Key Points & Questions

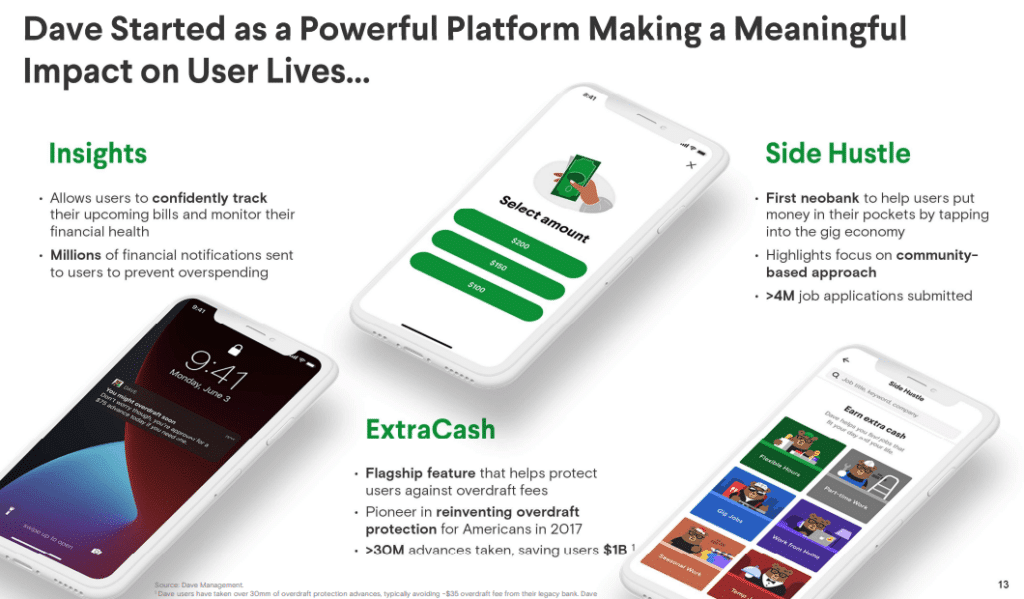

- Dave saves customers billions in overdraft fees, eliminating a pain point by predicting upcoming bills and fronting extra cash for no fees

- Dave has experienced tremendous user growth in such a short period of time and expects to return to profitability next year

- Can Dave keep its customer base, which skew younger and not as financially sound, as lifelong customers as they age and improve their financial condition

- Will the delayed M&A process, and slightly lower near term projections, hurt execution more than expected

“Dave” going against Goliath

Dave’s original mission was to help individuals avoid billions in overdraft fees from their banks by helping customers predict their monthly spending and fronting cash to save them from the high fees with interest free credit.

To date Dave has only raised around $61M in VC capital which is relatively small for a company that’s seen such tremendous growth. Mark Cuban is an early investor and Dave board member and a big believer in the mission. He has a long history with CEO Jason Wilk across other successful investments in addition to Dave.

Dave traditionally made money by charging a small (~$1) monthly subscription fee, fees if members need cash faster (otherwise it’s free), and tipping where members optionally tip Dave their perceived value from using the service. Dave Banking, recently rolled out, is set to become the company’s new primary product.

Dave targets the 45 million people a year who are over drafting about 10-20 times a year paying ~$400 in fees for both minimum balance and over drafting. Ancillary revenue is also driven by products skewed to the younger generation, like Side Hustle which connects customers to gig companies like Uber and DoorDash.

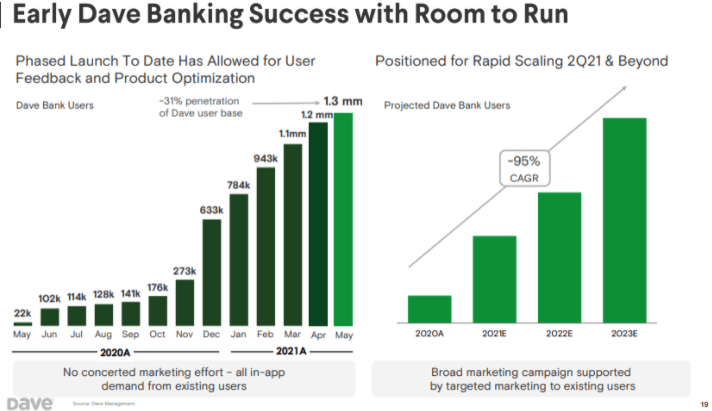

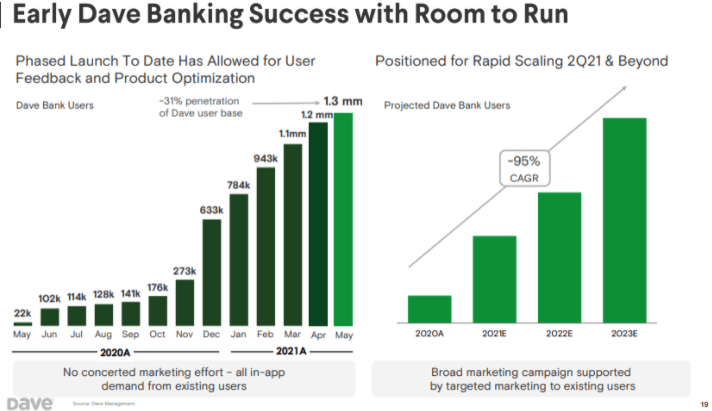

2021 saw the rollout of Dave Banking, a free checking account, that already has close to 2mm customers. Starting in 2022, Dave Banking will now be the primary product of the company.

User growth has been very healthy for Dave, who are up to almost 6mm unique users. COVID brought two interesting dynamics for the company. On the plus side, the shift to all digital away from brick and mortar has clearly been a positive for the business. Though interestingly, the government stimulus was a bit of a headwind for the company as people suddenly had some extra cash in their checking accounts buffering against overdrafts, almost in direct competition to Dave’s business.

Competitive Landscape + Valuation

There are over 14,000 different banking institutions in the US, so obviously there is immense competition in the space. Dave has been able to grow and stand out in their pioneering overdraft protection product. CEO Jason Wilks touts Dave’s brand and marketing wins in helping them win out vs. others.

Dave competes with all banks, but also mobile banking FinTechs including SoFi (SOFI), MoneyLion (ML), and eToro (FTCV) all which have gone public or plan to go public via SPAC. Dave’s valuation is struck at 6.7x 2023E revenue which prices it as a discount to SOFI and eTORO but a premium to ML.

Dave / VPCC SPAC Deal Details

The SPAC deal has a $210M PIPE led by Tiger Global, who helped validate the valuation in the PIPE prior to picking a SPAC partner. Other participants in the PIPE include Corbin Capital Partners and Wellington.

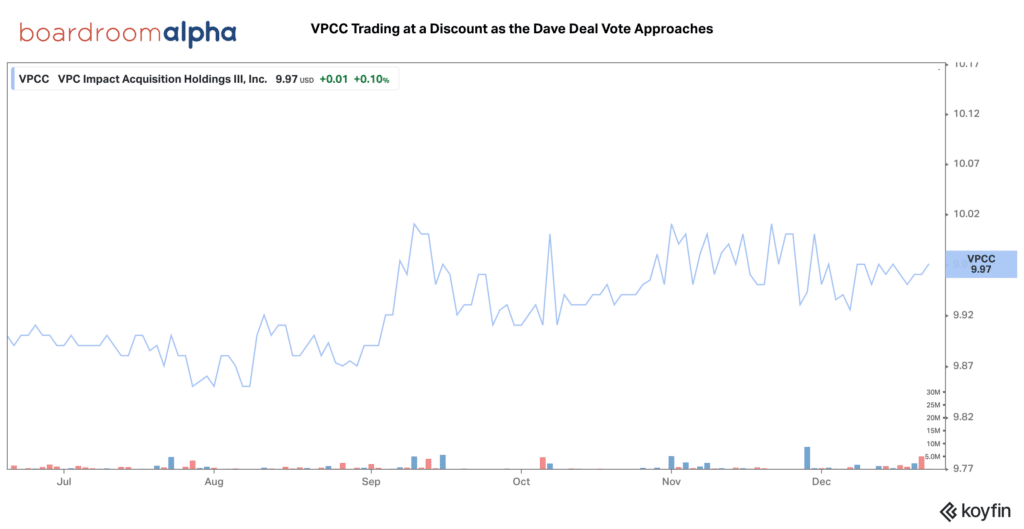

Wilk says that Victory Park’s SPAC size lined up well with what Dave needed, and had previously supplied Dave with a $100M credit facility. VPCC has about $254M in its trust account and shares are currently teetering close to NAV at $9.97. Given it is trading below NAV and the current SPAC environment investors will want to watch for redemptions — though given Dave’s strong business and track record they shouldn’t be surprised if redemptions are on the lower end.

About the Sponsor

VPC Impact Acquisition Holdings III (VPCC) is the third SPAC sponsored by private equity investors Victory Park Capital Partners. They are active in FinTech investing across asset classes via traditional PE, other credit/financing solutions, their own SPACs, and PIPE participation in others (e.g. LNFA), and leverage their full platform during the SPAC process.

The SPAC is led by Co-CEOs Brendan Carroll and Gordon Watson, both partners of VPC.

About Jason Wilk – Dave Co-Founder and CEO

Jason Wilk has 15 years of experience building successful digital companies. Currently, founder and CEO of Dave, a leading challenger bank focused on lifting the collective potential of America. The company has amassed 10 million users with its innovative checking account that was first to market in 2017 with fee-free overdraft, credit building, expense predictions and a gig-economy focused job board. As CEO, Jason sets the vision and product strategy for the 200+ person company.

From 2009 to 2016, with backing from Mark Cuban, Skip Paul, Jonathan Kraft and Y Combinator, Jason was co-founder and CEO of AllScreen.TV, which brought the successful model of television syndication to the internet. Clients included Vice, Time, CondeNast, AOL, Yahoo and many more. The company was named #29 on the 2015 Inc. 500 Fastest Growing Companies in America list and was acquired for $85mm. A lifelong entrepreneur, Jason began building companies in his dorm room when he founded golf equipment e-commerce site 1Daysports. He is also the founder of WriteyBoards and an investor in many other startups.

Topics On the Podcast

- Intro and background on Jason Wilk

- Overview of Dave and the origins

- Customer acquisition and targeted users

- Dave Banking and plans for rollout

- Side hustle and how Dave helps customers

- User growth, was it sustainable?

- Competition: many players, how to win?

- Deal, SPAC, and M&A process

- Dave’s Operating team + life as public company