The “SPAC King” is Back, but Will Investors Follow?

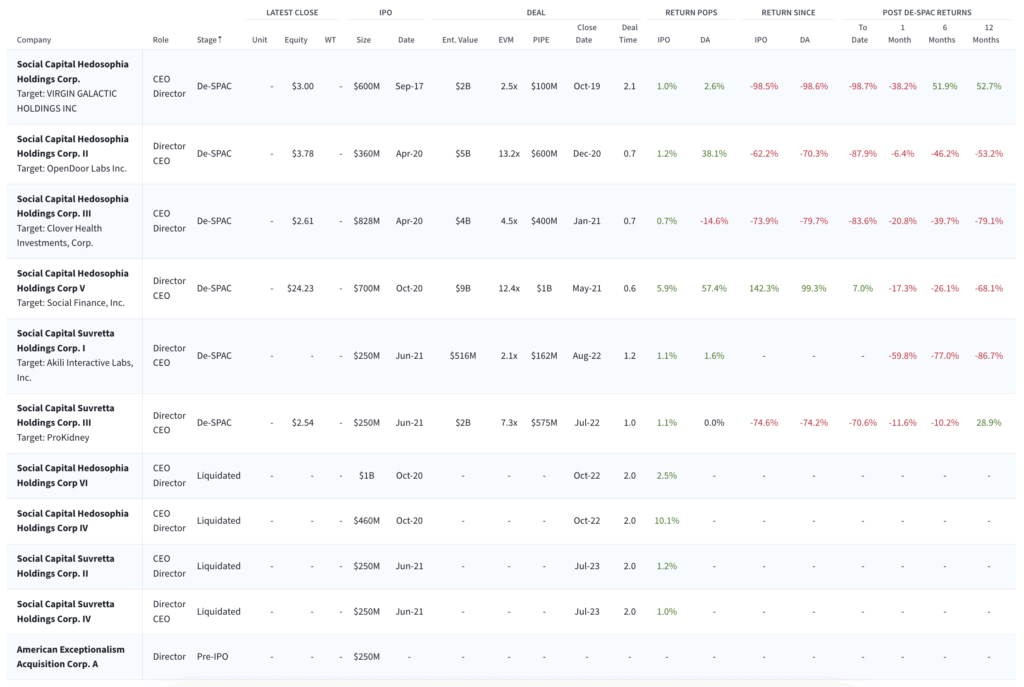

On August 18, 2025, Chamath Palihapitiya filed an S-1 with the SEC to launch a $250 million SPAC under the name American Exceptionalism Acquisition Corp. A, aiming to raise capital through an IPO at $10 per share for 25 million Class A shares. The SPAC plans to trade on the NYSE under the ticker AEXA. We see this as an intersection of an increasingly active SPAC market and hot market trends like crypto and AI and thus a true “made for Chamath” opportunity. However, the previously titled “SPAC King”‘s crown has lost much of its luster given the performance of his previous 10 SPAC attempts with only the DeSPAC of SoFi Technologies (SOFI) proving to be a win for investors. And, interestingly, in his founder letter (see below) he notes that there should be “no crying in the casino” as a clear sign to the legion of retail (and other) investors who historically have put their faith in him and put their trust in his process.

Chamath will lead the effort as the board’s Chairman and he is joined by Steven Trieu, Social Capital’s Group CFO and a long-time collaborator with Chamath on SPACs, who will serve as CEO. They are joined by Jeffrey Vignos who is Social Capital’s Controller and manages Palihapitiya’s family office.

The SPAC will prioritize mergers in sectors where Palihapitiya feels he brings domain expertise including: Decentralized Finance (DeFi), Artificial Intelligence (AI), Defense Technologies, and Energy Production. As noted above, its no coincidence that these are also some of the hottest areas for capital today.

Summary Insights

| Timing | Initial S-1 IPO filing marks a return to SPACs after ~2.5 years of retreat following a disappointing track record across 10 pervious SPAC attempts. |

| Size | $250 million raise provides material capital for a move, but will a DeSPAC see any funds left after (likely) redemptions? |

| Target Areas | Picks high-growth, macro-critical sectors — DeFi to bridge crypto and traditional finance; AI for systemic AI infrastructure; defense and energy to tap national security and climate theses. |

| Structure | No warrants included in the SPAC offering. |

| Sponsor Incentives | Elevated promote tied to performance adds alignment, but still a lucrative structure for sponsors. |

| Risk / Track Record Messaging | A clear acknowledgement of a checkered SPAC track record and continued skepticism around the SPAC market. |

A Tarnished Crown? Chamath’s SPAC Track Record

Once called the “SPAC King” for his prolific SPAC activities and retail excitement that followed him, his track SPAC track record has ultimately disappointed most who invested alongside him. Only SOFI has prospered post-DeSPAC while others have lost nearly all their value.

Take Away

Chamath’s re-entry into the SPAC market with American Exceptionalism Acquisition Corp. A feels calculated. The vehicle is calibrated for high-growth, tech-forward sectors, combines tighter economics with a more disciplined governance structure, and carries a realist’s message to investors. However, redemption hinges on delivering a successful merger, convincing performance, and restoring investor trust in the post-SPAC-mania era.

This move merits watching — if executed well, it could help reset expectations for SPACs; if misfired, it reinforces lingering skepticism.

Chamath’s Founder Letter for American Exceptionalism Acquisition Corp. A

To the Friends and Supporters of Social Capital,

When I raised my first SPAC in 2017, I wanted to help correct an increasingly unstable balance between the private and public markets. At the time, we estimated that there were approximately 150 private U.S. technology companies with a valuation in excess of $1.0 billion (a “unicorn”). These private companies were changing the world at an unprecedented pace by establishing new markets, creating new experiences and disrupting legacy industries. Yet, we believe they remained private in part due to a fundamentally broken IPO process across multiple vectors:

- Inefficient Pricing Mechanism: We believe the status quo was a process designed to deliver a “one day pop” and high-levels of oversubscription to an underwriting bank’s best customers, rather than creating a mechanism for efficient and market-driven price discovery.

- Misaligned Incentives: Pricing levels that delivered a high “one day pop” had the effect of increasing dilution to founders, early investors and employees and rewarding IPO investors, who often sell quickly and have no attachment to the underlying company itself.

- Long-Term Impact: Book-building and allocation dynamics led to high levels of shareholder turnover as IPO investors monetized their allocations by selling, rather than supporting long-term value creation by holding the stock over many quarters.

Unfortunately, this situation has only compounded since 2017.

There are now over 700 private companies in the United States valued at $1 billion or greater, a five times increase in only eight years. Despite unprecedented value creation in the U.S. economy, there are now under 5,000 public companies in the United States (relative to over 7,000 throughout the 1990s). We have averaged approximately 130 IPOs per year since 2017 versus an average of approximately 160 IPOs per year in the 1990s—a large reduction even after accounting for the 300 plus IPOs in 2021 that were driven in part by zero interest rate policy (“ZIRP”). This results in approximately 20% fewer companies entering the public markets each year.

Although the depth of the U.S. private markets has allowed these private companies to proliferate, fissures are clearly in the making. Early stage and growth financing remains down significantly from 2021 levels. Although the largest and most successful private companies are able to facilitate liquidity to reward early investors and employees, many employees are stuck with paper wealth that cannot be easily converted to cash. Additionally, the broader investing population remains shut out from owning exceptional private companies—often times relegated to owning the legacy company that is being disrupted instead. Together, these dynamics have important downstream impacts on liquidity and the investor universe. With early-stage investors unable to monetize positions and deliver cash to their limited partners, these investors are unable to fund the next wave of transformational companies. We believe this has a consequential and notable impact on long-term U.S. technological supremacy.

While SPACs are not the solution for every issue in the IPO process, I continue to believe that they have an important piece to play in capital formation—and especially now. While my early investment career saw outsized gains through investments in highly disruptive software-as-a-service, Bitcoin, space and other emerging technology sectors, I believe the biggest gains in the future will come from companies that are involved in fixing the fundamental risks that come from our interconnected global order while reinforcing American exceptionalism. Ultimately, there are four areas that I believe need substantial capital if the United States is to maintain its position as the most important country on earth and the only global superpower:

- Energy Production: While liquid natural gas and fracking can provide the United States with energy independence and freedom in the near term, our energy needs are only growing deeper. We must make investments in all vectors of energy production—ranging from coal, oil and natural gas to more modern forms of energy production like nuclear and solar power. The United States needs unlimited energy and

- AI: In 2016, I formed a partnership with Jonathan Ross, the founder of Google’s Tensor Processing Unit (TPU), to build Groq, Inc. (“Groq”) and its next-generation chip for artificial intelligence (“AI”) inference. This seemed like an oddball effort almost a decade ago, but is now considered conventional wisdom. AI will be a foundational element of global productivity and it will manifest in both physical form (robotics) and software. In 2024, I founded 8090 to leverage AI to rewrite trillions of dollars of sunk cost and trillions of lines of old software that have accumulated in businesses over the past 50 years. As generative AI and large language model (“LLM”) development continues to accelerate, I am confident that we are in the early innings of the biggest mega-trend in history. Similar to how the internet unlocked new industries within a decade, I believe that AI will create investment opportunities that will only be obvious in hindsight.

- Decentralized Finance: Traditional finance is defined by the power of incumbency, with large banks and lenders serving a dominant role in our economy. However, decentralized finance and cryptocurrency is no longer simply on the sidelines. As these new companies scale, I believe they will revolutionize multiple financial products—including international payments, smart contracts and supply chain transparency.

- Defense: Warfare is moving away from humans on the front lines to robots, drones and AI that bring next-generation capabilities to warfare and warfighters. As the United States builds economic and technological supremacy through energy, AI and cryptocurrency, it must also continue to project military supremacy both domestically and abroad. There are many companies that are working to rebuild U.S. military supremacy and its warfighting capabilities through the lens of twenty-first century technologies.

We will be attempting to find a great company at a great valuation to take public, but without doubt, the investment will entail substantial risk including the possibility of total loss. Unlike my private portfolios which hold many companies and thereby provide diversification, American Exceptionalism Acquisition Corporation A will be an investment vehicle into a single operating company. Consequently, we believe that this investment is most suitable for institutional investors, and retail investors should approach with caution, if at all. We believe that retail investors should only participate if (a) this investment is a small part of an otherwise diversified portfolio, (b) this investment is a quantum of capital they can afford to completely lose and (c) if they do lose their entire capital, they will embody the adage from President Trump that there can be “no crying in the casino.”