Amidst slowing consumer storage growth, Elliott wants to divest the company’s Flash business

Elliott sends letter to Western Digital. Elliott, which holds a 6% stake in Western Digital (WDC), sent a letter to the company calling for a strategic review and separation of the company’s Flash business. The firm believes a separation could drive the share price to more than $100 by the end of 2023, and urged Western Digital’s board to conduct a strategic review into the separation. Elliott also indicated the firm will invest more than $1 billion into the standalone flash segment at an enterprise value of $17B – $20B to be used either in a spinoff transaction or as equity financing in a sale or merger with a strategic partner.

Consumer business has been volatile, supply chain disruptions have been challenging. Western Digital, a major player in storage, is one of the largest computer hard disk drive manufacturers, along with solid-state drives (SSDs) and flash memory devices. The company operates two very different main segments — a hard disk drive segment and NAND flash memory segment. Additionally, the company provides data center devices and solutions, data storage platforms, and software solutions for enterprise servers. WDC’s original business is in hard disk drives, but these are becoming obsolete as faster and more reliable solid state drives decline in price. To stay ahead of this shift, WDC acquired flash memory manufacturer SanDisk Corp in May 2016 for $16B. SanDisk gave WDC a strong foothold in flash memory storage chips used in smartphones and tablets.

WDC: Navigating China lockdowns, supply chain issues

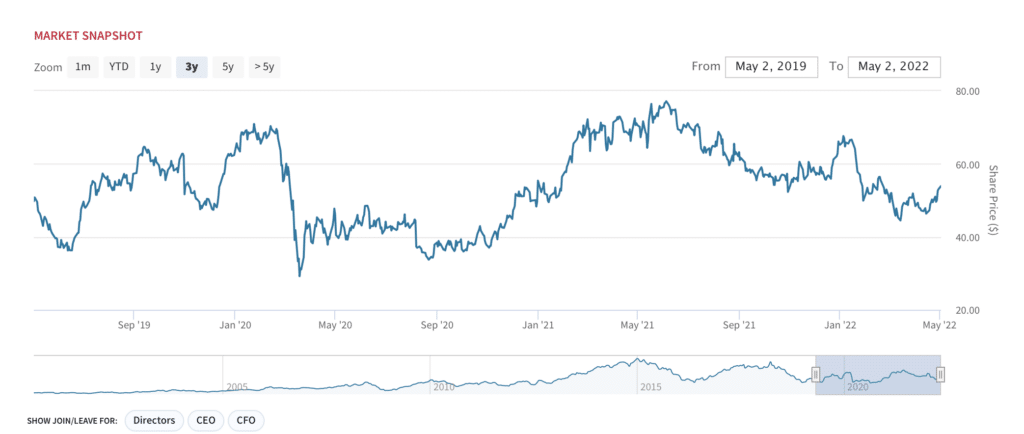

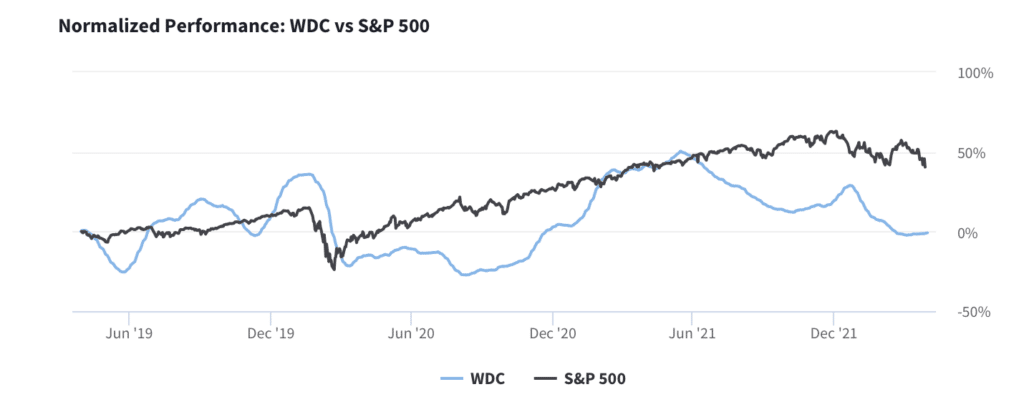

WDC shares have underperformed, delivering -30% TSR over the past 12 months. WDC shares have delivered TSR of -30% over the past 12 months – well below a 1% decline for the S&P500 over the same period. “This underperformance is particularly disappointing given the Company’s great potential in both businesses,” Elliott wrote.

WDC has underperformed the S&P 500

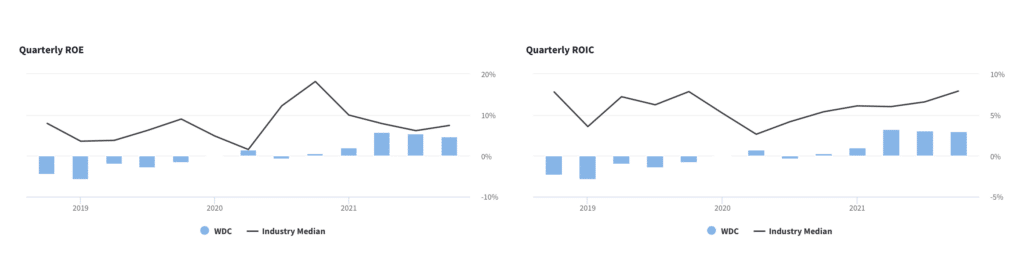

Capital efficiency closeup: ROE and ROIC trending below peers. Western Digital has underperformed on both metrics relative to peers. FQ4 ROE was 5%, below the industry median of 7%. ROIC for the same period was 3%, below the industry median of 8%. ROIC has been flat over the past three quarters.

WDC quarterly ROE and ROIC trends

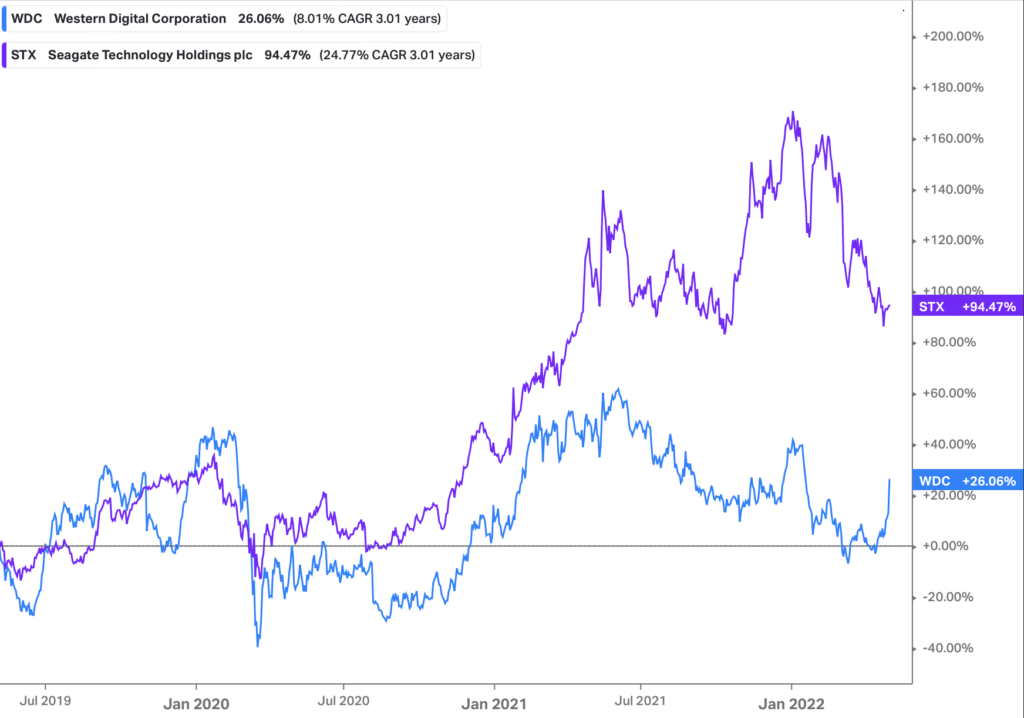

Seagate’s decision to stay out of consumer storage paid off. Western Digital expanded its flash memory (NAND) business through acquisitions and investments to address the disruptive rise of flash-based solid-state drives (SSDs), which are faster, smaller, more power-efficient, and less prone to damage than traditional HDDs. WDC now generates more than half its revenue from flash-based products. In contrast, Seagate (STX) didn’t chase WDC into the volatile and CAPEX-intensive NAND market. Instead, STX doubled down on HDDs with cheaper and higher-capacity drives, reduced its exposure to the consumer market, and focused on selling cheaper HDDs to cost-conscious enterprise and data center customers. Seagate’s approach has generated outsized returns versus WDC’s more aggressive response to SSDs. Over the past three years, Seagate’s stock has appreciated >90% versus 26% for WDC shares over the same period. In addition, STX has demonstrated more stable growth because the company isn’t heavily exposed to volatile NAND prices. STX also returns most of its cash to investors through buybacks and dividends.

A tale of two storage players: WDC and STX three-year performance

FQ3 results were solid, but slowing growth is a concern. Revenues in WDC’s most-recently reported FQ3Y22 grew 6% YoY to $4.38B. Importantly, however, growth has slowed for both the company’s HDD and Flash segments. Looking more closely at segment trends, Cloud remains the best grower, at $1.77B (+25% YoY). Within this segment there was a near 40% increase in nearline (high-capacity) disk drive revenue. Enterprise SSD and video disk drive are showing slower growth. Revenues from client product sales were $1.7B (-2% YoY), although client (PC) SSD sales improved, owing to PC manufacturers addressing supply chain problems. Consumer product revenues declined 8% YoY to $875M as retail SSD sales have slowed.

Supply chain, NAND contamination hurting margins. Additionally, concerns have centered around forward EPS growth, which will be curbed by Chinese COVID lockdown measures, supply chain issues, and a recent flash fab contamination issue at two of the company’s NAND fabs. The contamination depleted ~7 exabytes– just under 10% of all flash sold worldwide in a quarter. On the earnings call, Goeckeler indicated “We expect a bit of growth next quarter. We won’t be all the way back, but we’ll — we expect to accelerate from where we were this quarter.”

Guiding down for FQ4. WDC guided down to revenues of $4.5B-$4.7B– below the $4.9B reported in the year-ago quarter (-6.5% YoY at the midpoint of guidance). In the near term, slowing quarter-on-quarter growth across WDC’s business segments is a concern.

Red flag: overboarding risk. Taking a close look at governance, one member, Paula Price, is overboarded, currently serving at 4 other companies in addition to WDC: Warner Brothers, Bristol Myers Squibb, Davita, and Accenture.

WDC: Current board scorecard

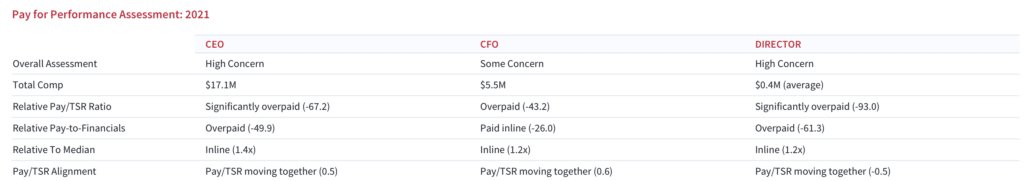

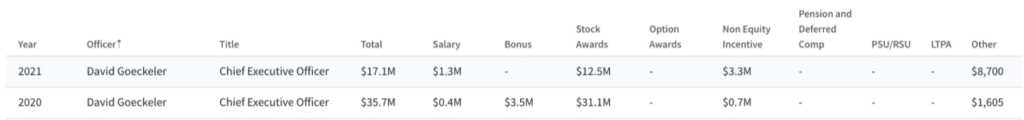

Red flag: executive compensation.CEO David Goeckeler was paid $17.1M in 2021, well above TSR ratio and overall financial performance. WDC directors were paid $0.4M on average, similarly above performance metrics. Notably, 91% of shareholders voted in favor of the company’s executive compensation plan in 2020, during which Goeckeler was paid $35.7M.

CEO David Goeckeler and WDC directors significantly overpaid relative to TSR

CEO compensation trends: Sizable pay in 2020

New CFO. Western Digital’s CFO Wissam G. Jabre recently joined in February of this year. Previous CFO tenures have been fairly short — between 2-3 years.

No dividend or buyback until leverage comes down. WDC suspended its dividend in 2020 and hasn’t repurchased any shares since the first quarter of 2019. The company ended its most recent quarter with $7.06B in long-term debt and has no plans to reinstate its dividend or buybacks until it further reduces leverage.

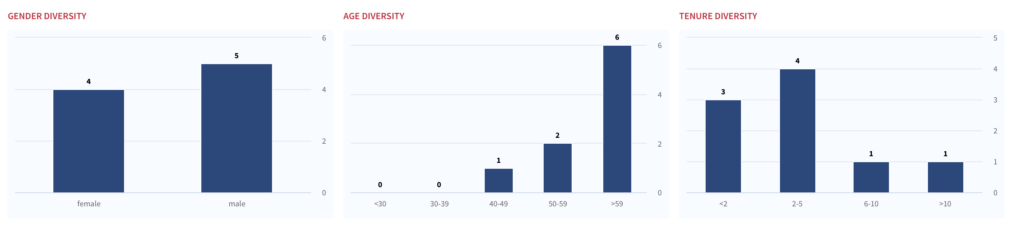

WDC: Gender Diversity & Inclusion Snapshot

WDC shares remain discounted largely on consumer exposure. While the growth in WDC’s cloud-oriented HDD and flash businesses remains healthy, growth in the consumer-facing businesses is likely to remain depressed. A separation would allow WDC shares to re-rate in line with the higher growth and profitability of the core business. Concerns surrounding ongoing supply chain challenges and a post-lockdown slowdown in PC sales have clearly pressured the valuation, with WDC shares currently trading at 5x EBITDA, a discount to STX at 8.3x. Applying a conservative STX multiple to WDC’s consensus 2023E EPS results in a fair value estimate of $78 for WDC shares, which represents ~26% upside to WDC’s current share price (~$62 as of this writing).

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.