As investors’ favorite contrarian buys COIN on the dip, we take a look at performance and insider trading.

Cathie Wood buying COIN. Shares of Coinbase (COIN) are seeing an upward bounce as Cathie Wood continues to purchase. Since March 25, Wood has made 20 purchases. In the past week, Wood has purchased COIN on three separate occasions across her various funds. Coinbase is now Ark’s ninth-largest holding across its entire array of ETFs–just below DraftKings (DKNG) and slightly above Twilio (TWLO). COIN is the eighth largest holding in Wood’s flagship ARK Innovation ETF (ARKK) and the fourth-largest holding in the Ark Fintech Innovation ETF (ARKF).

COIN shares down almost 70% YTD. Coinbase, the second largest crypto exchange by market capitalization, has seen its shares collapse ~70% this year– a function of the broader crypto meltdown and general market conditions. Bitcoin (BTC), the largest cryptocurrency, currently trades around $31,000, down ~55% from its all-time high of $68,000 reached in November last year. Crypto prices have fallen across the board in recent months.

Trading volumes have collapsed; guiding down. Q1 revenue declined 27% YoY while the exchange’s total trading volume declined to $309 billion in Q1 2022, down from $547 billion in Q4 2021. COIN posted a quarterly net loss of $430 million in Q1 as monthly transacting users fell to 9.2 million from 11.4 million in the previous quarter, driven by lower crypto asset price volatility and lower crypto asset prices overall. Subscription and services revenue was $152 million, representing ~ 13% of total revenue. Q2 guidance calls for monthly transacting users and transaction volume to be below Q1 levels, while subscription and services revenue are expected to be “similar to modestly lower” QoQ.

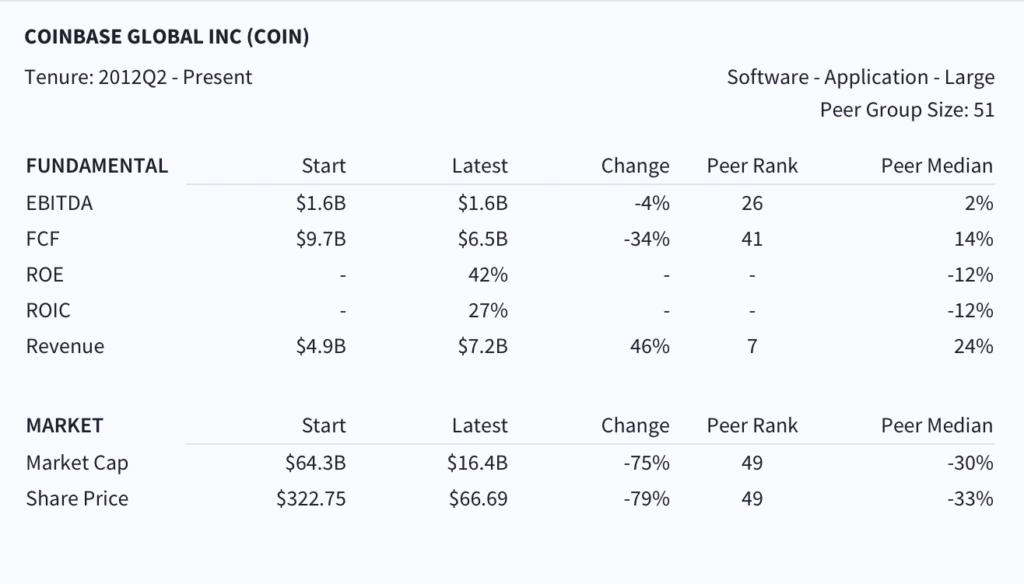

COIN: Market shapshot

After aggressively over-hiring, COIN’s board finally realizes it’s time to clamp down on costs ahead of a “crypto winter.” COIN has extended its current hiring freeze into the “foreseeable future” and is rescinding recent job offers for incoming hires who have not started their positions. Before the current downturn, Coinbase had tripled the size of its staff in 2021 to 3,730 employees. Clearly, COIN’s recent results aren’t validating this level of aggressive hiring activity. While we appreciate the company’s attention to cost control, halting and rescinding offers sends a message that the company does’t quite have its house in order, and will likely scare talent in an already competitive hiring environment. Coinbase’s hiring freeze comes as Gemini exchange founders Cameron and Tyler Winklevoss have laid off 10% of their workforce and warned that the industry is entering a “crypto winter”, described as a “contraction phase settling into a period of stasis.”

COIN CEO Brian Armstrong: performance scorecard

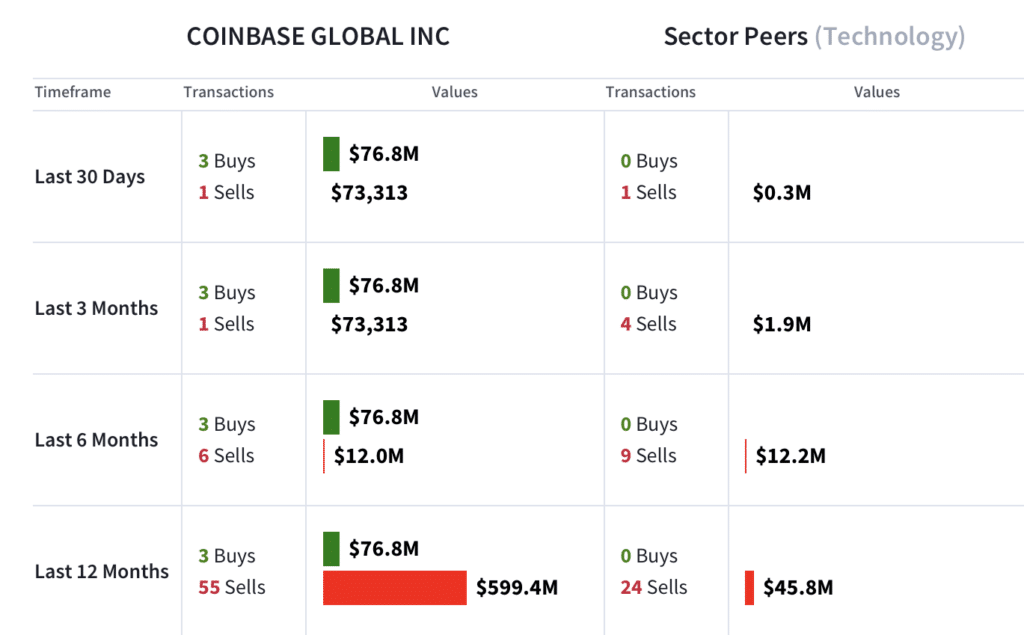

Red flag: heavy inside selling. Insiders sold $599.4M COIN shares over the past 12 months. Only one director has purchased stock in the last 12 months, COIN co-founder Frederick Ernest Ehrsam III.

An ostrich strategy in a volatile market. COIN’s long-term outlook is centered around the growth of the blockchain economy. However, in the near term, shares will continue to correlate with cryptocurrency prices. We see continued downside risk to COIN shares, as several headwinds will continue to pressure the stock– including a shelf offering and a new bankruptcy disclosure that potentially puts user assets at risk (customers would be viewed as general unsecured creditors and assets subject to bankruptcy proceedings). “When you trade on a crypto exchange—and I’m saying this to the investors who might watch this—you no longer own your crypto asset,” said SEC Chair Gary Gensler. “If that exchange gets hacked, if somebody steals the underlying token…you’re just a creditor. And when crypto exchanges fail, you’re just in line in bankruptcy court.” Without any evidence of a crypto bottom, we continue to avoid COIN shares.