Introduction

September brought market participants “back to their seats” (is that still a thing?) though SPAC market activity (and sentiment) remained largely unchanged, if not a touch bit more negative, given the carnage in the broader equity market. Announced deals were largely on par with August, as were deSPACs and liquidations. We’ll dive a bit more into the details below, and leading off with another big unknown for SPAC participants, in an asset class already ripe with large unknowns… the excise tax.

Excise Tax Man Cometh?

In conjunction with the Inflation Reduction Act there has been a lot of chatter about whether a (perhaps unintended) consequence of the legislation is that it will a trigger a 1% tax on SPACs that liquidate without completing a business combination starting in 2023. While we are not lawyers here at Boardroom Alpha (see this Cooley note for a good overview), it does appear certain SPACs are getting spooked and are looking to liquidate early, making sure to avoid any incremental tax that might come as a result of the IRA.

While the tax is not expected to affect non-US domiciled SPACS (we see you Bill Foley), there are a ton of uncertainties related to this new legislation. Who will pay? The sponsors? Investors? Money from trust or elsewhere? As such, and given the already terrible market merger dynamics, we’ve seen several SPACs file to move their liquidations into 2022 from 2023, and thus avoiding a potential 1% tax on redemptions.

- Liberty Media Acquisition (LMACA) is a big one to fall. The firm cited that it was “not feasible” to complete a transaction and “U.S. tax law could create corporate-level tax liabilities in connection with stockholder redemptions” and thus will seek to liquidate in December 2022 rather than January 2023

- NightDragon Acquisition Corp. (NDAC) is seeking to accelerate its expiration from March 2023 into 2022

- Both of Bill Foley’s (although non-US domiciled and perhaps exempt from the tax), Austerlitz Acquisition Corp. I + II (AUS, ASZ) will seek to liquidate in 2022

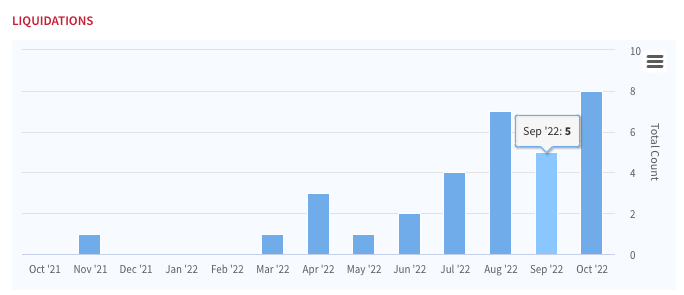

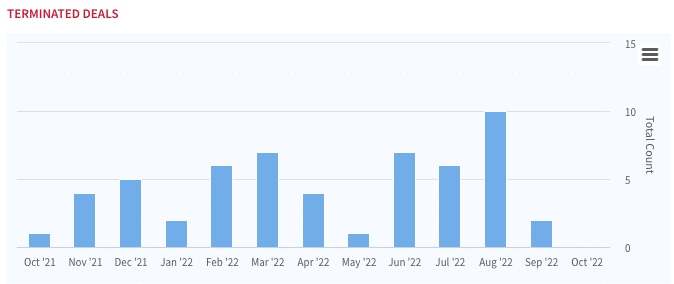

Chalk it up to another obstacle surrounding SPACs, one which will have an unintended spike in liquidations which are obviously already on the rise.

Liquidations and Great Maturity Wall

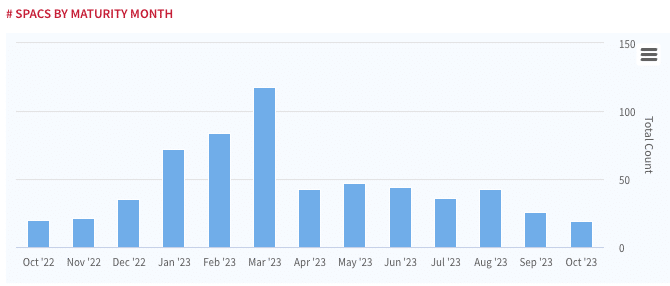

While liquidations are already on the rise, today’s levels surely wont hold a candle to what we have coming in 2023 with ~270+ SPACs set to expire within the first 3 months of the year.

Surely, some sponsors have deals, some will strike deals and others will seek to extend. But expectations call for a majority of those outstanding vehicles to return its capital to shareholders unless market conditions change drastically. It’s taking longer and longer for deals to close and with just 5 months until March, it’s highly unlikely to see a dramatic reduction in SPACs not liquidating.

SPAC Merger Activity

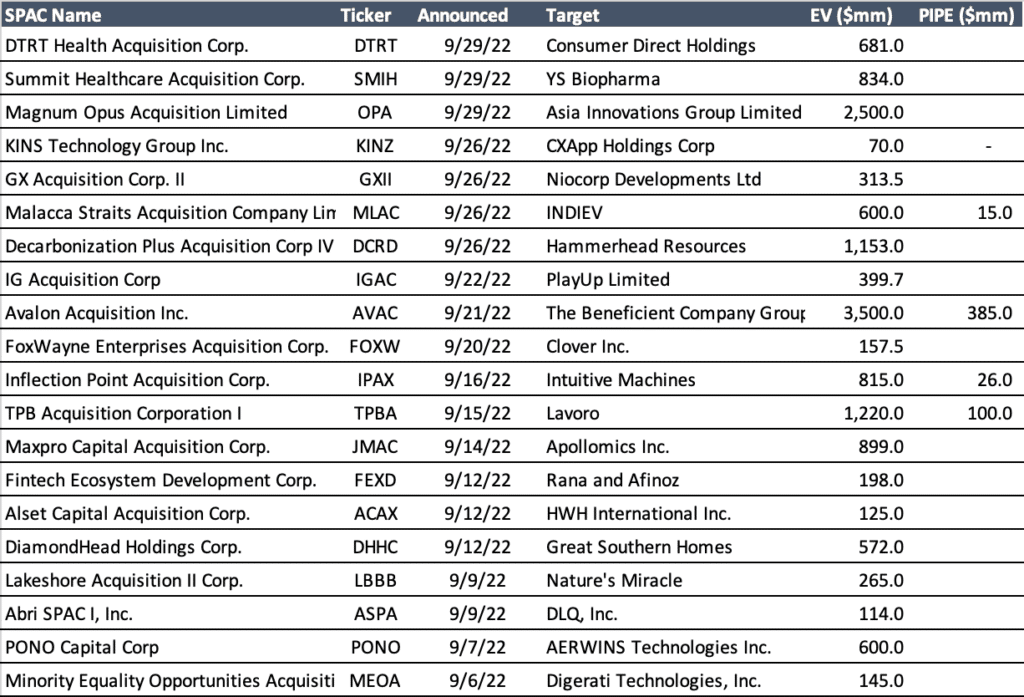

A pretty solid 20 new definitive agreements were announced in September, a slight uptick from August’s 19, and offset by just 2 deal terminations, making the highest net-new SPACs looking to close months in some time. Average deal size of ~$750M is definitely down from the hey day, and brought up by a few outliers including The Beneficent Company and Asia Innovations Group, both valued at over $2B.

September SPAC Deal Announcements

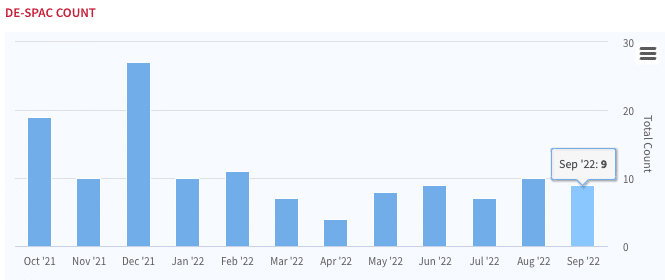

SPACs completing DeSPACs continue to trudge along at a pretty slow pace with just another 9 completions in September. In addition the market took a blow with Cohn Robbins Holding Corp. (CRHC) announced that its (previously shareholder approved) deal with Allwyn would be called off do to capital reasons. The market could’ve used a high-profile well funded deal from market veterans to help regain its footing.

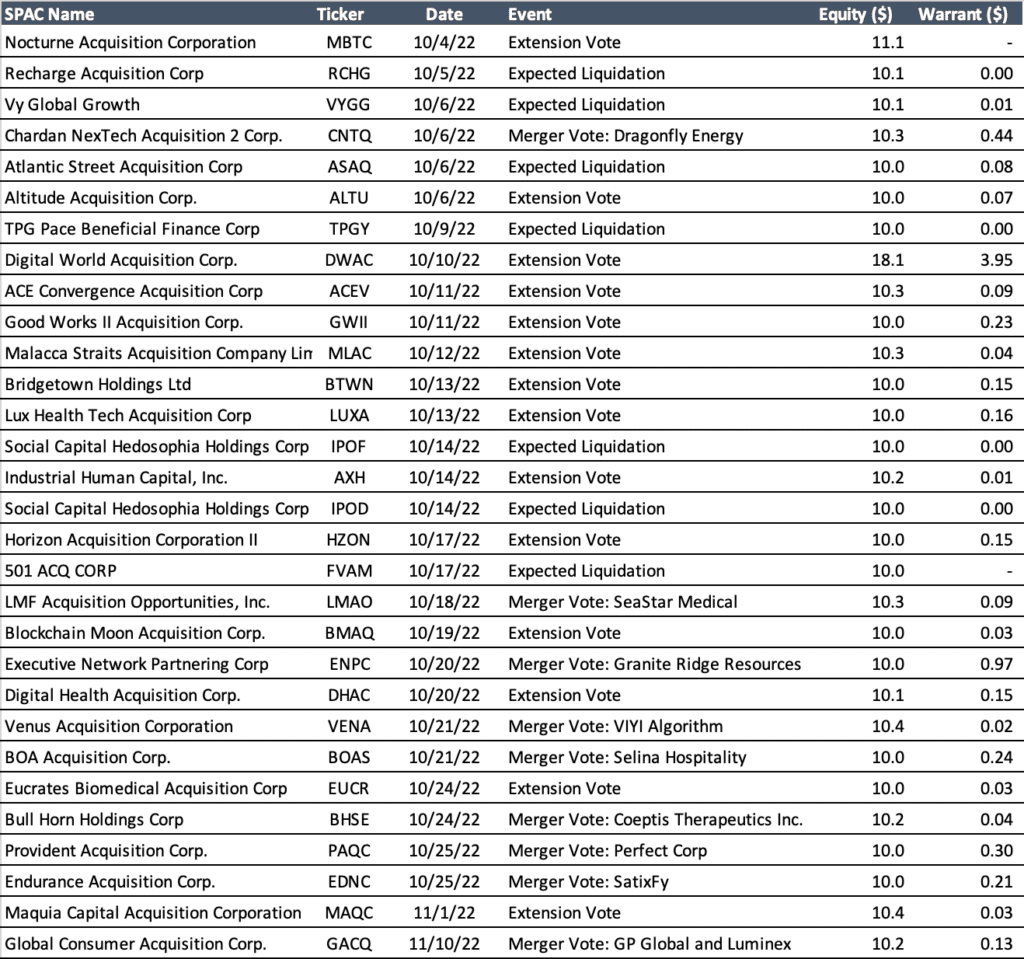

As such, there still remains 125 SPACs with picked targets in the closing process. There are ~9 SPACs that have either preliminary or definitive vote dates for their DeSPAC transactions. See the calendar below for upcoming dates.

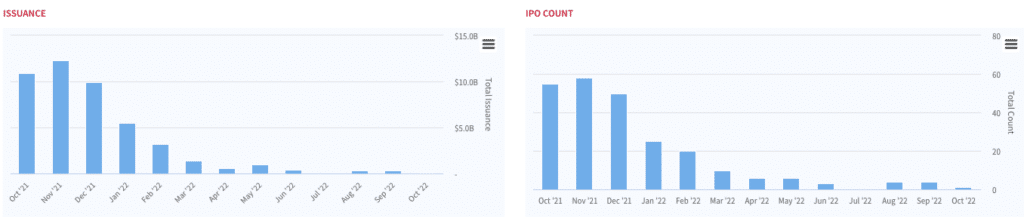

SPAC IPOs – Inching Along

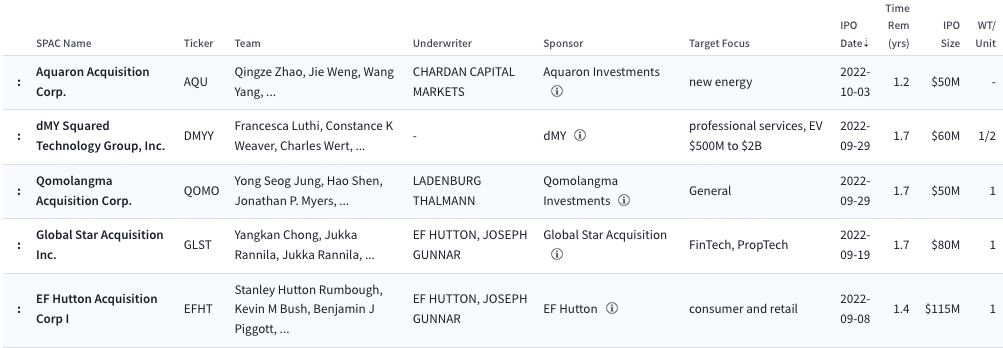

SPAC IPO activity continues to tread along at a massively depressed rate compared to the irrational exuberance meme days. However, it’s not dead. In one of the brighter moments in recent memory a respected, serial sponsor brought a new vehicle with Niccolo de Masi and Harry You’s dMY pricing a new IPO, dMY Squared Technology Group (DMYY) a $60M vehicle. While that’s a smaller trust size than they are used to, it’s a good sign that existing real-sponsors aren’t jumping ship and expect the product to stick around.

ICYMI we spoke to dMY’s Niccolo de Masi in a broad ranging conversation on SPACs and his targets.

Recent SPAC IPOs

What’s Next?

Extensions extensions and more extensions. With just 9 merger votes scheduled there are 14 extensions on the calendar (+ the handful that are voting to liquidate early), so be sure to keep an eye out on the vehicles that are looking to extend and those that are likely to call it quits.