14 companies have already failed a Say-on-Pay Vote. We look at the most problematic of the bunch.

Say-on-Pay stats. More than a decade following the introduction of Say on Pay in 2011, shareholders are speaking loudly when it comes to executive compensation. While Say on Pay is a non-binding, advisory vote, failure reflects shareholder dissatisfaction with executive pay or company performance. Companies that fail Say on Pay tend to increase the proportion of long-term incentive plan grants strictly tied to performance. While most shareholders tend to focus on compensation metrics as opposed to absolute numbers, the ratio of CEO compensation to worker pay is another closely-watched metric– particularly as income inequality becomes an increasingly contentious topic.

Halfway through Say-on-Pay voting for the year, here are the stats: 607 companies successfully passed a Say-on-Pay vote (98%) and 14 companies failed (2%). These results align with last year’s trends. In 2021, the pass / fail split was 97%/3%.

Say-on-Pay Failures Year-to-Date

We look at the companies with the worst Say-on-Pay vote outcomes: Arrowhead Pharmaceuticals (ARWR, 20% for); Goodyear Tire (GT, 21%); and Centerpoint Energy (CNP, 22%).

Arrowhead Pharmaceuticals (ARWR)

ARWR in brief. With a market capitalization of $3.6B, ARWR is a pre-commercial biotech whose RNAi therapeutics platform targets NASH, fibrosis, other liver diseases, cardiovascular and hepatitis.

Red flag: underperformance. Shares have delivered a 1-year TSR of -39% versus -2% for the S&P500 over the same period. At $34, shares trade at ~May 2020 levels.

ARWR: Market snapshot, TSR and CEO pay overview

Red flag: executive compensation. Arrowhead had the worst vote performance of the group, with just 20% of shareholders voting in favor of the company’s executive compensation package. CEO Christopher Richard Anzalone was paid $24.7M in 2021. ARWR stock declined 14% from 2020-2021, while the S&P500 gained 27% during this period. Anzalone’s 2021 comp is also a considerable jump from his 2020 pay of $14.3M, and significantly above the peer median. $23M of Anzalone’s 2021 compensation package was in stock awards. CFO Kenneth Allen Myszkowski was paid $5.3M, inline with peers. Board compensation, $4.7M in total, is also in line with peers.

ARWR: 2021 officer compensation

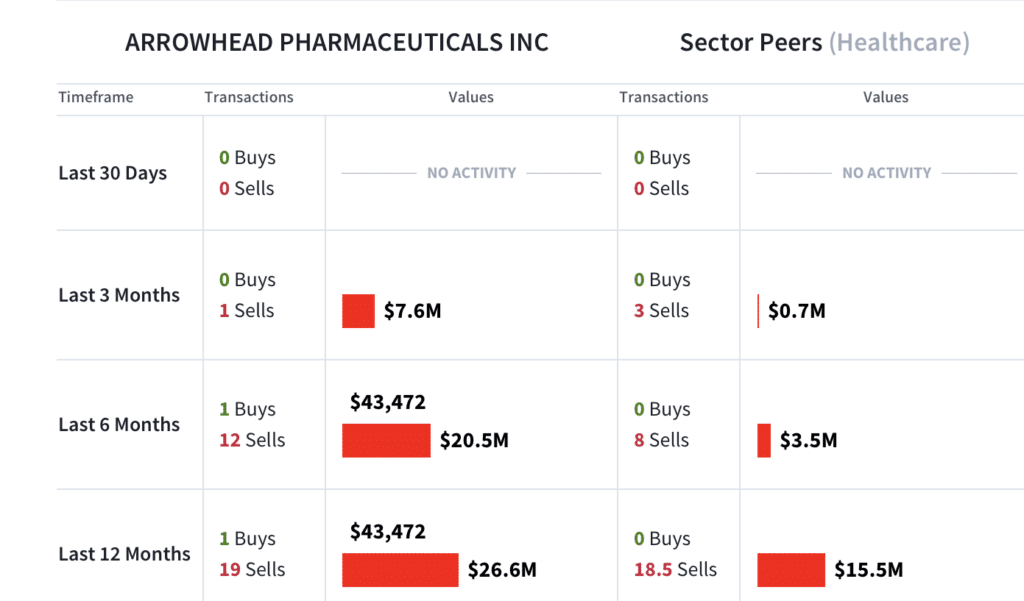

Red flag: high insider selling. Insiders sold $20.5M worth of stock, well above sector norms. Anzalone sold 146,388 shares in early February.

Goodyear Tire (GT)

GT in brief. With a market capitalization of $3.2B, The Goodyear Tire & Rubber Company is an American multinational tire manufacturing company. The company suffered from automotive supply chain challenges which limited auto production. While cost pressures are likely to persist, the company should benefit from expansion efforts as well as the EV (electric Vehicle) manufacturing ramp. The 2021 acquisition of Cooper Tire & Rubber gives Goodyear greater exposure to the North American replacement-tire market. The company has an industry-leading share of about 20% of this market and sees an expansion opportunity in the still nascent Chinese market.

Red flag: underperformance. It’s been a difficult year for consumer discretionary stocks as inflationary pressures have curbed earnings growth. GT shares have delivered a 1-year TSR of -30% versus -2% for the S&P500 over the same period. That said, the company’s recently reported Q1 earnings beat on top and bottom line. EPS of $0.37 were well above consensus of $0.21. Q1 revenues of $3.5B were also ahead of consensus of $3.4B.

GT: Market snapshot, TSR and CEO pay overview

Red flag: executive compensation. 21% of shareholders voted in favor of the company’s executive compensation package. CEO Richard Kramer was paid $21.4M in 2021– significantly overpaid relative to TSR, financial performance and the peer median.

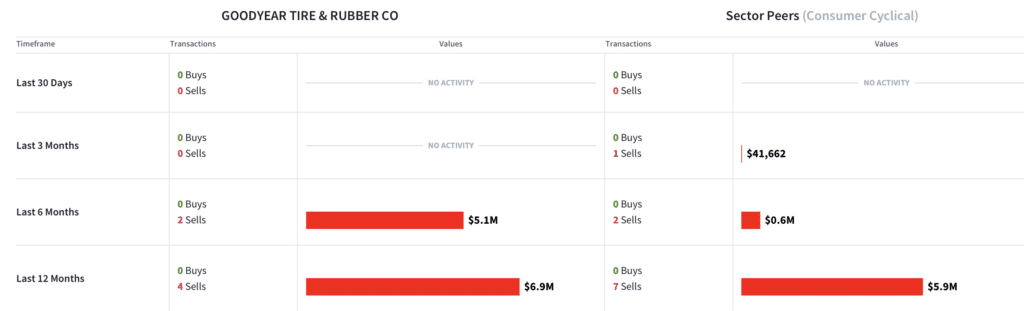

Red flag: insider trading. Insiders sold $5.1M worth of stock over the past 6 months, above the peer average.

CenterPoint Energy (CNP)

CNP in brief. With a current market capitalization of $19B, CNP is a Fortune 500 electric and natural gas utility. Unlike the other two stocks in this group, CNP shares have outperformed– as has the entire utility sector. CNP has delivered a 31% TSR year-to-date, versus a 2% decline for the S&P500 over the same period.

CNP: Market snapshot, TSR and CEO pay overview

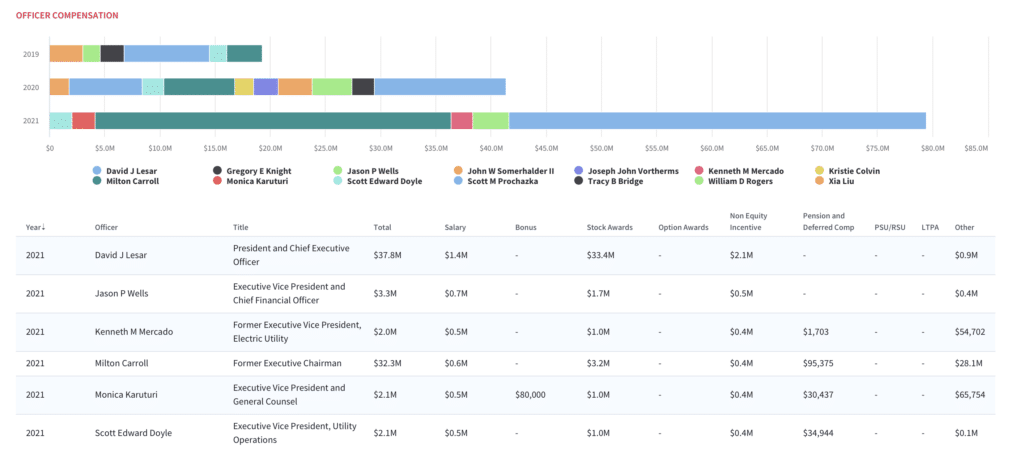

Red flag: executive compensation. Only 22% of shareholders voted in favor of the CenterPoint’s executive compensation package. It’s worth noting that no large utility has lost a “Say on Pay” vote in at least three years. CenterPoint’s CEO David J Lesar was paid $37.8M in 2021– significantly above TSR metrics, financial performance and the peer median for other utility CEO salaries. Lesar also received the vast majority of his compensation– $33.4M– in stock awards as a part of a retention incentive agreement. Given that the lofty compensation package was juxtaposed with rate hikes for customers, many shareholders were upset. Lesar made 366 times as much as the average CenterPoint employee ($103,170). CFO and Directors are also overpaid relative to these metics.

CNP: 2021 Pay for Performance assessment

CNP: Officer Compensation

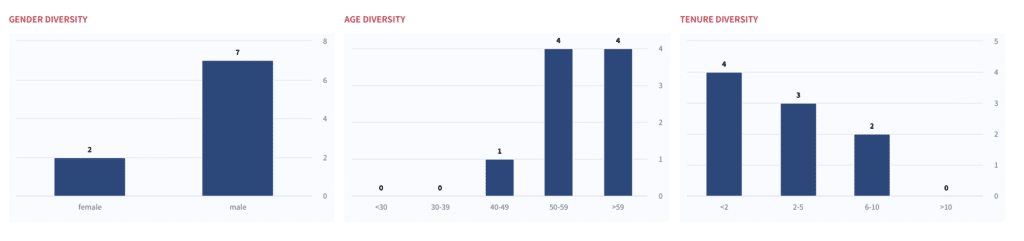

Red flag: governance. Last July, CNP made some board changes, the most significant of which was the appointment of Martin Nesbitt as Independent Chairman of the Board, replacing Milton Carroll. Gender diversity, however, could use some improvement– only two women sit on the board currently.

CNP: Diversity & Inclusion snapshot

Latest Podcast: NYC Pension Funds Want Amazon Accountable for Human Capital

Our latest podcast explores the ESG situation at Amazon (AMZN), which is facing activist pressure as employees demand better working conditions. The tech giant has drawn increasing criticism for its treatment of workers, including claims of poor working conditions at its warehouses and attempts to block unionization. To dive into the details on why Amazon is failing in human capital management, Boardroom Alpha sat down with Michael Garland, Assistant Comptroller for Corporate Governance and Responsible Investment at the New York City Office of the Comptroller. Garland details the NYC Pension Funds’ campaign– along with New York State Comptroller Thomas DiNapoli and trustees of all five of the New York City Retirement Systems– to unseat two Amazon board members responsible for human capital management– Daniel Huttenlocher and Judith McGrath. Amazon’s annual shareholder meeting is coming up on May 25th.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.