SPACs End July, Start August with a Bang with 2 SPAC Deals (Everli / Eagle Energy Metals) and Another SPAC IPO for $220M.

Boardroom Alpha SPAC Resources

– Full SPAC Listing

– SPAC SEC Filings

– Boardroom Alpha IPO & SPAC Intelligence Platform (7-Day Trial)

Daily SPAC Update

NEW SPAC IPOs

Aug 01: HCMA – Hcm III Acquisition Corp. $220M IPO

Jul 30: APAD – A Paradise Acquisition Corp. $200M IPO

SPAC VOTE RESULTS

ASCBF – ASPAC II ACQUISITION CORP * Extend to Aug 05, 2027 * 344,384 redeemed

SPAC DEAL & EXTENSION VOTES SET

FTII – Futuretech Ii Acquisition Corp * EXTENSION VOTE SET: Aug 14, 2025 * trust $12.53

SEPARATE WARRANTS/RIGHTS

Aug 04: BLUE ACQUISITION CORP (BACC)

Aug 01: AXIOM INTELLIGENCE ACQUISITION CORP 1 (AXIN)

SPAC DEALS ANNOUNCED

Jul 31 | MACI – Melar Acquisition Corp I + Everli Global Inc.

ABOUT Everli Global Inc.

Everli is a major e-grocery technology & fulfillment platform in Italy, seamlessly connecting consumers with their favorite grocery retailers through a fully integrated digital marketplace. By managing the entire logistics chain, from online ordering to in-store picking and last-mile delivery, Everli empowers retailers to offer a premium online shopping experience without the need for additional infrastructure, staffing, or operational changes. Its model is built on exclusive partnerships with the country’s top grocery chains, ensuring broad product availability and trusted brand access for consumers. At the heart of Everli’s operations is a dedicated network of trained shoppers who ensure accuracy, freshness, and reliability with every order. Everli’s union-endorsed delivery framework reinforces its commitment to fair labor practices while supporting consistent service quality at scale.

Jul 31 | SVII – Spring Valley Acquisition Corp Ii + Eagle Energy Metals Corp.

ABOUT Eagle Energy Metals Corp.

Eagle Energy Metals Corp. is a next-generation nuclear energy company that combines domestic uranium exploration with proprietary Small Modular Reactor (SMR) technology. The Company holds the rights to the largest mineable, measured and indicated uranium deposit in the United States, located in southeastern Oregon. This includes the Aurora deposit, with over 50 million pounds4 of near-surface uranium resource, and the adjacent Cordex deposit, which offers significant potential to expand the project’s overall resource inventory. By integrating advanced SMR technology with a sizeable uranium asset, Eagle is building an integrated nuclear platform positioned to help restore American leadership in the global nuclear industry.

OTHER SPAC NEWS

IGTA – INCEPTION GROWTH ACQUISITION LTD * Confirmed Trust * trust $12.22

MACI – MELAR ACQUISITION CORP I * Investor Deck

SVII – SPRING VALLEY ACQUISITION CORP II * Investor Deck

PLMJF – PLUM ACQUISITION CORP III * Merger Agreement Amendment

IGTA – INCEPTION GROWTH ACQUISITION LTD * Merger Agreement Amendment

BRR / CCCM – COLUMBUS CIRCLE CAPITAL CORP I * Ticker Change

BRR / CCCM – COLUMBUS CIRCLE CAPITAL CORP I * Media Transcript

DYNX – DYNAMIX CORP * Media Transcript

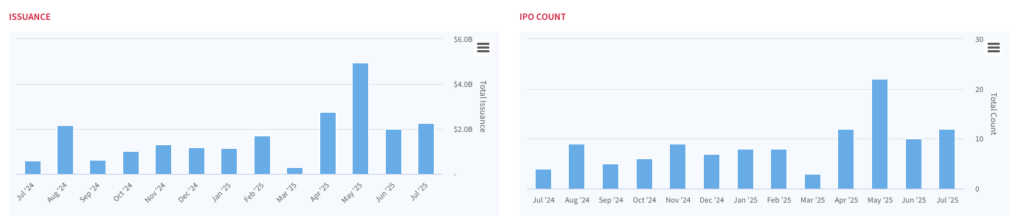

JULY 2025 SPAC ISSUANCE

SPACs may not be back to peak times, but they are back. July saw another 12 SPAC IPOs for over $2B. This continues the elevated trend we’ve seen since the start of April, though remains off the peak of May. This makes a total of 75 new SPACs in 2025 for $15B in total new SPAC issuance. At the moment, the stars are the Crypto SPACs like Anthony Pompliano’s which today changes its ticker to BRR which represents “Bitcoin Rate of Return.”

SPAC Movers

YESTERDAY’S TOP SPAC GAINERS

28.29% ~ $ 13.20 | FACT – FACT II ACQUISITION CORP (Pre-Deal)

5.84% ~ $ 10.70 | CHEB – CHENGHE ACQUISITION II CO (Announced)

4.02% ~ $ 10.62 | LOKV – LIVE OAK ACQUISITION CORP V (Pre-Deal)

3.76% ~ $ 11.30 | DYCQ – DT CLOUD ACQUISITION CORP (Announced)

2.17% ~ $ 10.81 | SBXD – SILVERBOX CORP IV (Pre-Deal)

YESTERDAY’S TOP SPAC LOSERS

-2.01% ~ $ 10.75 | CEPT – CANTOR EQUITY PARTNERS II INC (Pre-Deal)

-1.20% ~ $ 12.40 | ISRL – ISRAEL ACQUISITIONS CORP (Announced)

-1.17% ~ $ 10.95 | CEPO – CANTOR EQUITY PARTNERS I INC (Announced)

-1.03% ~ $ 10.60 | HLXB – HELIX ACQUISITION CORP II (Announced)

-1.02% ~ $ 11.60 | RTAC – RENATUS TACTICAL ACQUISITION CORP I (Pre-Deal)

LATEST SPAC IPO PERFORMANCE

Aug 01 | HCMA – HCM III Acquisition Corp.

Jul 30 | APAD – A Paradise Acquisition Corp.

Jul 17 | $ 10.03 | PAII – Pyrophyte Acquisition Corp. II

Jul 16 | $ 10.07 | SOCA – Solarius Capital Acquisition Corp.

Jul 15 | $ 10.11 | SPEG – Silver Pegasus Acquisition Corp.

Jul 09 | $ 10.16 | GTER – Globa Terra Acquisition Corporation

Jul 02 | $ 10.47 | ONCH – 1RT Acquisition Corp.

Jul 02 | $ 10.00 | ORIQ – Origin Investment Corp I

Jul 02 | $ 10.09 | EVAC – EQV Ventures Acquisition Corp. II

Jul 02 | $ 10.01 | VNME – Vendome Acquisition Corp I