Activism Snapshot

Garden Investments Off to a Fast Start

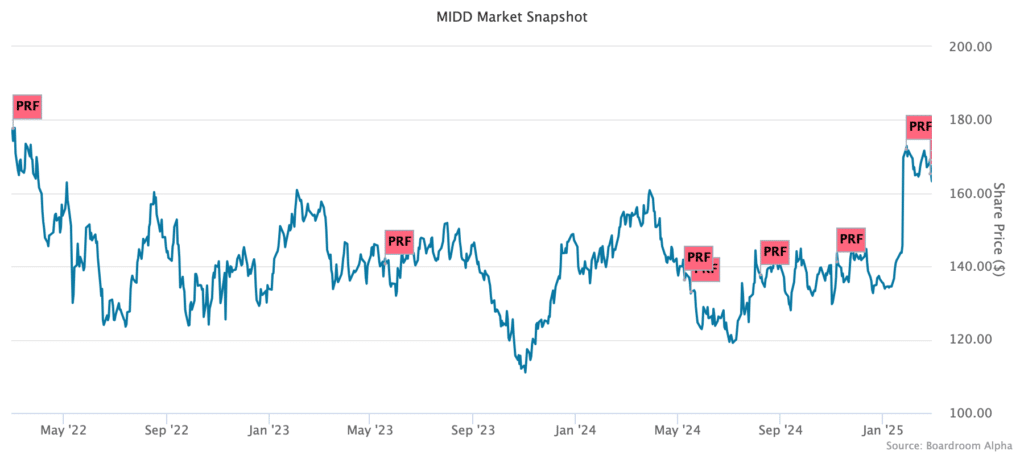

Ed Garden’s newly formed Garden Investments notched its first win as it took a stake in Middleby (NASDAQ: MIDD) — a manufacturer of equipment for commercial foodservice, residential kitchens and food processing industries — and subsequently signed a cooperation agreement (BA analysis — SEC filing).

Garden is joined by fellow Trian alumns, Brian Jacoby and and Chad Fauser, and will be looking to build on their already impressive track records. Garden’s impact was quick as he’s been added to the board and seemingly has accelerated a spin-out of MIDD’s food processing business to a new public company. Given the Garden team’s deep knowledge of the food industry — recall that this is the same team that was deeply involved in Wendy’s / Trian — this seems like a smart first play.

Despite a recent uptick in the stock, Middleby has a negative 3% TSR over the past 3 years. We weren’t surprised to see the cooperation agreement with MIDD given its elevated Boardroom Alpha Activist Risk score. In addition to Garden, MIDD has added Julie Bowerman to the board as it looks to refresh what looks like a stagnant, underperforming board.

Starboard Gets a Seat at Fortrea

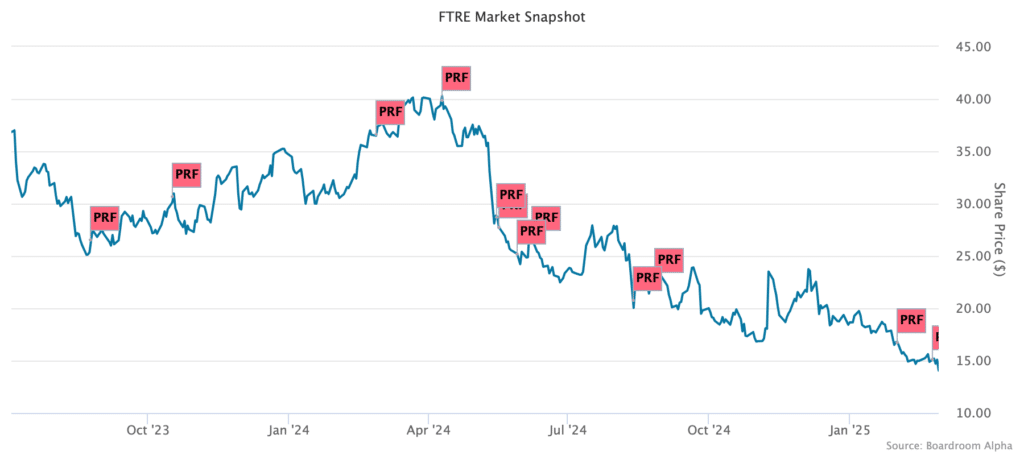

It’s safe to say that the Fortrea (NASDAQ: FTRE) spin-out from Labcorp (NYSE:LH) has not gone to plan. Down over 60% since its July 2023 debut, Fortrea will need a big change in direction and Starboard could be the impetus.

Starboard first reported its stake of 8.7% in an October 2023 13D and its January 2025 13D/A filing noted that it was considering nominating its own slate of directors. On February 21st, Starboard and Fortrea officially entered into a cooperation agreement and has Erin Russell joining the board in March. Starboard’s current stake is just over 5% and they will need to maintain at least a 3% (or 2.69M shares) ownership to continue the agreement. CEO Thomas Pike may not like having Starboard pushing its way in, but he certainly has a lot to gain from it given his 2023 equity and option awards of over $24M.

Starboard also has a proxy contest at Kenvue (NYSE:KVUE), another underperforming spin-out. Starboard argues that KVUE is underperforming on total shareholder return, a strong brand portfolio that should command a higher valuation relative to peers, and deteriorating financial performance, missed commitments, and growth deceleration since the May 2023 IPO. Starboard filed its preliminary proxy on February 5th and is looking to place four directors onto the board with Jeffrey Smith being joined on the slate by Bindu Shah, Cara Robinson, and Michelle Millstone-Shroff.

Votes of Note

We take a look at shareholder votes of note over the past week to see what we can learn about the companies, the market, and shareholders.

Caveat Emptor

- Johnson Outdoors (JOUT) held its annual meeting and shareholders voiced their concerns with only 67% of shareholders voting FOR John M Fahey Jr, the board’s lead independent director and chair of the board’s Nominating & Governance committee.

- This marks the third year in a row that Fahey has received less 71% (or lower) shareholder support. In the table below, you’ll note that Fahey, Alexander, and Mowbray are the Class A directors and the rest are Class B directors.

- Many will wonder why the CEO should continue to collect over $2M annually when shareholders continue to lose.

- Our Take: Caveat Emptor. JOUT is a controlled company with multi-class shares and the opinion of shareholders will, unfortunately, likely continue to hold little sway with the company despite the disastrous performance.

Is Good Performance Enough to Overlook High Pay?

- Raymond James (RJF) stock is on a tear over the past year, up 29%, and is beating the S&P 500 by 12 percentages points. While that has been good enough to garner the board high support again this year from shareholders, they did again voice some concern regarding executive pay. This year’s 89% FOR an annual say-on-pay isn’t far off from the 91% historical average support for say-on-pay and is 6 percentage point jump from RJF’s low of 83% in 2023.

- This would seem a validation of the management’s belief that “the 2024 vote approving the Say-on-Pay proposal once again conveyed our shareholders’ strong support of the Compensation and Talent Committee’s decisions and our existing executive compensation programs” (see proxy).

- Our Take: As a matter of governance, we’d like to see an 83% in favor be a signal that compensation may not be quite right — especially when prior years averaged 94% — but, shareholders apparently by and large believed CEO Paul C Reilly earned his $11.6M cash bonus and overall $24M pay package.

| Company | 1/3/5 Yr TSR |

Avg Director Rating | Avg Vote FOR Directors | Vote FOR Pay | Activist Vulnerability | Director | % FOR Director |

Director TSR |

Director Rating |

Started | Vote Filing |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JOHNSON OUTDOORS INC (JOUT) | -38% -64% -53% |

C | 81% | 98% | HIGH | Leipold Helen P Johnson Edward F Lang Katherine Button Bell Richard Case Sheahan Edward A Stevens Liliann Annie Zipfel John M Fahey Jr Paul Garvin Alexander Jeffrey M Stutz |

100% 100% 100% 100% 100% 100% 67% 77% 98% |

2% 3% 2% 2% -2% -31% 8% -31% -34% |

A B+ C+ C+ C- D A D D |

1994 2006 2014 2014 2016 2021 2001 2021 2023 |

View 8-K |

| RAYMOND JAMES FINANCIAL INC (RJF) | 29% 41% 172% |

B | 98% | 89% | LOW | Benjamin Esty Jeffrey N Edwards Gordon L Johnson Art A Garcia Anne Gates Paul C Reilly Roderick C McGeary Paul M Shoukry Raj Seshadri Raymond W McDaniel Marlene Debel Cecily Mistarz |

95% 96% 97% 97% 97% 97% 98% 98% 99% 99% 99% 99% |

16% 17% 18% 33% 15% 13% 18% 22% 21% 33% 25% 22% |

B+ B+ A B- C+ B A- B- B B- B+ B- |

2014 2015 2010 2023 2018 2006 2015 2024 2019 2023 2020 2024 |

View 8-K |

CEO & CFO Moves

Highlights

- Lifestance Health Group (NASDAQ: LFST) hands the reins to CFO David Bourdon as its stock has taken off in the past year, but remains down -7% over the past three years. Shareholders have understandably been displeased with the board with average support around 85% for 2024’s class of directors and only 83% support for pay.

- De-SPAC and once market darling Lucid Group (LCID) continues its steady descent and there will remain a heavy focus on operational efficiency (’23 and ’24 both saw restructurings). So, putting Winterhoff at the helm to drive it all may make sense.

- Almost across the board, the new CFOs will face challenging circumstances with their companies underperforming and at high risk of activists coming in.

| COMPANY | COMPANY RED FLAGS | ROLE | LEAVING | JOINING |

|---|---|---|---|---|

| LIFESTANCE HEALTH GROUP INC |

|

CEO | Kenneth A Burdick

2.5 yrs |

David Bourdon

Bourdon has served as CFO of LifeStance since November 2022. He has more than two decades of experience in the health care and mental health industries in both financial and operational roles. He previously served as CFO of Magellan Health, a leader in behavioral health and pharmacy management, and held multiple positions at Cigna. He began his career serving for eight years with the United States…read full bio |

| LUCID GROUP INC |

|

CEO | Peter Dore Rawlinson

3.6 yrs |

Marc Winterhoff

Mr. Winterhoff, age 56, has been the Company’s COO since December 2023, with responsibility for overseeing the Company’s operational efficiency, international expansion, go-to-market strategy, and manufacturing operations. Prior to joining the Company, Mr. Winterhoff was a partner at Roland Berger, the European management consultancy, where he focused on operational leadership for large automotive manufacturers, managing manufacturing and cost efficiency, introduction of sales, service, and new mobility concepts, and long-term strategies for renowned automotive brands. Mr. Winterhoff holds a M.A. in electrical and electronics engineering and management from the Technische Universität Darmstadt. |

| MARQETA INC |

|

CEO | Simon Khalaf

2.1 yrs |

Mike Milotich (interim)

Mike Milotich. Mr. Milotich has served as our Chief Financial Officer since February 2022. Prior to joining Marqeta, Mr. Milotich was Senior Vice President, Head of Corporate Finance and Investor Relations at Visa Inc., a publicly traded global financial platform company, from November 2018 to February 2022. He previously served in a number of finance roles of increasing seniority at Visa since 20…read full bio |

| BAKER HUGHES CO |

|

CFO | Nancy Buese

2.3 yrs |

Ahmed Moghal

Mr. Moghal, age 43, has served as Senior Vice President and Chief Financial Officer of the Industrial and Energy Technology business of Baker Hughes since 2023. Prior to this role, he was appointed as the Financial Planning & Analysis Leader at the time of the merger of Baker Hughes and GE Oil & Gas in 2017. In his over two decades of experience, Mr. Moghal has worked i…read full bio |

| BIOGEN INC |

|

CFO | Michael R McDonnell

4.5 yrs |

Robin Kramer

Robin C. Kramer Experience Ms. Kramer has served as our Senior Vice President, Chief Accounting Officer since December 2020. Prior to that, Ms. Kramer served as our Vice President, Chief Accounting Officer from November 2018 to December 2020. Prior to joining Biogen, Ms. Kramer served as the Senior Vice President and Chief Accounting Officer of Hertz Global Holdings, Inc., a car rental company, fr…read full bio |

| DARLING INGREDIENTS INC |

|

CFO | Brad Phillips

7.1 yrs |

Robert W Day

Mr. Day, age 55, joined the Company in August of 2023 as Executive Vice President and Chief Strategy Officer. Mr. Day has over 30 years executive management and investment banking experience in agriculture, soft and energy commodity industries. Prior to joining the Company, beginning in January 2023, he served as a partner at Ascendant Partners, an investment bank and advisory firm, wher…read full bio |

| ELASTIC NV |

|

CFO | Eric Prengel

.2 yrs *interim* |

Navam Welihinda

Prior to joining Elastic, Mr. Welihinda, age 46, served as Chief Financial Officer of Grammarly, Inc., an AI writing assistant company, from September 2024 to February 2025. Before his service with Grammarly, Inc., Mr. Welihinda served as the Chief Financial Officer of HashiCorp, Inc., an infrastructure cloud company, from February 2021 to September 2024, and as Vice President of Finance from Febr…read full bio |

| LIFESTANCE HEALTH GROUP INC |

|

CFO | David Bourdon

2.3 yrs |

Ryan McGroarty

Prior to joining LifeStance, Mr. McGroarty has served as the Chief Financial Officer of Help at Home, LLC, the largest U.S. homecare company, since September 2021, where he led finance, accounting, treasury and revenue management functions. Previously, Mr. McGroarty held a variety of positions with The Cigna Group, including Chief Financial Officer, Vice President, Government Business Se…read full bio |

| LUCID GROUP INC |

|

CFO | Gagan Dhingra

1.2 yrs *interim* |

Taoufiq Boussaid

Mr. Boussaid, 53, has been an advisor for N.V. Bekaert S.A., a Belgium-listed industrial steel and coatings technology group, since October 2024 and was the group’s Chief Financial Officer from July 2019 through October 2024. From 2007 to 2019, Mr. Boussaid was employed at Bombardier Transportation, a rolling stock and rail transport manufacturing company, where he served multiple leadership…read full bio |

| OPEN TEXT CORP |

|

CFO | Madhu Ranganathan

.9 yrs |

Chadwick Westlake

Mr. Westlake, age 46, is a highly experienced finance and transformation executive, previously serving as the Chief Financial Officer of EQB Inc., a leading digital financial services company. In his role, Mr. Westlake led corporate strategy and development, and overall financial management including investor relations, treasury, capital markets, core finance functions and strategic process i…read full bio |

| TELEFLEX INC |

|

CFO | Thomas E Powell

13.1 yrs |

John Deren

Mr. Deren has had a wide-ranging set of responsibilities within the Teleflex Finance organization since joining the company in 2013. During his tenure, John has had executive oversight of various functions within Finance, including Corporate Finance, Finance Shared Services, Global Supply Chain Finance, Treasury, and Tax. John has over 30 years of financial management and reporting experien…read full bio |

| TEXTRON INC |

|

CFO | Frank T Connor

15.5 yrs |

David Rosenberg

David Rosenberg, currently our Vice President – Investor Relations, has been appointed Executive Vice President and Chief Financial Officer to succeed Mr. Connor, effective March 1, 2025. Mr. Rosenberg, 48, has more than 24 years of experience in the aviation industry. Prior to his role as Vice President – Investor Relations, he served as Senior Vice President & Chief Financial Officer of Textron…read full bio |

| WESTERN DIGITAL CORP |

|

CFO | Wissam G. Jabre

3.0 yrs |

Don R. Bennett (interim)

Mr. Bennett, 55, has served as the Company’s Senior Vice President, Finance, and Chief Financial Officer of the Company’s hard disk drive (“HDD”) business since November 2020. From 2017 to November 2020, he served as the Company’s Vice President II, Finance, Global Real Estate Operations and Finance Transformation. Since joining the Company in 1995, Mr. Benn…read full bio |