SPAC IPOs Slowing in August, but Remain Well Ahead of 2024. Breeze Holdings Deal Approved. Globalink’s Redemption Overpayment Requires Restatement.

Boardroom Alpha SPAC Resources

– Full SPAC Listing

– SPAC SEC Filings

– Boardroom Alpha IPO & SPAC Intelligence Platform (7-Day Trial)

Daily SPAC Update

SPAC IPOs SLOWING IN AUGUST

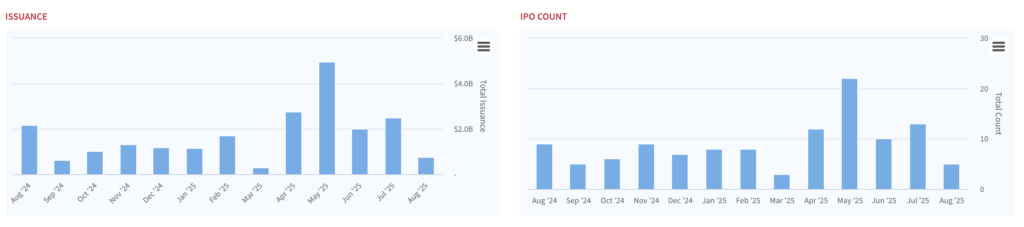

As we move through August, SPAC issuance appears to be slowing compared to June and July. Still, with 81 IPOs year-to-date, activity has already surpassed the total for all of 2024, putting 2025 on pace to average at least 11 new IPOs per month. While the surge seen in May has moderated, issuance remains elevated compared to last year.

SPAC VOTE RESULTS

BRZH – BREEZE HOLDINGS ACQUISITION CORP * Deal Approved with YD Biopharma Limited * 49,715 redeemed

SPAC NON-RELIANCE 8-K

GLLI – Globalink Investment Inc : Non-Reliance on Previously Issued Financials (after incorrect redemption payments)

SPAC DEAL TERMINATIONS (Last 10 Days)

2025-08-14: IVCBF + nexxbuild (note: this is the second SPAC deal in 2-years to terminate for Investcorp Europe)

SPAC DEALS ANNOUNCED

Aug 14 | BACQ – Bleichroeder Acquisition Corp I + Merlin

ABOUT Merlin

Merlin is the leading U.S.-based developer of cost-effective, takeoff-to-touchdown autonomy for both legacy and next-generation airborne systems. Our aircraft-agnostic, AI-powered software is purpose-built for military and civil programs, and is powering an expanding range of missions and aircraft, proven through hundreds of autonomous flights from test facilities across the globe. With $100M+ total in awarded contracts from military customers, Merlin is helping to solve national security challenges through safe, reliable autonomy.

SEPARATE WARRANTS/RIGHTS

Aug 18: FIGX CAPITAL ACQUISITION CORP (FIGX)

OTHER SPAC NEWS

CMCAF – CAPITALWORKS EMERGING MARKETS ACQUISITION CORP * Auditor Change

IGTA – INCEPTION GROWTH ACQUISITION LTD * Confirm Trust* trust $12.31

BACQ – BLEICHROEDER ACQUISITION CORP I * Investor Deck

BACQ – BLEICHROEDER ACQUISITION CORP I * Merger Agreement

SPAC Movers

YESTERDAY’S TOP SPAC GAINERS

3.17% ~ $ 12.70 | ISRL – ISRAEL ACQUISITIONS CORP (Announced)

1.71% ~ $ 10.73 | CHEB – CHENGHE ACQUISITION II CO (Announced)

1.65% ~ $ 12.92 | DMYY – DMY SQUARED TECHNOLOGY GROUP INC (Pre-Deal)

.47% ~ $ 10.65 | EURK – EUREKA ACQUISITION CORP (Pre-Deal)

.43% ~ $ 11.72 | FORL – FOUR LEAF ACQUISITION CORP (Announced)

YESTERDAY’S TOP SPAC LOSERS

-6.95% ~ $ 12.05 | EMCG – EMBRACE CHANGE ACQUISITION CORP (Announced)

-5.39% ~ $ 27.22 | CEP – CANTOR EQUITY PARTNERS INC (Announced)

-4.94% ~ $ 9.62 | RAAQ – REAL ASSET ACQUISITION CORP (Pre-Deal)

-1.44% ~ $ 10.30 | OACC – OAKTREE ACQUISITION CORP III LIFE SCIENCES (Pre-Deal)

-1.40% ~ $ 10.54 | CEPT – CANTOR EQUITY PARTNERS II INC (Pre-Deal)

LATEST SPAC IPO PERFORMANCE

Aug 12 | $ 9.99 | MKLY – McKinley Acquisition Corp

Aug 12 | $ 10.07 | HVMC – Highview Merger Corp.

Aug 08 | $ 10.04 | SSEA – STARRY SEA ACQUISITION CORP

Aug 05 | $ 10.04 | QUMS – Quantumsphere Acquisition Corp

Aug 01 | $ 10.15 | HCMA – HCM III Acquisition Corp.

Jul 31 | $ 9.95 | BCAR – D. Boral ARC Acquisition I Corp.

Jul 30 | $ 10.02 | APAD – A Paradise Acquisition Corp.