We were fortunate to sit down with Amy Nauiokas, the Co-Founder, Co-Chair, and Co-CIO of fintech investing platform Anthemis ($1.2B in AUM), who has been a leading fintech investor for nearly 15 years. Though she has a career that us regular folks might find astounding given she also runs a film and television production company, Archer Gray, which promotes story telling from diverse individuals.

In her day job at Anthemis, Amy leads investments across the FinTech landscape from insurtech, to neo banking, and SME banking. Some investment highlights include Betterment, eToro, Pipe, and Carta. Anthemis invests across all stages but their bread and butter is investing from pre-seed, really helping to shepherd founders along their journey.

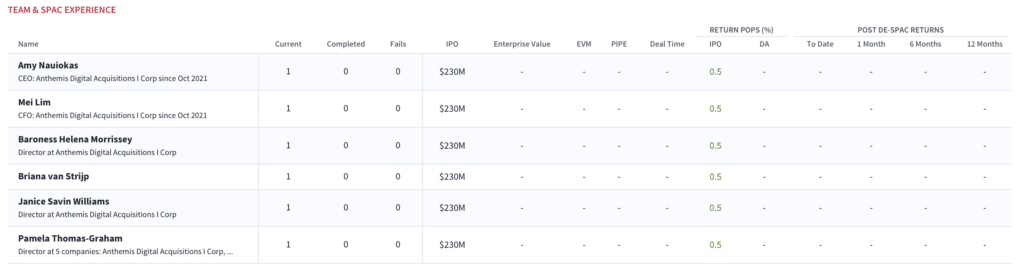

The idea behind Amy’s SPAC Anthemis Digital Acquisition Corp (ADAL) (raised $230M in Oct-21 IPO), is to take more of a partnership-style approach to the market vs. the purely transactional nature of many SPACs. Which is partly why, as Amy points out, they took a patient approach and decided to wait until October (vs. peak SPAC in early 2021) to price their IPO.

Promoting Diversity

There are a handful of SPACs that are led by all-female, or predominantly female teams, including Queens Gambit Growth 1 & 2 (GMBT, QWNB) founded by Victoria Grace, and Athena Technology Acquisition 1 & 2 (ATHN, ATEK) led by Isabelle Friedman and let us not forget one of the original SPAC pioneers, Betsy Cohen, who counts over 10 SPACs to the FinTech Masala franchise.

However SPACs, not unlike Wall St. VC and several other industries, still remain a male dominated world. In fact, according to Boardroom Alpha data, just 4% of SPACs priced since 2020 were led by a female CEO, and just ~19% of all SPAC board members from the same time period are female.

Which is what led Amy to create a SPAC with a 100% female-led founding team. Though, as Amy notes, it’s also a diverse team from the standpoint of both ethnicity and international citizenship. The idea of a broad-set of experiences and global footprint helps to differentiate ADAL in the sea of SPACs out there.

ADAL will, of course, target a company in the fintech space but also one that is ESG friendly and led by a diverse team. But, almost most importantly, will identify a leadership team that is actually public ready.

Have a listen to Amy, I think you’ll enjoy it.