With NFLX approaching a 4-year low, we’d like more action

Broken business model: Losing subs, profitability flattening. It’s hard to see the current situation at Netflix (NFLX) as anything short of disastrous. The video streaming company reported a historically bad quarter in Q1 2022, losing subscribers for the first time in a decade. Netflix lost 200,000 subscribers, falling well short of its guidance (+2.5 million subscribers). A decision in early March to suspend service in Russia after its invasion of Ukraine resulted in the loss of 700,000 subs. While Netflix expects subscriber growth to be positive for the year, operating margin guidance of 19%-20% for 2022– flat– is down from its earlier expectations for an average annual margin expansion of 19%-20%.

Ackman votes with his feet. Bill Ackman’s Pershing Square Capital Management liquidated a $1.1B position in Netflix at a loss of more than $400 million (after only 3 months). “While Netflix’s business is fundamentally simple to understand, in light of recent events, we have lost confidence in our ability to predict the company’s future prospects with a sufficient degree of certainty,” he wrote.

Stock approaching 4-year low. NFLX stock has now plummeted 40% in the last four sessions since reporting its quarterly results. Shares are trending toward their lowest close since January 2018.

NFLX: Shares approaching 2018 levels

Succumbing to the advertising beast. Co-CEO Reed Hastings said he was contemplating an ad-supported option to attract more price-sensitive consumers. The move was criticized by some as the transformation of streaming into cable TV. What’s more likely is that Netflix will offer several service tiers, including a premium ad free service, and perhaps one or two tiers below, subsidized by ad revenue.

“Taking it up a notch.” NFLX says it will push harder on quality by “taking it up a notch.” We’d like a better sense of what that means. In particular, we think the company has made a mistake by staying out of live sports. In contrast, Disney, Amazon, CBS, NBC, and Fox are securing rights to more live content– especially the NFL and NHL– bolstering their content offerings. Apple, for example, began broadcasting Friday Night Baseball and is reportedly close to a deal for NFL Sunday Ticket.

Password imbroglio: NFLX should tread lightly. Netflix will clamp down on an estimated 100 million households with shared passwords globally. For accounts that are sharing a password across addresses, Netflix will charge an additional fee to add “sub accounts” for up to two people outside the home. NFLX is entering unchartered waters as no major streamer has ever cracked down on password sharing before. The company will have to be careful around how it defines password sharers as well as how it differentiates between a home account and a sub account in order to avoid subscriber upset. Netflix’s position with respect to passwords is a marked change from only five years ago, when the company actually encouraged password sharing. At that time, Hastings commented “we love people sharing Netflix,” as the company’s openness drove more eyeballs to its content, which in turn drove subscription growth.

Fixes will take 18-24 months to take effect. Both initiatives are currently in testing phase and will clearly take time: the security fixes will ramp in 2023; an ad-based service is targeted for 2024.

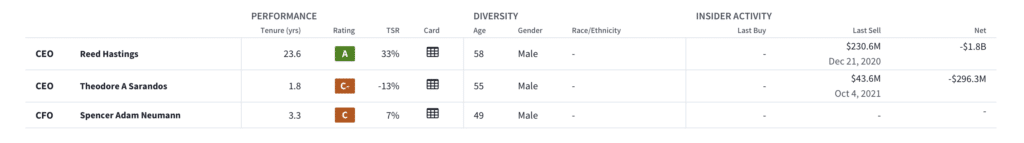

Two Caesars in the C-Suite. Netflix has two co-CEOs: Reed Hastings and Ted Sarandos. The company is one of less than 25 Fortune 500 that have had co-CEOs in the last 30 years. Both co-CEO Sarandos and CFO Spencer Neumann have C performance ratings on the Boardroom Alpha scorecard, owing in part to the slowing, then declining stock price growth over their tenures.

NFLX: C-Suite Scorecard

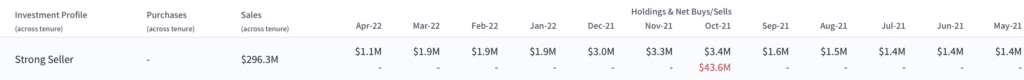

Red flag: Free cash flow. Notably, since Sarandos first began his tenure in Q3 2020, NFLX shares have declined 60%– versus a 3% gain for the peer median over the same period. He has also sold $296.3M worth of stock during his tenure. The company’s FCF trajectory (-100% over Sarandos’ tenure) is another key concern. While the company was FCF positive in 2020 for the first time since 2010, this was due almost entirely to cutting content spending during the COVID-19 pandemic. Netflix won’t be able to generate positive FCF while investing more heavily into content spending.

NFLX Co-CEO Sarandos has been a strong seller

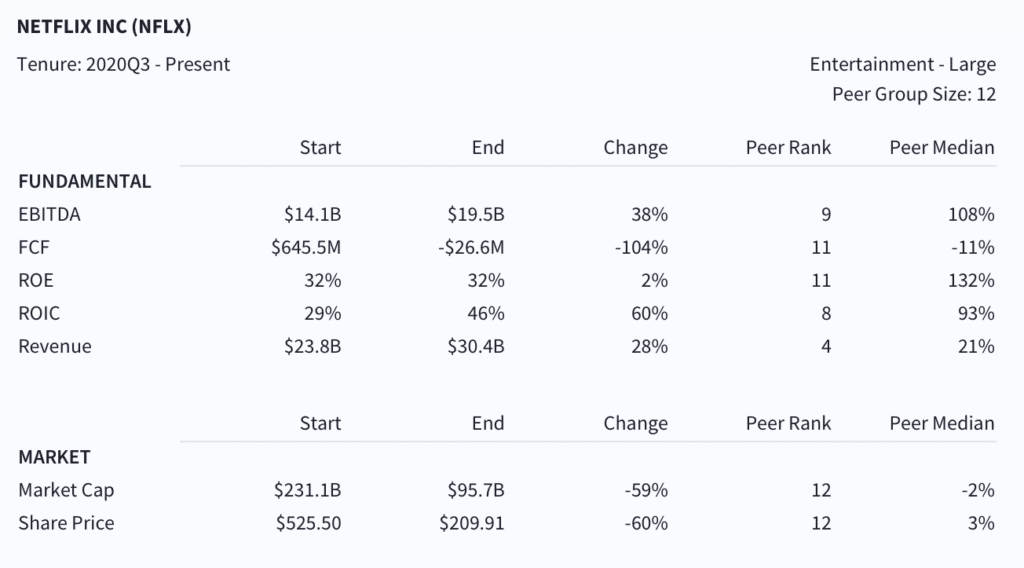

Downward momentum: Since Sarandos’ tenure, NFLX has underperformed peers

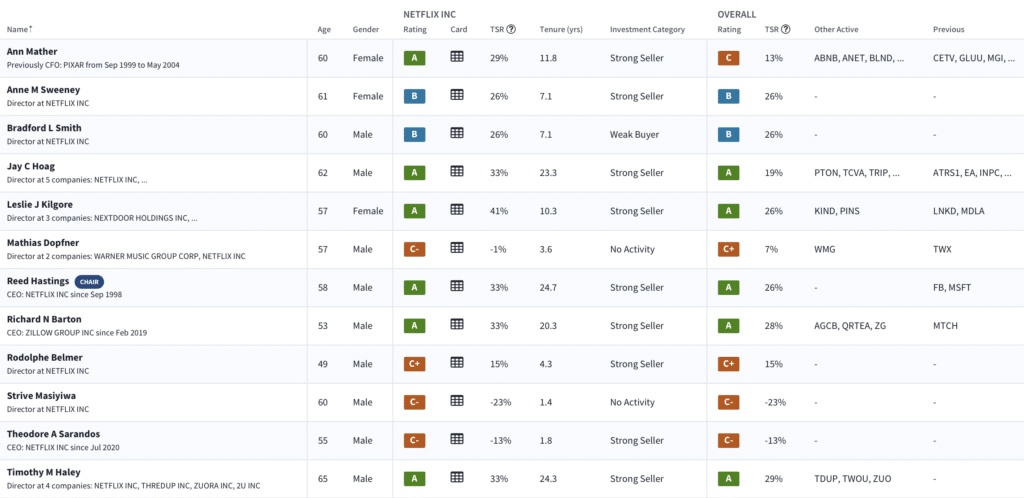

Insider ownership: Skin in the game? Inside ownership offers a good insight into the alignment between executive leadership and shareholders. Netflix insiders (directors and executives) own a healthy position– about 10.7B shares (2.39% of the company). That said, that ownership position for many directors is heavy in options to buy stock. The ownership position for director Ann Mather, for example– is entirely in options. We’d like to see more NFLX directors increase their ownership as evidence of their commitment to long term goals.

NFLX Board Overview

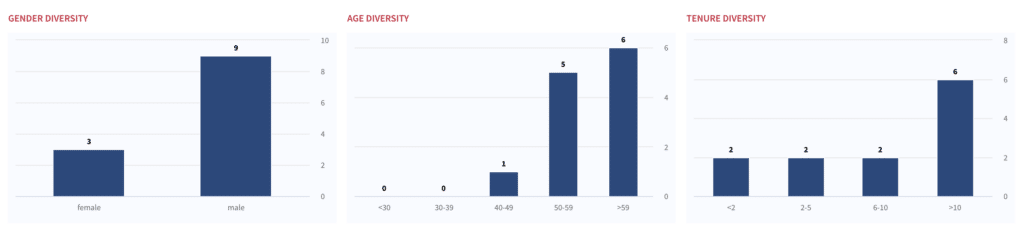

Board Diversity Snapshot

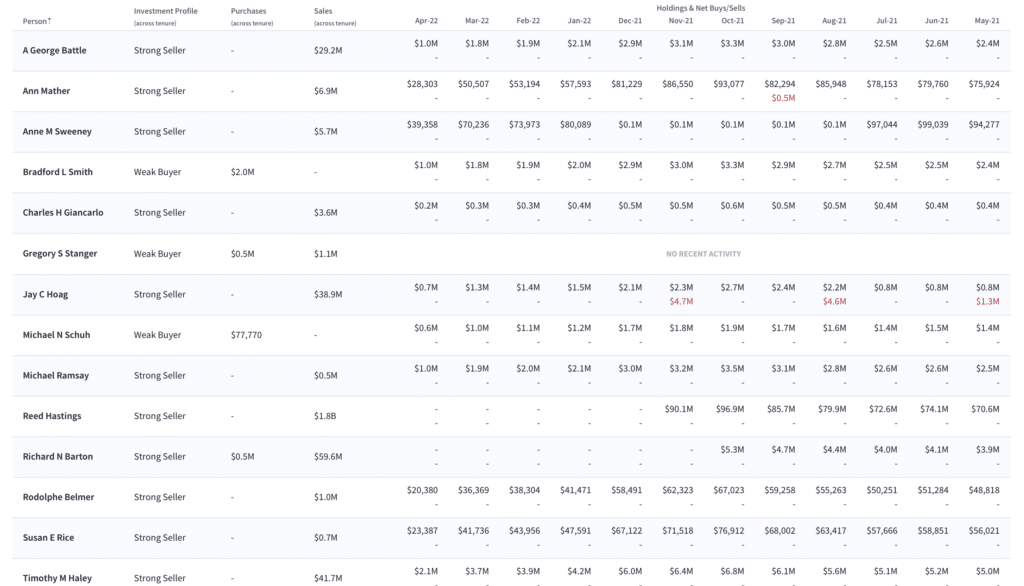

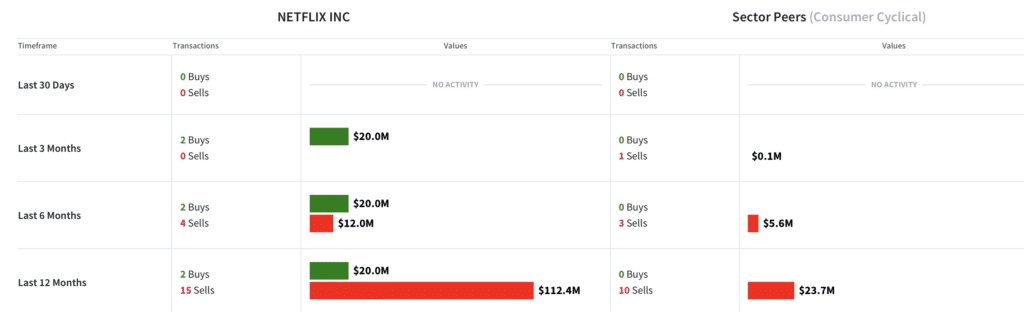

We’d like to see some directors step in and buy stock here. Insiders sold $112.4M in stock over the past 12 months, substantially above sector peers. Despite Hastings’ insider purchase worth $20M, it’s important to note that it’s insignificant compared to his existing stake of 7.6M shares (1.7% stake), which is worth $1.5B at today’s price ($198.40). With a few exceptions, the majority of Netflix’s Board has been a seller of NFLX stock. We’d like to see more independent directors use this recent sell-off to accumulate shares at this valuation– particularly given fundamental concerns.

No diamond hands here: Trading activity at the NFLX board

NFLX: Insider trading versus peers

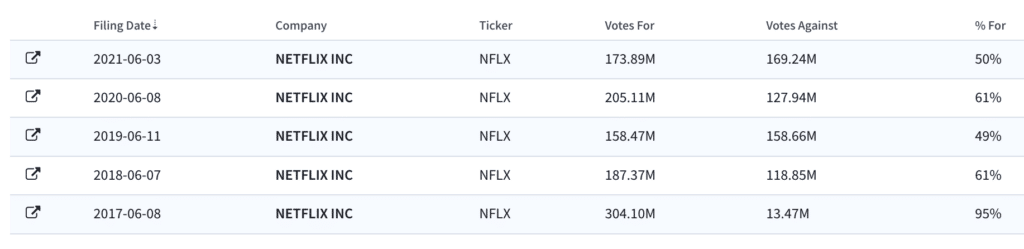

Executive Compensation: Some concern. Netflix disclosed in its 2021 proxy statement that co-Founder and co-CEO Reed Hastings’ total compensation for 2021 declined to $40.8 million from $43.2 million in 2020. 2021 compensation included 650,000 in base salary, the same as 2020, while option awards declined modestly to $39.7 million from $42.4 million. Note that 50% of shareholders voted in favor of the company’s executive compensation plan at the most recent Say-on-Pay vote. Another unique feature of Netflix’s executive compensation plan: it’s very heavy on equity. Netflix pays all employees (including their named executive officers) only in cash and fully vested stock options (excluding “limited” perquisites). Most public companies include a mix of cash salary, stock awards, non-stock bonus payments, and stock options. For now, with NFLX stock price declining, the implications of an options-heavy compensation plan are muted. But it’s worth noting should NFLX reverse course.

A History of Negative Say-On-Pay Votes

Demand picture remains choppy; monetization is the key to a turnaround. While Netflix expects a return to subscriber growth in the back half of the year from seasonal strength and a stronger content slate, management’s emphasis has clearly shifted to monetization in the near term as demand remains choppy.

Subscriber declines likely to continue; margins are a concern. We expect subscriber contraction could be the new normal for Netflix– particularly as more competitors invest in streaming– including Disney (DIS), Amazon (AMZN) and Apple (AAPL). We are also concerned that Netflix’s margins could decline even further given competitive pressures, more spending on content creation, and subscriber acquisition.

More action needed. With the Board selling stock, and very limited insight into growth levers, we’d like to see incremental evidence of some strategic changes at NFLX.

Latest Podcast: Did Activision Blizzard’s Governance Failures Lead to a Quick, Cheap Sale to Microsoft, with Richard Clayton

Shareholders vote this Thursday on the $68.7 billion proposed acquisition of Activision Blizzard (ATVI) by software giant Microsoft (MSFT). Boardroom Alpha sat down with Richard Clayton, Director of Research at the Strategic Organizing Center (SOC) Investment Group. Founded in 2006, the SOC Investment Group works with pension funds sponsored by unions affiliated with the Strategic Organizing Center, a coalition of unions representing more than four million members. Clayton shares his take on Activision’s recent governance moves and why the proposed takeover by Microsoft isn’t in the best interest of shareholders. Listen to the podcast and read our overview here.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.