————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

News of the Day

Mastercard Ties Executive Bonuses to ESG Goals

Global payment technology company Mastercard (MA) will begin including achievement of the company’s ESG goals in the calculation of employee bonus pay, according to a memo released today by CEO Michael Miebach.

The new initiative builds on the company’s new compensation model introduced last year for senior executives with incentive pay tied in part to the company’s ESG priority areas of carbon neutrality, financial inclusion, and gender pay parity. The company will incorporate the goals into its annual corporate score, which also takes into account revenue and earnings, and is one of the metrics used in determining bonus levels.

Last November, Mastercard committed to reach net-zero greenhouse-gas emissions by 2040, a decade sooner than it had previously planned as it reduces its carbon footprint. The company has also made progress toward closing its gender pay gap, with female employees now making 93 cents for every dollar male employees earn on average, an improvement from 92.4 cents reported in 2020.

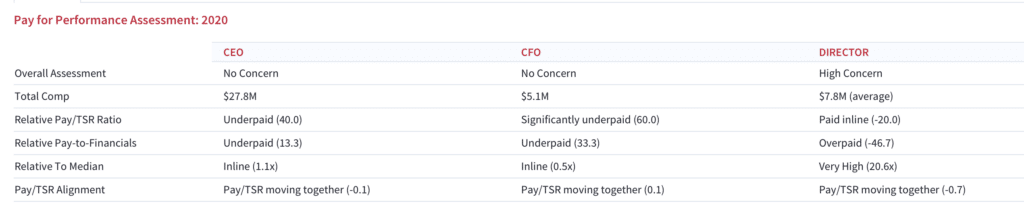

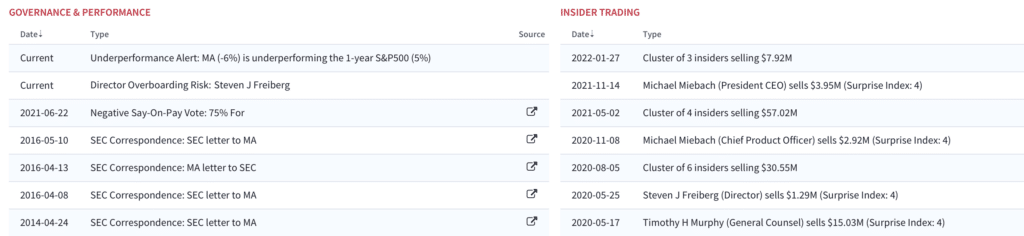

In last year’s proxy statement, Mastercard indicated that its mandate to link executives’ annual incentives to ESG goals could raise or lower payouts by as much as 10 percentage points. Executive compensation remains a concern at the company, with MA shareholders voting 75% in favor in a June Say-on-Pay vote. Also of note: MA Directors were paid $7.8M on average in 2020, well above the comparable median.

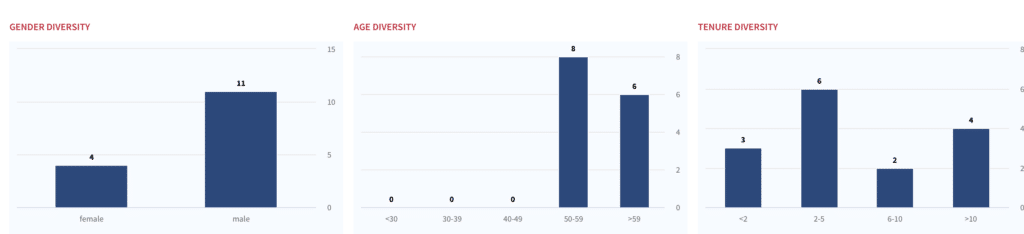

MA: Board Diversity & Inclusion Snapshot

MA: Director Compensation is a Concern

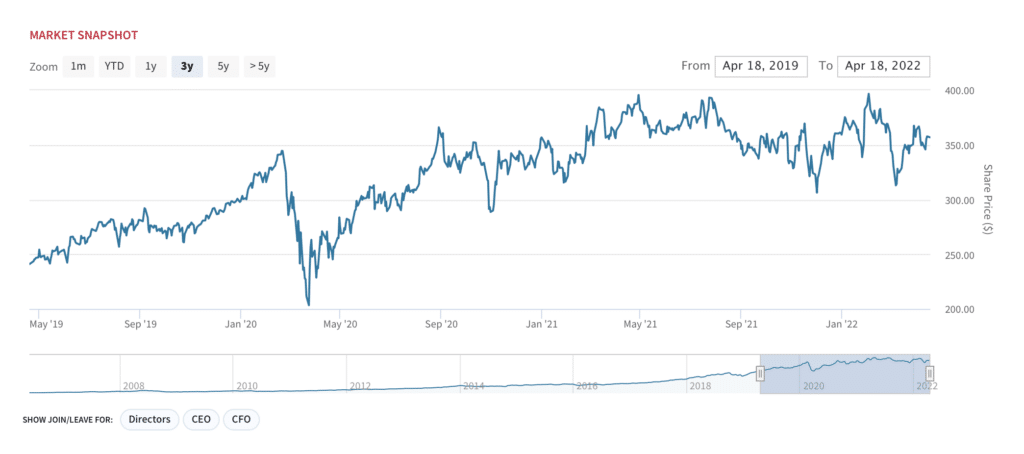

MA stock has largely traded sideways since the start of the year. Despite reporting improving cross-border payment volumes last quarter (+53% YoY) and processing $2.1 trillion in gross dollar volume in the quarter (+23% YoY), shares are down 3% YTD, versus a 7% decline for the S&P500 over the same period. Of particular concern: Mastercard’s high margin cross-border travel-related payments still haven’t returned to pre-pandemic volumes, hovering around 77% of 2019 levels in January. This Q1 figure is below the 79% level reported in Q4.

MA stock: The Inflation Effect

Mastercard also issued mixed Q1 guidance, calling for revenues at the high end of its high-teens forecast and operating expenses at the “high end of high single digits,” excluding acquisitions. The company didn’t raise its three-year guidance, reiterating net revenue growth in the high teens and earnings growth in the low 20s.

MA: Red Flags and Insider Trading

Special Situations/ Activism

Ingevity (NGVT)

Inclusive Capital Partners reported a 5.41% interest in bio-based specialty chemicals manufacturer Ingevity (NGVT). Inclusive is a returns-driven fund with a focus on ESG investing. The firm’s primary focus is on environmental and social value creation. Inclusive is known for a unique method it uses has to screen and value companies: enterprise value to carbon emissions abated.

Ingevity converts waste streams and by-products from the wood, paper, and pulp into specialty chemicals. The company, which was spun off from paper and packaging supplier Westrock (WRK) in 2016, has products across a variety of applications, including asphalt paving, oil exploration and production, agrochemicals, adhesives, lubricants, printing inks and automotive components.

Ingevity’s Chemicals segment (63% of revenue), takes pine tree waste and separates it into sticky and oily materials that are converted into adhesives, lubricants and paving ingredients. The Materials segment (37% of revenue) is the industry leader for converting sawdust into activated carbon.

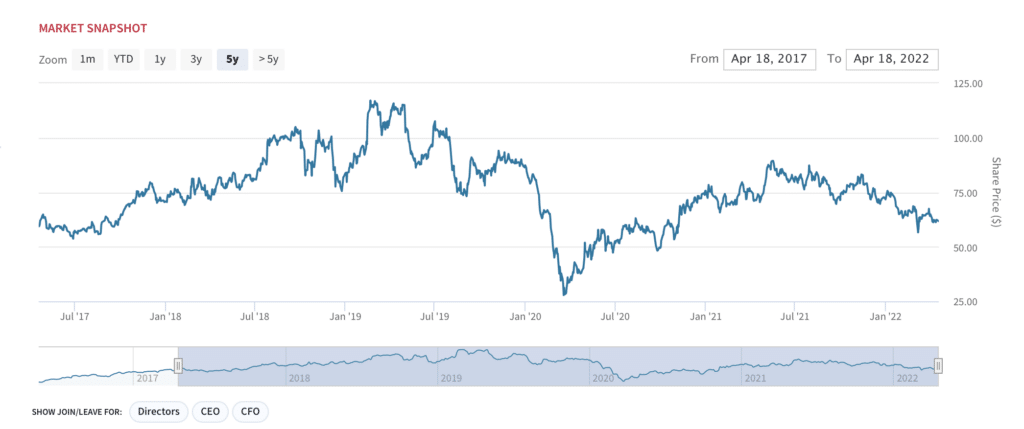

NGVT shares had a strong run from $25 at the time of the Westrock spin-off to ~$100 in early 2018 on the heels of several large acquisitions. Notably, Ingevity was spun off from Westrock after pressure from activist investor Starboard Value. At the time of the separation, the company’s Chemicals business was ~75% of sales, yet reported EBITDA margins of ~20%. The Materials business was much smaller but carried roughly 2x EBITDA margin.

Today, the company’s segment trends are largely unchanged. NGVT’s Performance Materials segment generates ~45%+ EBITDA margin and mid-single-digit long-term growth. The Performance Chemicals segment generates ~ 20% EBITDA margins and mid-to-high single-digit long-term growth. The company’s blended EBITDA margin is ~28%, with a blended growth rate in the mid-to-high single digits.

NGVT shares have declined sharply and are trading at 2020 levels. Notably, at ~8x EBITDA, NGVT trades at a deep discount relative to peers, which trade in the range of 10-14x EBITDA. The biggest concern is the company’s exposure to the automotive industry, which is clearly facing slowing growth owing to supply chain constraints.

NGVT Stock: Back to 2020 Levels

NGVT: Red Flags and Insider Trading

Ingevity has clear growth levers, including further geographic and product expansion. The company, with a better articulated ESG story, could re-rate more toward other biomaterials companies such as Danimer Scientific (DNMR) and Origin Materials (ORGN).

Best of the Rest

Boardroom Alpha Podcast

Want to dive deeper into the world of biomaterials? Check out our latest podcast with Origin Materials (ORGN). We talk with co-CEOs John Bissell and Rich Riley about how Origin’s technology converts plant-based material into a wide variety of carbon negative materials– from textiles, packaging, automotive parts and more. The stock is moving nicely today on news of a strategic partnership with LVMH to develop sustainable low-carbon footprint packaging for the perfumes and cosmetics industry.

Check out our latest Boardroom Alpha podcasts here.

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.