Jana’s Scott Ostfeld Brings a Strong Track Record from ConAgra

Jana Now Has 3 Directors at TreeHouse Foods (THS). Jana Partners filed a 13D/A form with the SEC disclosing ownership of ~9.2% of private-label food company TreeHouse Foods (THS).TreeHouse Foods also appointed Scott Ostfeld, a Jana partner, to its board. Ostfeld’s appointment comes a year after settling with Jana and appointing two independent directors to the company’s board. Last month, TreeHouse said it would not pursue a sale of the whole company, but will continue to explore potential divestitures, including its meal preparation business.

Jana has a successful track record in this space. Jana has extensive experience in food industry, with a successful track record in the consumer retail space and involvement in sales of Pinnacle, PetSmart, Safeway, Whole Foods and the spinoff of the Lamb Weston business by ConAgra Brands (CAG).

The ConAgra Effect. Ostfeld has stepped down from the Board at ConAgra, where he served since 2019, to take on this role. Other board positions include three years at industrial distributor HD Supply Holdings, where he served a three-year board tenure. Jana acquired an over 8% stake in the company and pressured for change. HDS was ultimately acquired by Home Depot (HD) in November 2020. Notably, Jana was instrumental in pushing ConAgra to sell its private label business to Treehouse for $2.7B back in 2016. Here’s the quick history. ConAgra first entered the private label business in November 2012 via the $5B acquisition of Ralcorp Holdings. At the time, coming out of a recession, the private label business looked like a potential growth lever for Conagra, which was struggling with older brands that were losing ground with consumers. But the acquisition proved to be unwieldy and problematic. ConAgra struggled to the combine the two businesses, downsizing the sales force excessively while reducing prices, which eroded margins and earnings. The private-label business also sold a lot of cereal and pasta, which became declining categories as consumers shifted other food options. Jana started building a position in CGA stock and became an outspoken critic of the deal, which carried with it roughly $2.2 billion in write downs, and ultimately pushed for the sale of the business to Treehouse.

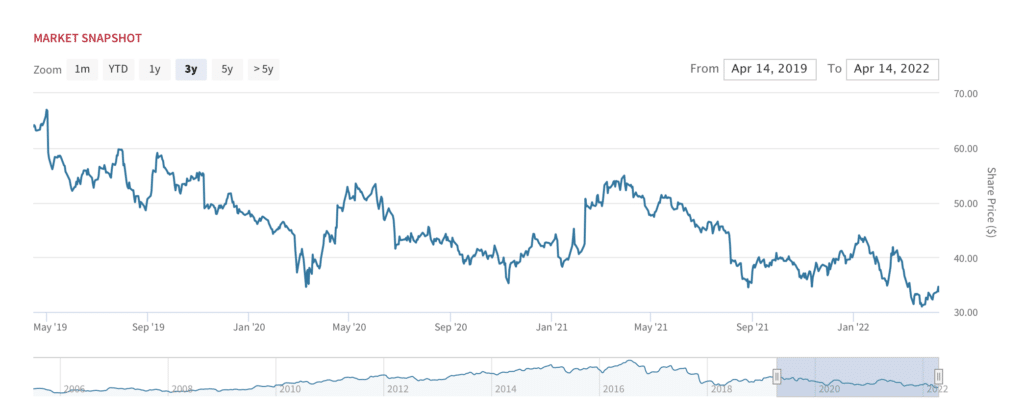

THS: More Pruning Necessary. For TreeHouse, the acquisition of ConAgra’s private label business further bolstered the company’s position as a giant in the business of manufacturing off-brand products. But the company quickly faced the same problems as ConAgra: integrating and streamlining operations. TreeHouse, which has grown through more than 40 mergers, has spent the past several years downsizing, including closing plants, cutting jobs and divesting business units. To be fair, THS is several years into an extensive turnaround program and has made improvements its product portfolio, go-to-market strategy, and supply chain and service operations. That said, the stock has languished, prompting Jana’s involvement early last year. THS stock has declined ~36% over the past 12 months, versus a 5% gain for the S&P500 over the same period.

THS: A Broken Stock

Recent board changes. Today, Treehouse announced Joseph E. Scalzo joins the Board of Directors, effective immediately. John P. Gainor Jr. and Ashley Buchanan will resign from the Board, effective April 30, 2022. Scalzo brings over 30 years of experience in the consumer packaged goods industry, having Since 2013, he has served as the CEO of Atkins Nutritionals. (“Atkins,” now known as Simply Good Foods USA, Inc.), and as a member of its Board of Directors. Scalzo has also served as CEO and President of The Simply Good Foods Company and a member of its Board of Directors since its acquisition of Atkins in July 2017.

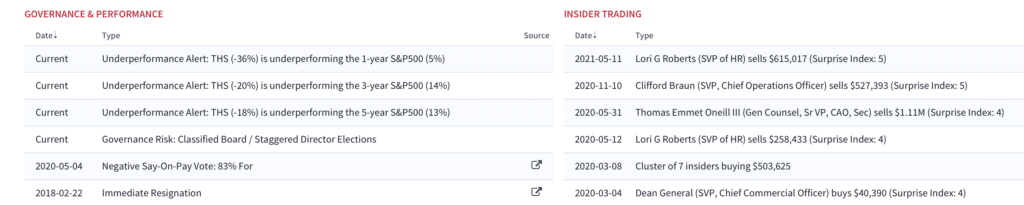

Other red flags. In addition to the obvious underperformance of THS stock, Treehouse has a classified board, which allows directors to serve varying term lengths and limits the number of board members up for re-election in any given year. Executive compensation is another issue to watch, with an 83% vote in favor (May 2020).

Red Flags and Insider Trading

Insider ownership. Recent events at Twitter (TWTR) bring to light the Board’s ownership. After all, most investors like to see a board who has skin in the gamer. As Elon Musk points out, the vast majority of Twitter’s board ownership is in the hands of co-founder Jack Dorsey, who owns ~2.4% of the company, versus about ~2.6% owned by the entire board. In the case of THS, the 10-K notes an equity compensation plan of 2.3M shares (55.6M shares outstanding).

Jana’s End Game May Be to Take Treehouse Private. As a pure-play private label business, TreeHouse has strong secular tailwinds– particularly in an inflationary environment. Private label brands are cheaper for consumers and more profitable for retailers. As a result, grocers are increasingly allocating more shelf space to private label products. From a relative valuation perspective, THS, as one of the only pure play private label manufacturers, lacks many direct comps. Lamb Weston Holdings (LW) is the second largest private label company, albeit the company has a more concentrated portfolio (frozen potato products). We think the opportunity here for Jana is to sell THS to private equity. JANA also knows the potential buyers in this space– having sold similar companies in the past to firms like Cerberus, Veritas, BC Partners and Clayton, Dubilier and Rice. Also of note: Jana successfully advocated for a sale of supermarket chain Safeway to Albertsons (ACI) back in 2014.

What’s THS Worth? With LW trading at 17x EBITDA, THS shares appear discounted at these levels. As a comparison, in 2018, Post Holdings (POST) sold part of its private label business to Thomas H. Lee Partners for ~10 times EBITDA. Applying a conservative 10 times multiple on THS’s trailing EBITDA would imply a target price for THS in the $38 range, or ~15% upside to current levels. However, we argue that THS, with operational improvements, should be worth closer to 12x – 14x EBITDA, which would imply incremental upside.