Soundhound debuts tomorrow. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

SPAC Deal: ISLE + Cytovia Therapeutics

Isleworth Healthcare Acquisition Corp. (ISLE) announced a DA with Cytovia Therapeutics, a biopharmaceutical company using stem cell engineering and multispecific antibodies for cancer treatment. The transaction values Cytovia Therapeutics at an enterprise value of $367M. PIPE: $20M (at BCA signing); $30M (seeking post-BCA signing). Slide deck here. The merger is expected to be completed in Q3 of 2022. Cytovia is expected to be listed on NASDAQ under the ticker symbol INKC.

Soundhound merger approved; SOUN begins trading tomorrow

Archimedes Tech SPAC Partners Co. (ATSPT). Merger with Soundhound was approved. Soundhound, a leader in voice artificial intelligence, begins trading tomorrow as SOUN.

Redemption Update: SV / NuScale Power

Spring Valley Acquisition Corp. (SV) / NuScale Power. Redemptions 37.5%. Merger vote is tomorrow.

Elsewhere in SPACs

Brookline Capital Acquisition Corp.(BCAC) extension approved (on a monthly basis) out till November. 688,408 shares redeemed (12%). $51M remains in trust.

Today’s Price Action

Biggest Gainers

13.82% ~ $ 10.59 | TUGC – TradeUP Global Corp (Announced)

9.19% ~ $ 44.55 | DWAC – Digital World Acquisition Corp. (Announced)

4.69% ~ $ 11.82 | CFVI – CF Acquisition Corp. VI (Announced)

1.51% ~ $ 10.06 | SV – Spring Valley Acquisition Corp (Announced)

.98% ~ $ 11.39 | AGBA – AGBA ACQUISITION LIMITED (Announced)

.81% ~ $ 9.92 | LCW – Learn CW Investment Corp (Pre-Deal)

.66% ~ $ 9.89 | TWNI – Tailwind International Acquisition Corp. (Pre-Deal)

.50% ~ $ 9.99 | DPCS – DP Cap Acquisition Corp I (Pre-Deal)

.50% ~ $ 10.05 | SHCA – Spindletop Health Acquisition Corp. (Pre-Deal)

.45% ~ $ 10.00 | CNDB – Concord Acquisition Corp III (Pre-Deal)

.41% ~ $ 9.86 | HCII – HUDSON EXECUTIVE INVESTMENT CORP. II (Pre-Deal)

.41% ~ $ 9.88 | CTAQ – Carney Technology Acquisition Corp. II (Pre-Deal)

.41% ~ $ 9.91 | RJAC – Jackson Acquisition Co (Pre-Deal)

.40% ~ $ 9.93 | JGGC – Jaguar Global Growth Corp I (Pre-Deal)

.40% ~ $ 9.97 | DSAC – Duddell Street Acquisition Corp (Announced)

.40% ~ $ 9.99 | ADAL – Anthemis Digital Acquisitions I Corp (Pre-Deal)

.40% ~ $ 10.05 | CITE – Cartica Acquisition Corp (Pre-Deal)

.31% ~ $ 9.75 | LITT – Logistics Innovation Technologies Corp. (Pre-Deal)

.31% ~ $ 9.76 | DNAD – Social Capital Suvretta Holdings Corp. IV (Pre-Deal)

.31% ~ $ 9.77 | GFOR – Graf Acquisition Corp. IV (Pre-Deal)

Biggest Losers

-1.22% ~ $ 9.74 | SKYA – Skydeck Acquisition Corp. (Pre-Deal)

-.85% ~ $ 9.98 | SHUA – SHUAA Partners Acquisition Corp I (Pre-Deal)

-.61% ~ $ 9.77 | FTPA – FTAC Parnassus Acquisition Corp. (Pre-Deal)

-.56% ~ $ 10.63 | THCA – Tuscan Holdings Corp. II (Pre-Deal)

-.51% ~ $ 9.76 | PEGR – Project Energy Reimagined Acquisition Corp. (Pre-Deal)

-.51% ~ $ 9.77 | MACC – Mission Advancement Corp. (Pre-Deal)

-.51% ~ $ 9.85 | OHAA – Opy Acquisition Corp. I (Pre-Deal)

-.50% ~ $ 9.94 | AEAE – AltEnergy Acquisition Corp (Pre-Deal)

-.47% ~ $ 10.56 | ESSC – East Stone Acquisition Corporation (Announced)

-.43% ~ $ 9.82 | CSLM – Consilium Acquisition Corp I, Ltd. (Pre-Deal)

-.41% ~ $ 9.75 | HCNE – Jaws Hurricane Acquisition Corporation (Pre-Deal)

-.41% ~ $ 9.77 | NGC – Northern Genesis Acquisition Corp. III (Pre-Deal)

-.41% ~ $ 9.78 | FRXB – Forest Road Acquisition Corp. II (Pre-Deal)

-.41% ~ $ 9.82 | GSQB – G Squared Ascend II, Inc. (Pre-Deal)

-.40% ~ $ 9.84 | IXAQ – IX Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.90 | DUET – DUET Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.96 | FNVT – Finnovate Acquisition Corp. (Pre-Deal)

-.39% ~ $ 10.09 | FST – FAST ACQ CP (Pre-Deal)

-.31% ~ $ 9.72 | MITA – Coliseum Acquisition Corp. (Pre-Deal)

-.31% ~ $ 9.76 | BSKY – Big Sky Growth Partners, Inc. (Pre-Deal)

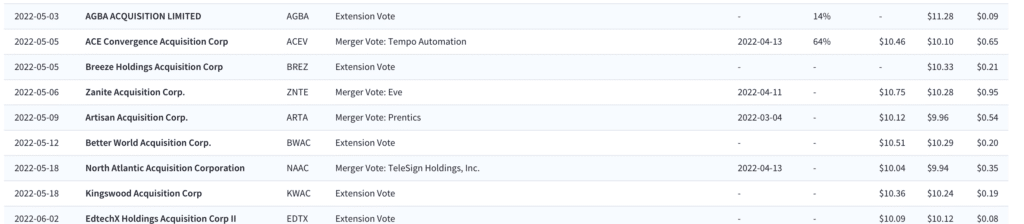

Upcoming Merger and Extension Votes

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.