3 SPAC Deals Go to Vote: WINV, DIST, BSII. Aetherium (GMFI) Vote Postponed to June. Digital Asset and Real Asset Set Warrant Separation Dates.

Boardroom Alpha SPAC Resources

– Full SPAC Listing

– SPAC SEC Filings

– Boardroom Alpha IPO & SPAC Intelligence Platform (7-Day Trial)

Daily SPAC Update

SEPARATE WARRANTS/RIGHTS

Jun 02: DIGITAL ASSET ACQUISITION CORP (DAAQ)

Jun 02: REAL ASSET ACQUISITION CORP (RAAQ)

Jun 02: COPLEY ACQUISITION CORP (COPL)

SPAC DEAL TERMINATIONS (Last 10 Days)

2025-05-21: ASPC + HDEducation Group Limited

OTHER SPAC NEWS

GMFI – AETHERIUM ACQUISITION CORP * Vote Postponed

NEW SPAC IPOs

May 29: WTG – Wintergreen Acquisition Corp. $50M IPO

May 29: JENA – Jena Acquisition Corporartion Ii $200M IPO

May 28: KCHV – Kochav Defense Acquisition Corp. $220M IPO (+underwriter overallotment: $33M)

May 28: CHPG – Championsgate Acquisition Corp $65M IPO (+underwriter overallotment: $9.75M)

MERGER VOTES

WINV – Winvest Acquisition Corp + Xtribe P.L.C.

Xtribe P.L.C. is a technology company that operates a digital platform that aims to connect buyers and sellers. Through its advanced features and commitment to sustainability, Xtribe aims to empower businesses, foster economic growth, and create a vibrant and inclusive online community.

DIST – Distoken Acquisition Corp + Youlife International Holdings Inc.

Youlife is a leading blue‑collar lifetime service platform in China. Operating under the brand name Youlan, Youlife is a platform company that integrates vocational education services, recruitment services, employee management services, and market services for blue-collar talent and businesses in China. Cognizant of the deep-rooted pain points within China’s massive vocational education industry, blue-collar recruitment service industry, blue-collar employee management industry and blue-collar market service industry, Youlife’s blue-collar lifetime service platform aims to empower blue-collar workers with vocational learnings and on-the-job skills, navigate their job search, connect blue-collar job seekers with suitable employers, and deliver tailored human resources solutions to businesses.

BSII – Black Spade Acquisition Ii Co + World Media and Entertainment Universal Inc.

World Media and Entertainment Universal Inc., jointly established by AMTD Group, AMTD IDEA Group (NYSE: AMTD; SGX: HKB) and AMTD Digital Inc. (NYSE: HKD), is headquartered in France and focuses on global strategies and developments in multi-media, entertainment, and cultural affairs worldwide as well as hospitality and VIP services. WME comprises L’Officiel, The Art Newspaper, movie and entertainment projects, collectively a diversified media and entertainment portfolio of businesses, and a global portfolio of premium properties.

SPAC IPOs SURGE IN MAY

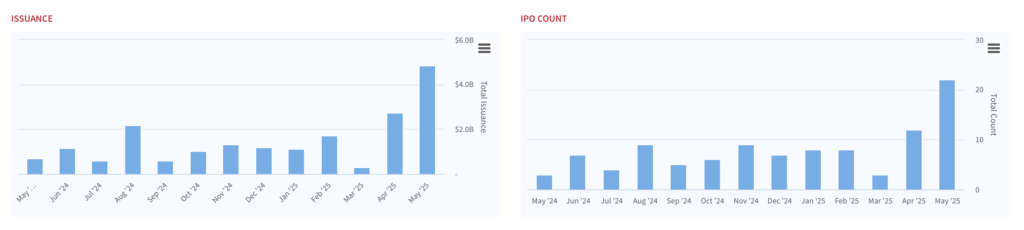

With today’s SPAC IPOs of Wintergreen and Jena II, SPAC IPO activity continues to surge in May 2025, with issuance volume and IPO count both hitting their highest levels in over a year. The number of SPAC IPOs more than doubled compared to April 2025, jumping from just over 10 to more than 20 new listings. This marks a dramatic rebound from the subdued levels seen in May 2024, when monthly IPO counts were in the low single digits. Similarly, total issuance in May 2025 spiked to nearly $5 billion—also nearly double April’s figure—highlighting renewed investor appetite and market momentum. The charts below clearly illustrate this sharp acceleration in both deal volume and capital raised.

SPAC Movers

YESTERDAY’S TOP SPAC GAINERS

4.96% ~ $ 42.11 | CEP – CANTOR EQUITY PARTNERS INC (Announced)

1.09% ~ $ 10.17 | LOKV – LIVE OAK ACQUISITION CORP V (Pre-Deal)

.98% ~ $ 14.47 | CLBR – COLOMBIER ACQUISITION CORP II (Announced)

.79% ~ $ 11.45 | CEPT – CANTOR EQUITY PARTNERS II INC (Pre-Deal)

.44% ~ $ 11.41 | FORL – FOUR LEAF ACQUISITION CORP (Announced)

YESTERDAY’S TOP SPAC LOSERS

-32.76% ~ $ 7.09 | CHEB – CHENGHE ACQUISITION II CO (Announced)

-5.82% ~ $ 10.20 | BSII – BLACK SPADE ACQUISITION II CO (Announced)

-1.34% ~ $ 11.75 | RENE – CARTESIAN GROWTH CORP II (Pre-Deal)

-1.09% ~ $ 10.93 | ESHA – ESH ACQUISITION CORP (Pre-Deal)

-.99% ~ $ 14.01 | DMYY – DMY SQUARED TECHNOLOGY GROUP INC (Pre-Deal)

LATEST SPAC IPO PERFORMANCE

May 29 | JENA – JENA ACQUISITION CORPORATION II

May 29 | WTG – Wintergreen Acquisition Corp.

May 28 | $ 10.02 | CHPG – ChampionsGate Acquisition Corp

May 28 | $ 9.99 | KCHV – Kochav Defense Acquisition Corp.

May 23 | $ 10.01 | PELI – Pelican Acquisition Corp

May 23 | $ 10.01 | CRA – Cal Redwood Acquisition Corp.

May 22 | $ 10.02 | OYSE – Oyster Enterprises II Acquisition Corp

May 21 | $ 10.63 | PCAP – ProCap Acquisition Corp

May 21 | $ 10.03 | AACI – Armada Acquisition Corp. II

May 16 | $ 10.39 | WENN – WEN Acquisition Corp

May 16 | $ 10.11 | CCCM – Columbus Circle Capital Corp. I

May 15 | $ 11.40 | RTAC – Renatus Tactical Acquisition Corp I

May 15 | $ 10.04 | TVAI – Thayer Ventures Acquisition Corp II

May 14 | $ 10.33 | CCCX – Churchill Capital Corp X

May 13 | $ 10.15 | PMTR – Perimeter Acquisition Corp. I

May 09 | $ 10.07 | EGHA – EGH Acquisition Corp.

May 07 | $ 10.03 | IPOD – Dune Acquisition Corp II

May 02 | $ 10.03 | CGCT – Cartesian Growth Corp III

May 02 | $ 11.45 | CEPT – Cantor Equity Partners II, Inc.

May 02 | $ 10.20 | GTEN – Gores Holdings X, Inc.

May 01 | $ 10.27 | RDAG – Republic Digital Acquisition Co

May 01 | $ 10.03 | COPL – Copley Acquisition Corp