Daniel Loeb targets Cano Health. As the deSPAC firesale rages on, let the arbitrage begin.

Cano Health (CANO) is trading up ~38% intraday after Daniel Loeb’s Third Point disclosed an increased stake in the company to 1.5M shares. Given the shares’ recent decline, there isn’t much of a bump to the firm’s position (6.37%, versus 6.25% previously). That said, this is the first time a prominent activist is targeting a company that went public via a SPAC in recent years.

CANO provides primary health services for seniors. Cano Health operates full-service health care services through approximately 71 medical centers in Florida, Texas, Nevada, and Puerto Rico. The company has grown through several regional acquisitions.

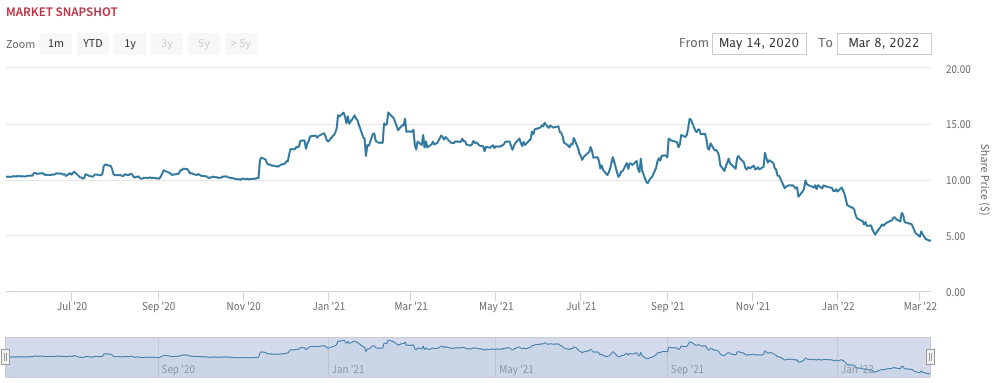

Strong statement about the deSPAC market. CANO shares are down ~ 58% from ~$15 peak in September 2021. Loeb is pushing for a sale of the company. What’s interesting here is his rationale: the market doesn’t like SPAC mergers. “Given recent developments at the Issuer and taking into account the market’s largely unfavorable view of companies taken public through special purpose acquisition vehicles, (Third Point) believe the Board of Directors should immediately engage financial and legal advisors to commence a review of strategic alternatives,” Third Point states.

Start of a trend? Private Equity may be the future exit path for many deSPACs. Activists like Third Point, given an event-driven, value-oriented investing bias– generally don’t start campaigns to force a strategic review without a deep understanding of potential acquisition targets. With most deSPACs are trading at significant discounts, there may be an arbitrage opportunity here for select ‘good’ deSPACs—particularly for private equity firms looking for good turnarounds. The only deSPAC-PE example to date is Soc Telemed (TLMD), which announced an acquisition by Patient Square Capital (expected close 2Q).

CANO: It’s been a familiar downhill run since deSPAC

Cano delayed release of Q4 and full year results. In late February, Cano (CANO) announced it was delaying the release of its Q4 and full-year 2021 results after discovering “certain potential non-cash adjustments to account for revenue recognition” that “relate to how and when the Company accrues revenue related to Medicare Risk Adjustments.” The bright spot is that the adjustments impact revenue recognition timing, not cash or receivables.

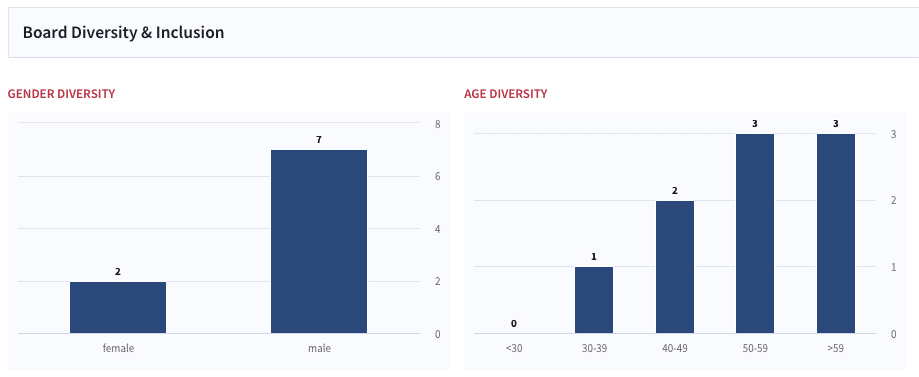

Red flag: overboarding. Barry Sternlicht is overboarded—who serves on the board of 4 companies: EL, CANO, VLD, and STWD. The board has been in place since they completed the DeSPAC transaction in June-2021. Notably, Loeb doesn’t plan to seek board seats now but may do so in the future if Cano’s board does not “adequately address the value gap” between the company’s share price and its intrinsic value.

CANO: Board Diversity and Inclusion Snapshot

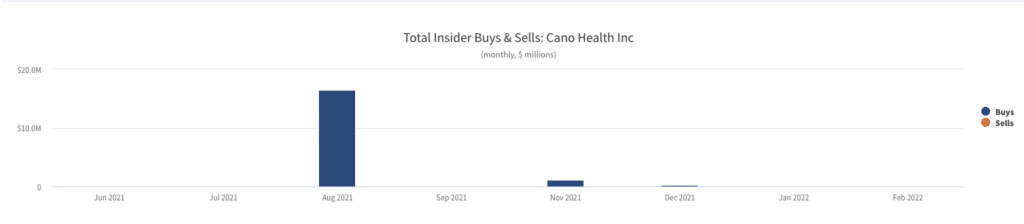

Insider Buying. Insiders purchased $17.8 million over the last 12 months– a potential signal regarding an M&A-based exit strategy.

Private investors, retailers and health insurers are pouring into primary-care. This trend has accelerated since the COVID-19 pandemic. The competition to acquire physicians is intensifying with CVS and others increasingly vying for doctors. UnitedHealth Group (UNH) added about 10,000 last year; Walgreens Boots Alliance (WBA) paid $5.2 billion for a controlling stake in clinic chain VillageMD in October. It’s been speculated that Cano could be a target for a company like Aetna/CVS Health Corp. (CVS) which is beginning to acquire into primary health. In addition to CVS, Cano is also partnered with Humana Inc (HUM), UnitedHealth Group, Anthem Inc. (ANTM). Humana owns ~5% of CANO.

Less noisy than usual for Loeb. This seems a lot less noisy than Loeb’s recent campaigns. Back of the envelope here says that CANO shares are discounted at 0.5x forward sales/2x book. Balance sheet is a concern: Cano had $208.9 million in cash and $927 million in debt as of December 2021.

Binary event; we’re not inclined to jump in on takeout speculation. For CANO, there are two possible outcomes: the company 1) starts executing to close the valuation gap; or 2) gets acquired, potentially by an HMO or private equity firm. Given the weak fundamentals and cash situation, this looks more like a distressed situation and we are not inclined to jump in on takeout speculation.

A good time to start sifting through the deSPAC wreckage. The main investing takeaway here is to start looking at good deSPAC businesses that may be undervalued by the market. Caremax (CMAX) is another deSPAC in the group getting a lift.