Galata Acquisition III Debuts for $150M Making it 91 SPAC IPOs This Year. Alphavest Acquisition Extension Vote. CSLM Separate Trading Begins.

Boardroom Alpha SPAC Resources

– Full SPAC Listing

– SPAC SEC Filings

– Boardroom Alpha IPO & SPAC Intelligence Platform (7-Day Trial)

Daily SPAC Update

SPAC IPO UPDATE

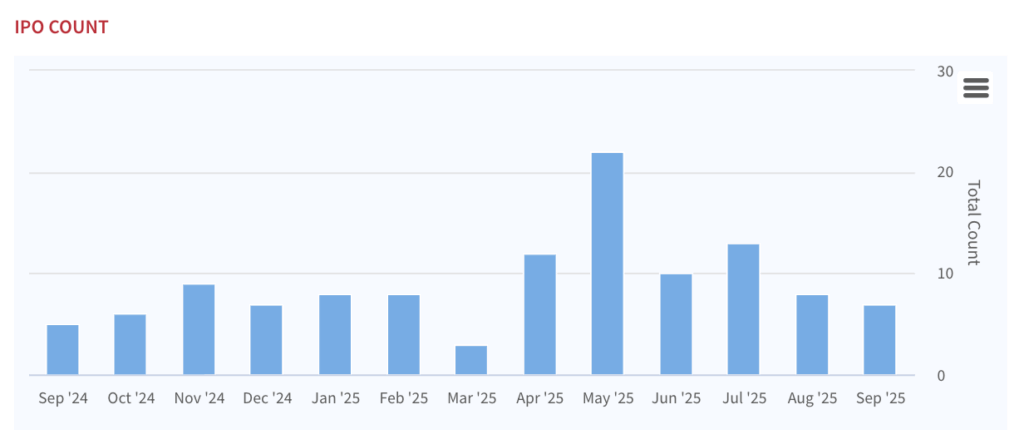

Glatata Acquisition’s $150M debut brings the 2025 SPAC IPO count to 91 year-to-date. That’s already on pace to double last year’s total—a clear sign that SPACs are regaining momentum. Still, the story isn’t all fireworks.

May’s surge gave hope for a sustained breakout, but since then the market has settled into a slower, steadier rhythm. Activity has cooled, but it hasn’t vanished—far from it.

The big picture: SPAC IPO activity is now at its highest sustained level since the peak-SPAC era. While the pace may not match the mania of 2021, the consistency we’re seeing today could be even more important for market health. For participants, that means opportunity in a market that’s more in balance and sustainable as a vehicle for public market activity.

EXTENSION VOTES

ATMV – ALPHAVEST ACQUISITION CORP * vote Sept 19, 2025 -> extend from September 22, 2025 to January 22, 2026

SEPARATE WARRANTS/RIGHTS

Sep 19: CSLM DIGITAL ASSET ACQUISITION CORP III LTD (KOYN)

NEW SPAC IPOs

Sep 19: LATA – Galata Acquisition Corp. III $150M IPO

Sep 16: CHECU – Chenghe Acquisition III $110M IPO (+underwriter overallotment: $16.5M)

Sep 12: OTGA – OTG Acquisition Corp. I $200M IPO (+underwriter overallotment: $30M)

Sep 10: BLZR – Trailblazer Acquisition Corp. $240M IPO (+underwriter overallotment: $35M)

Sep 09: TLNC – Talon Capital Corp. $225M IPO (+underwriter overallotment: $24M)

SPAC Movers

YESTERDAY’S TOP SPAC GAINERS

12.76% ~ $ 15.11 | ATMV – ALPHAVEST ACQUISITION CORP (Announced)

5.12% ~ $ 11.50 | WLAC – WILLOW LANE ACQUISITION CORP (Announced)

4.45% ~ $ 22.06 | CEP – CANTOR EQUITY PARTNERS INC (Announced)

2.38% ~ $ 13.35 | DMYY – DMY SQUARED TECHNOLOGY GROUP INC (Announced)

2.09% ~ $ 11.25 | CCCX – CHURCHILL CAPITAL CORP X (Announced)

YESTERDAY’S TOP SPAC LOSERS

-14.67% ~ $ 10.47 | FACT – FACT II ACQUISITION CORP (Pre-Deal)

-4.12% ~ $ 12.11 | ISRL – ISRAEL ACQUISITIONS CORP (Announced)

-.79% ~ $ 10.10 | IROH – IRON HORSE ACQUISITIONS CORP (Announced)

-.40% ~ $ 11.88 | ATMC – ALPHATIME ACQUISITION CORP (Announced)

-.38% ~ $ 10.37 | ALDF – ALDEL FINANCIAL II INC (Pre-Deal)

LATEST SPAC IPO PERFORMANCE

Sep 16 | $ 9.98 | CHECU – Chenghe Acquisition III

Sep 12 | $ 10.02 | OTGA – OTG Acquisition Corp. I

Sep 10 | $ 10.03 | BLZR – Trailblazer Acquisition Corp.

Sep 09 | $ 10.01 | TLNC – Talon Capital Corp.

Sep 04 | $ 10.07 | SVAC – Spring Valley Acquisition Corp. III

Sep 04 | $ 10.10 | GSRF – GSR IV Acquisition Corp.

Aug 27 | $ 10.06 | MBVI – M3-Brigade Acquisition VI Corp.

Aug 27 | $ 10.07 | KOYN – CSLM Digital Asset Acquisition Corp III, Ltd

Aug 21 | $ 10.16 | CEPF – Cantor Equity Partners IV, Inc.