Inception Growth + AgileAlgo Deal Vote. Corner Growth 2 Announces Capital Increase Vote. Embrace Change Going to Pink Sheets.

Boardroom Alpha SPAC Resources

– Full SPAC Listing

– SPAC SEC Filings

– Boardroom Alpha IPO & SPAC Intelligence Platform (7-Day Trial)

Daily SPAC Update

The “SPAC King” is Back, but Will Investors Follow?

Chamath Palihapitiya filed an S-1 with the SEC to launch a $250 million SPAC under the name American Exceptionalism Acquisition Corp. A yesterday. Will investors be willing to “trust the process” this time or will they look at a disappointing SPAC track record and choose not to go along for the ride?

Read our piece here: Chamath Palihapitiya’s SPAC Comeback?

MERGER VOTES

IGTA – Inception Growth Acquisition Ltd + AgileAlgo

AgileAlgo, a British Virgin Islands business company, through its Singapore-based subsidiary, AgileAlgo Pte Ltd., is a maker of enterprise-grade natural language code generator for machine-learning and data management platforms. It utilizes Generative-Artificial Intelligence (“AI”) techniques to automate AI codes development and scaling to other technology stacks. AgileAlgo intends to grow and acquire IT consulting practices as well as work with large-scale project owners to drive down complexity, time and cost of producing software scripts and code, contributing to the transformation of the global workforce, which is now still heavily reliant on offshoring costs and capability.

OTHER SPAC NEWS

TRON2 – CORNER GROWTH ACQUISITION CORP 2 * Vote to Increase Authorized Capital * trust $12.36

EMCG – EMBRACE CHANGE ACQUISITION CORP * Delisting

CSLMF – CSLM ACQUISITION CORP * Media Transcript

NEW SPAC IPOs

Aug 12: MKLY – Mckinley Acquisition Corp $150M IPO

Aug 12: HVMC – Highview Merger Corp. $200M IPO (+underwriter overallotment: $30M)

SPAC DEAL TERMINATIONS (Last 10 Days)

2025-08-14: IVCBF + nexxbuild

SPAC IPOs SLOWING IN AUGUST

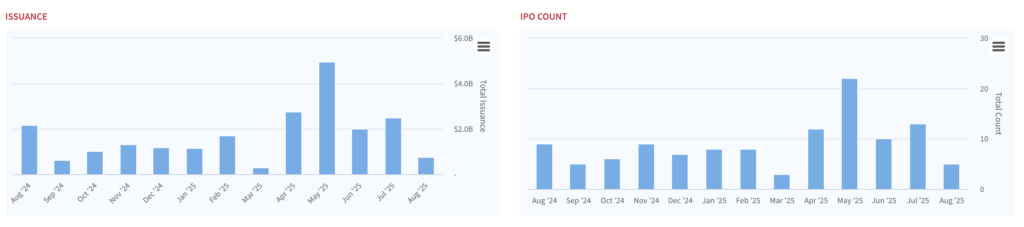

As we move through August, SPAC issuance appears to be slowing compared to June and July. Still, with 81 IPOs year-to-date, activity has already surpassed the total for all of 2024, putting 2025 on pace to average at least 11 new IPOs per month. While the surge seen in May has moderated, issuance remains elevated compared to last year.

SPAC Movers

YESTERDAY’S TOP SPAC GAINERS

29.86% ~ $ 9.09 | IROH – IRON HORSE ACQUISITIONS CORP (Announced)

13.75% ~ $ 11.69 | FACT – FACT II ACQUISITION CORP (Pre-Deal)

5.82% ~ $ 10.18 | RAAQ – REAL ASSET ACQUISITION CORP (Pre-Deal)

3.02% ~ $ 10.92 | CHEB – POLIBELI GROUP LTD (Announced)

2.26% ~ $ 11.77 | HOND – HCM II ACQUISITION CORP (Announced)

YESTERDAY’S TOP SPAC LOSERS

-2.20% ~ $ 12.42 | ISRL – ISRAEL ACQUISITIONS CORP (Announced)

-1.95% ~ $ 26.69 | CEP – CANTOR EQUITY PARTNERS INC (Announced)

-.94% ~ $ 10.52 | CEPO – CANTOR EQUITY PARTNERS I INC (Announced)

-.70% ~ $ 9.97 | LWAC – LIGHTWAVE ACQUISITION CORP (Pre-Deal)

-.55% ~ $ 10.42 | VCIC – VINE HILL CAPITAL INVESTMENT CORP (Pre-Deal)

LATEST SPAC IPO PERFORMANCE

Aug 12 | $ 9.99 | MKLY – McKinley Acquisition Corp

Aug 12 | $ 10.05 | HVMC – Highview Merger Corp.

Aug 08 | $ 10.03 | SSEA – STARRY SEA ACQUISITION CORP

Aug 05 | $ 10.04 | QUMS – Quantumsphere Acquisition Corp

Aug 01 | $ 10.15 | HCMA – HCM III Acquisition Corp.

Jul 31 | $ 9.96 | BCAR – D. Boral ARC Acquisition I Corp.

Jul 30 | $ 10.03 | APAD – A Paradise Acquisition Corp.