————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

News of the Day

Carter’s Has a New ESG Strategy

With the baby and children’s apparel retail announcing a new ESG strategy today, we take a closer look at the stock

Carter’s ESG Push. Baby and children’s apparel company Carter’s (CRI) announced its new ESG strategy, called “Raise the Future,” which features plans to provide sustainable product labelling, expand its sustainability-focused brand, and enable clothing recycling, along with plans to invest $50 million in early childhood education and literacy.

Category leader by a wide margin. Carter’s is the largest branded marketer of apparel and related products for babies and young children in the United States and Canada. The company has several brands, including Carter’s and OshKosh B’gosh, which are two of the most recognized in the marketplace. Carter’s products are sold in department stores, national chains and specialty retailers, as well as through more than 1,000 company-operated stores and online. The company has ~3x the market share of its next largest competitor, The Children’s Place (PLCE).

Structurally improved post-pandemic. Coming out of the pandemic, the company has made significant structural improvements– including rationalizing low growth/low margin stores, simplifying SKU count, and expanding its e-commerce/multi-channel offerings.

More an earnings than revenue growth story. For 2022, the company has guided to revenue growth between 2-3% and EPS growth of 12-14%– driven by the strength of its brands and an extensive distribution network. Management also recently discussed longer term goals, forecasting annual sales to exceed $4 billion by 2026, with earnings in excess of $12.00 per share.

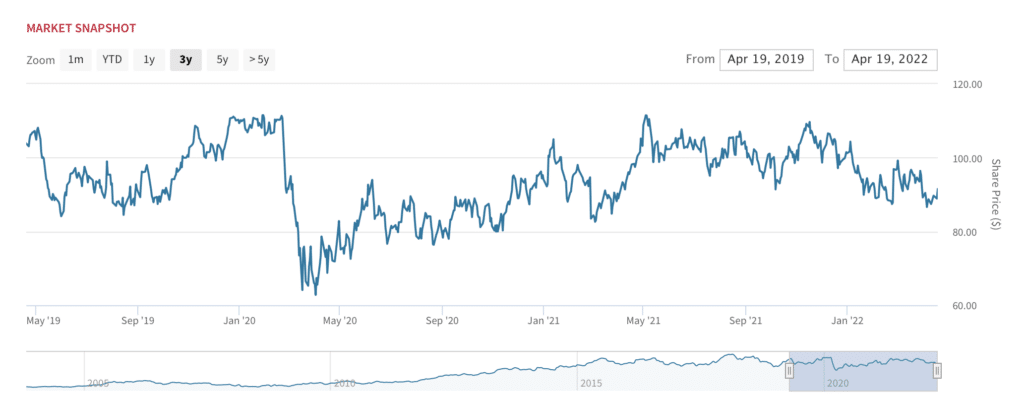

Shares trade at significant discount to historicals. CRI shares are trading at a significant discount to historical levels– a reflection of rising interest rates and negative sentiment on consumer discretionary stocks. Rising wages and higher commodity prices are also negatively impacting earnings in this sector. CRI shares have declined ~9% year-to-date, versus a 7% decline for the S&P500 over the same period.

Carter’s (CRI): A Secular Growth Leader to Buy on Dips

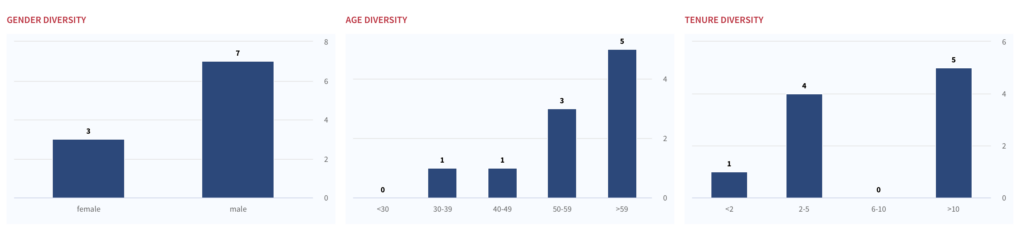

CRI: Board Diversity & Inclusion Snapshot

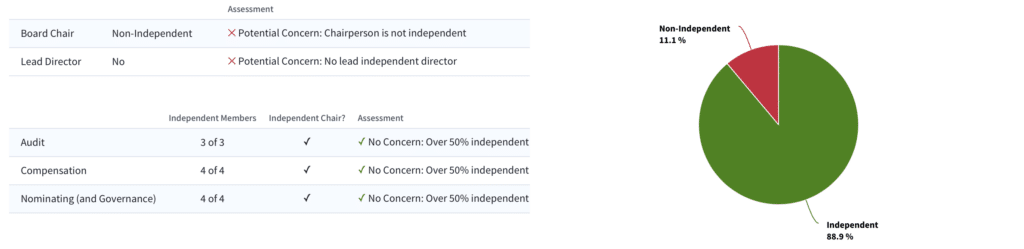

Red Flags. The main concern is the relative underperformance of the stock. CRI shares have underperformed the S&P over the last 1, 2 and 5 year periods. In terms of governance, it’s worth noting Michael Casey, CEO, is also Board Chair. Most investors prefer a separation of CEO and Board Chair positions as an indicator of independent leadership. Also note: a CEO who is also chair votes on their own compensation, an obvious conflict of interest.

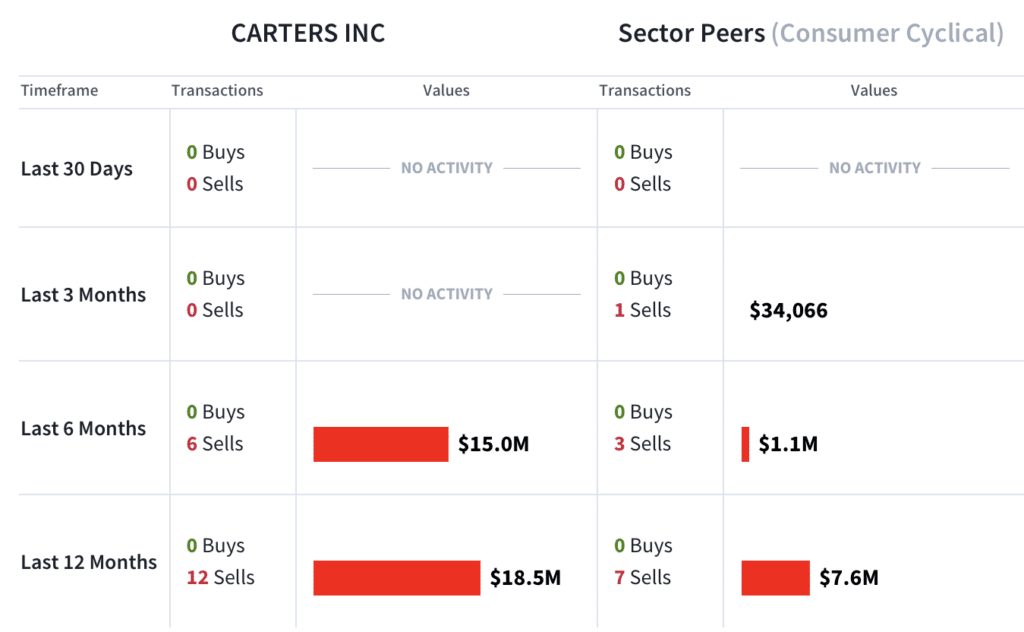

Other red flags include insider selling (12 sells totaling $18.5M in the last six months), including two insiders which sold a large block totaling $6.97M in November of last year.

Capital Allocation. On its Q4 earnings call, Carter’s authorized a 25% increase to its quarterly dividend to $0.75 per share and authorized a new $1.0B share repurchase plan (~26% of current market cap).

Shares trade at a discount to EPS growth and appear priced-in for a flatter EPS growth profile over the next 6-12 months. Carter’s revenue and earrings growth is tied to population growth and household formation. While retail stocks have suffered in the current environment, it’s important to point out that the baby/young children apparel business is less discretionary than other consumer segments. Shares currently trade at 9x 2023E EPS. Applying a conservative forward EPS multiple of 11x to 2023E EPS results in a fair value estimate of $109 for the stock, or 17% upside from the current share price ($93 as of this writing). Note that the applied multiple represents a discount to CRI’s 5 year average forward earnings multiple of 15x and a discount to EPS growth of 12-14%. We think the shares are discounted for a flatter earnings growth profile and are opportunistic buyers.

Best of the Rest

Boardroom Alpha Podcast

Looking for a good ESG and sustainable technology growth story? Check out our latest podcast with Origin Materials (ORGN). We talk with co-CEOs John Bissell and Rich Riley about how Origin’s technology converts plant-based material into a wide variety of carbon negative materials– from textiles, packaging, automotive parts and more. The stock continues to trend higher following yesterday’s announcement of a strategic partnership with LVMH to develop sustainable low-carbon footprint packaging for the perfumes and cosmetics industry.

Check out our latest Boardroom Alpha podcasts here.

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.