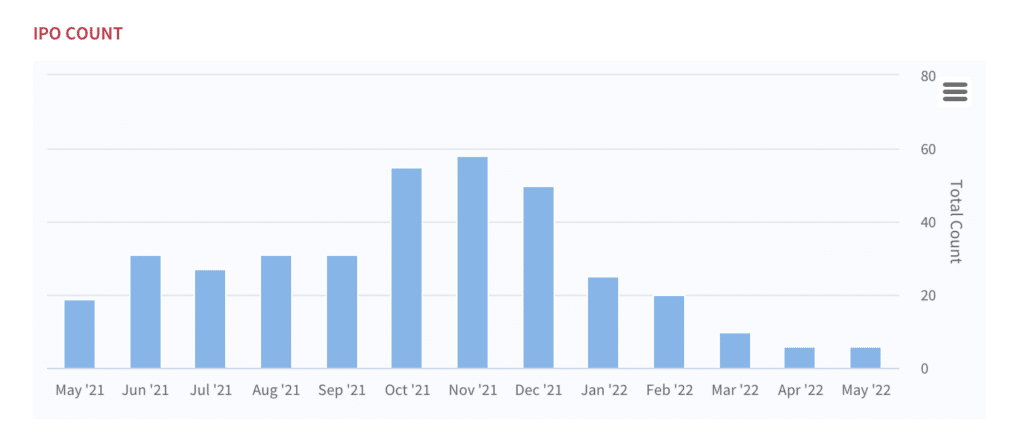

SPAC IPOs have slowed considerably, with only 6 IPOs this month, down from 19 a year ago. Two new S-1s filed:

- Mars Acquisition Corp (MARXU). Filed for a $75M IPO and will target businesses in crypto-currency and block-chain, electronic vehicles, healthcare technology, financial technology, cleantech, specialty manufacturing, big data and artificial intelligence, and other related technologies. The SPAC is led by CEO, CFO, and Director Karl Brenza, former Senior Managing Director of Investment Banking for Paulson Investment Company; COO and Director Iris Zhao, the CIO of Future Fintech Group (FTFT); and Chairman Shanchun Huang, the CEO of Future Fintech Group. Zhao and Huang are spouses.

- ESH Acquisition Corp (ESHU).Filed for a $300M IPO. ESH includes industry veterans in entertainment, sports, and hospitality. The SPAC is led by CEO and Director James Francis, founder and former CEO of Chesapeake Lodging Trust and Highland Hospitality, Chairman Allen Weiss, former consultant at Apollo Investment and President of World Wide Operations for the Walt Disney Parks and Resorts business, and Vice Chairman Magic Johnson, former NBA player and founder and CEO of investment firm Magic Johnson Enterprises. ESH intends to target the global entertainment, sports, and hospitality sectors. Areas of focus include professional sports franchises, luxury resorts, destination and regional theme parks, record labels, and music and television streaming services.

SPAC Deal: Aesther Healthcare Acquisition + United Gear & Assembly

Aesther Healthcare Acquisition (AEHA) announces a DA with United Gear & Assembly. Limited information on this one; $107M in trust. United Gear & Assembly designs and manufactures high precision gears for electric vehicles, construction and mining and agriculture end markets. Customers include Lucid Group (LCID), Volvo, HUSCO, Dana and GM, among others.

GBTG / American Express Global Business Travel Closes

American Express Global Business Travel (GBTG) to begin trading on the NYSE 5/31. Still no word on redemptions.

Elsewhere in SPACs

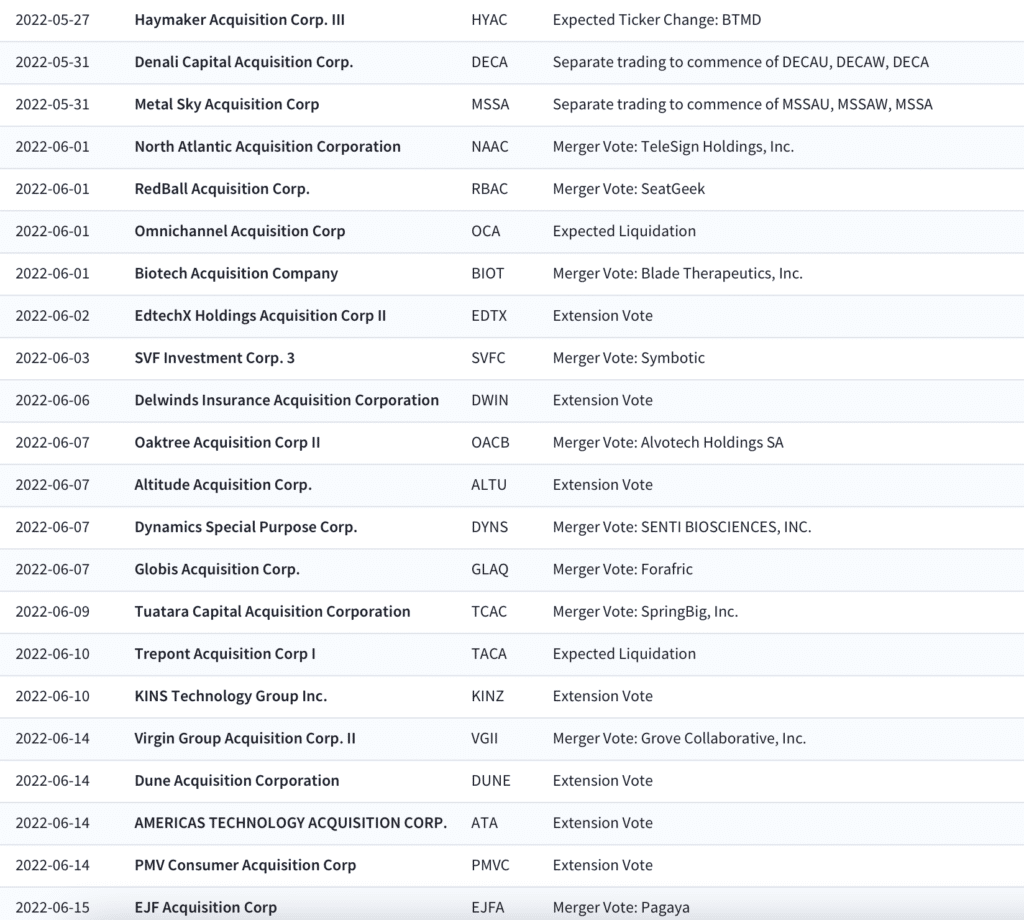

- SPAC liquidation: Trepont Acquisition Corp I (TACA) on 6/10. $10.10 redemption.

SPAC Calendar

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.