Activist Anson Funds is pressing Clear Channel Outdoor (CCO) to explore a full sale, according to Bloomberg, arguing that the company’s standalone path is unlikely to deliver strong shareholder returns. The stock jumped ~7% on the news. We wanted to take a closer look at this situation, especially in the context of a potential proxy fight if CCO is unable to materially improve returns and chooses not to fully explore a sale.

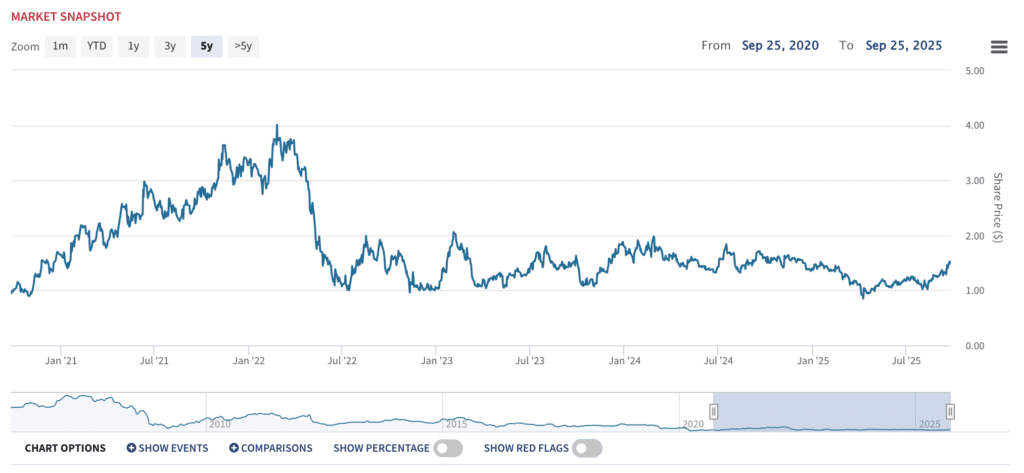

Clear Channel Outdoor shareholders have suffered steep losses. Will a sale happen or is a proxy fight next?

Does a Sale Make Sense?

We’ll leave it to others to decide. But the market’s initial reaction—a 7% stock rise—suggests investors see real merit in Anson’s thrust. Meanwhile, CCO is still carrying heavy leverage (near 10× EBITDA), and its multi-year growth and deleveraging plans may not suffice to deliver differentiated returns.

Does Anson Have Experience with Clear Channel?

Anson’s campaign at CCO is informed by the playbook Sagar Gupta honed at Legion Partners. Legion entered a cooperation agreement with CCO in early 2024, leading to the appointment of Ted White to the board as an independent director under terms negotiated with Legion. Under the agreement, Legion agreed to standstill and voting commitments in exchange for board influence, while CCO committed to a search for additional independent directors and governance reforms. While Gupta had left Legion by the time the cooperation agreement came to fruition, he’ll almost certainly have the necessary background and insight from the build up.

Has Anson Been Successful Elsewhere?

At Match Group (MTCH), Anson applied a similar approach — acting as a governance catalyst, forcing board refresh, and creating credible pressure on management without necessarily escalating to a full-blown fight.

Will Anson and Clear Channel Go to a Proxy Fight?

If Clear Channel’s board resists a sale, Anson still has room to escalate. With the 2026 shareholder meeting and a nomination deadline at the end of February, the board has time to initiate or signal a sale process. If it does not, Anson could nominate directors directly and make its case to investors.

Is CEO Scott Wells Under Pressure?

It’s worth noting that CEO Scott Wells will also be under particular pressure as his Boardroom Alpha Hot Seat Score — a measure of how likely it is for a CEO to be dismissed in the next six months for performance reasons — remains at an elevated level. So, the board could consider jettisoning Wells as part of a story to shareholders about improving returns with a new strategy, but we see that as an unlikely move.

Could the Board Withstand a Proxy Fight?

Governance weaknesses—especially an insider-tilted board with limited digital and transformation experience—leave the company exposed to activist pressure. Many board members have little public company track record outside of CCO. Chairman Benjamin Moreland will be a familiar name for those following activist campaigns; he was on the Crown Castle (CCI) board when Elliott successfully pushed for changes, won board seats, and Moreland ultimately resigned.

| Director | Rating at CCO | Total Shareholder Return at CCO |

Overall Rating | Overall TSR | Currently a Director At | Previously a Director At |

|---|---|---|---|---|---|---|

| Andrew W Hobson | C | -17% | D | -31% | CUMULUS MEDIA INC | |

| Jinhy Yoon | C | -17% | C | -19% | ||

| Joe Marchese | C | -17% | B- | -16% | NATIONAL CINEMEDIA INC | |

| John D Dionne | C | -17% | B- | -8% | CAESARS ENTERTAINMENT CORP, SEQUENTIAL BRANDS GROUP INC | |

| Lisa Hammitt | C | -17% | C | -19% | ||

| Raymond T White | C- | -8% | C- | -11% | ||

| Scott Wells | C | -20% | C | -21% | ||

| Thomas C King | C | -17% | C- | -24% | CONCORD ACQUISITION CORP, CONCORD ACQUISITION CORP II, GCT SEMICONDUCTOR HOLDING INC, RADIUS GLOBAL INFRASTRUCTURE INC, SVB FINANCIAL GROUP | |

| Timothy P. Jones | C- | -7% | C- | -6% | ||

| W Benjamin Moreland | C | -17% | C | 3% | CHENIERE ENERGY INC | CROWN CASTLE INC, CALPINE CORP, MONOGRAM RESIDENTIAL TRUST INC |

So could the board withstand a proxy fight? To help answer the question we also consulted Boardroom Alpha’s Vote Guidance Engine using a model focused on whether or not the board is meeting its fiduciary responsibilities — ie are they delivering returns for shareholders. According to the model, all directors would receive a vote AGAINST. So using a data-driven approach plus the context on the board and CCO, we don’t see a compelling case that could be made by management that would convince shareholders with steep losses to support them.

Shareholders have already shown low support at director elections.

Shareholder discontent with the board is already apparent, if not glaring. At the 2025 meeting all board members, except Legion connected Ted White, support below 92% after receiving low support in 2024. While these numbers are dramatically low, they are meaningfully lower than the average support for directors which tends to be over 96% in an average director election.

Our Take

Boardroom Alpha remains neutral on whether a sale is inherently optimal. However, we do believe Anson is well positioned to gain board influence if CCO cannot deliver for shareholders. Given Gupta and Anson’s track record, the board’s relative weakness, the market’s positive reaction to the news, and big, return-focused investors like Ares and Legion owning significant stakes, a proxy fight is not our baseline expectation.

But if a fight does occur, Anson is likely to win seats.