December Delivers: SPAC Issuance Caps a Quietly Resurgent 2025

Boardroom Alpha SPAC Resources

– Full SPAC Listing

– SPAC SEC Filings

– Boardroom Alpha IPO & SPAC Intelligence Platform (7-Day Trial)

December didn’t just close out the calendar year, it confirmed that the SPAC market has decisively re-entered the public-markets conversation.

After two years of retrenchment, 2025 marked a broad-based reopening of the SPAC IPO window, capped by one of the most active Decembers since the 2021 peak. The resurgence has been driven less by speculative growth narratives and more by sponsor quality, tighter structures, and a renewed focus on infrastructure-adjacent themes.

December 2025: A Busy Finish to a Rebuilt Market

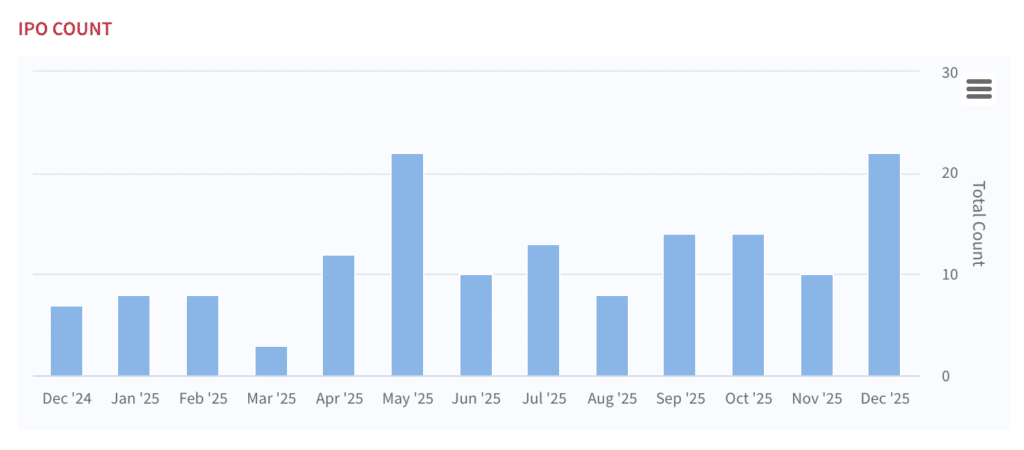

December saw 22 SPAC IPOs, raising approximately $5.3 billion in gross trust proceeds. That compares with just 10 IPOs and $1.8 billion in the prior month, underscoring how sharply issuance accelerated into year-end. It also narrowly missed beating out May as the biggest month for SPAC IPOs despite the holidays squeezing the monthly window.

The pace extended beyond IPOs alone. During the month:

- 28 S-1s were filed, signaling a healthy early-2026 pipeline

- 5 deals were announced and 4 transactions closed, a modest but notable improvement from November

- No SPAC liquidations occurred in December, a sharp contrast to earlier periods of forced wind-downs

This combination—heavy IPO volume, continued filings, and declining liquidations—points to a market that is stabilizing structurally, not merely enjoying a short-term issuance window.

The December IPO Class: Breadth Over Hype

The December SPAC cohort was notable for its breadth rather than exuberance. Twenty-two vehicles came to market across a wide range of sponsor types and thematic mandates, with most pricing cleanly around trust value.

Notable December IPOs included:

- Churchill Capital Corp XI (CCXI) – Michael Klein’s latest vehicle, reinforcing the continued dominance of serial sponsors

- Karbon Capital Partners Corp. (KBON) and SilverBox Corp V (SBXE) – extensions of established sponsor franchises

- Crane Harbor Acquisition Corp. II (CRAN) and Iron Horse Acquisition Corp. II (IRHO) – repeat sponsors returning with tighter structures

- Bitcoin Infrastructure Acquisition Corp. Ltd. (BIXI) – one of the few crypto-adjacent offerings, notably focused on infrastructure rather than tokens

Across the board, December SPACs emphasized industrial technology, energy, infrastructure, and “picks-and-shovels” digital assets, rather than the pre-revenue consumer or mobility concepts that defined earlier cycles.

Full-Year Context: 2025 by the Numbers

December capped a year that marked a decisive reset for the asset class.

For 2025 as a whole:

- 212 S-1s filed, up sharply from 75 in the prior year

- 144 SPAC IPOs completed, raising $30.4 billion, versus 57 IPOs and $9.1 billion last year

- 75 deals announced and 43 mergers closed, though deal completions lagged issuance

- SPAC liquidations fell dramatically, with 10 liquidations in 2025 compared to 53 the year before

The data tells a clear story: capital formation has recovered faster than deal execution. While sponsor confidence has returned, the de-SPAC process remains selective, time-consuming, and highly negotiated.

What’s Driving the Rebound?

Sponsor credibility has replaced thematic hype.

Serial sponsors and established investment platforms dominated issuance in 2025, reflecting investor preference for execution risk over narrative risk.

Structures have normalized.

December IPOs largely featured reduced warrant coverage, cleaner promote economics, and clearer guardrails—features increasingly demanded by institutional buyers.

Infrastructure is the connective tissue.

Whether in energy, industrial automation, data centers, or digital-asset plumbing, 2025 SPACs skewed toward businesses tied to long-duration capital investment rather than discretionary growth.

Looking Ahead to 2026

With more than 170 active SPACs now searching and deal announcements trailing IPO formation, the next phase of the cycle will hinge on execution. Either 2026 becomes a year of accelerated mergers—or sponsors will face renewed pressure as clocks begin to matter again.

For now, December’s activity confirms that SPACs have reclaimed a role as a credible, if more disciplined, capital-raising vehicle. The market may never return to its 2021 excesses—but it no longer looks like an experiment on life support.