The world is a scarier place, which should be a good thing for Palantir. With Q1 earnings sending the stock into a downward spiral, we take a look at fundamentals and governance.

What’s next for Palantir? Data analytics company Palantir (PLTR) has always been a controversial stock– mostly to the company’s relationship with U.S. defense and intelligence agencies and the role played by Peter Thiel, the company’s chairman and co-founder, who lately has become a vocal supporter of Republican political candidates with ties to former president Donald Trump. Much of Palantir’s government work is classified, and its ties to defense operations and Homeland Security and ICE can be controversial. The company, which provides artificial intelligence and data analytics services to mostly to government customers, has come under fire in the past for controversies involving racial discrimination, spying and copyright infringement. Since its inception in 2003, Palantir has been deepening relationships with government customers (over 50% of sales) and is now firmly established as a cornerstone software solution within the US Government. More recently, however, Q1 government revenue growth slowed to 16% year-over-year– the lowest in the company’s history– raising concerns about Palantir’s ability to meet its goal of sustainable year-over-year revenue growth above 30%. Coupled with the lack of profitability (PLTR is losing ~$100 million a quarter), shares look like they are in the penalty box for the foreseeable future.

PLTR shares down over 70% from 52-week high. Palantir went public in September 2020 via direct listing at a market cap of $16.5B. Though PLTR shares skyrocketed over 280% during the pandemic, Palantir has struggled over the past year owing largely to valuation and a sector rotation away from technology stocks. PLTR shares have declined 56% over the past year, versus a 7% decline for the S&P500 over the same period. Shares are down 73% from a 52-week high of $29.

Diminished confidence on PLTR’s 30% growth target. Palantir’s predictable history of beat-and-raise quarters has come to end, with the company reporting minimal upside to consensus revenue forecasts in its most recently-reported quarter. Q1 revenue of $446.4 million (+ 31% YoY) was slightly above guidance and consensus of $443 million. More concerning, however, was Palantir’s disappointing Q2 guidance, which called for revenue of $470 million (+6% QoQ). The soft guide has raised concerns about the company’s ability to sustain its 30%+ top line growth trajectory. Backing out contributions from the company’s SPAC investments, Palantir’s total deal value actually declined in Q1.

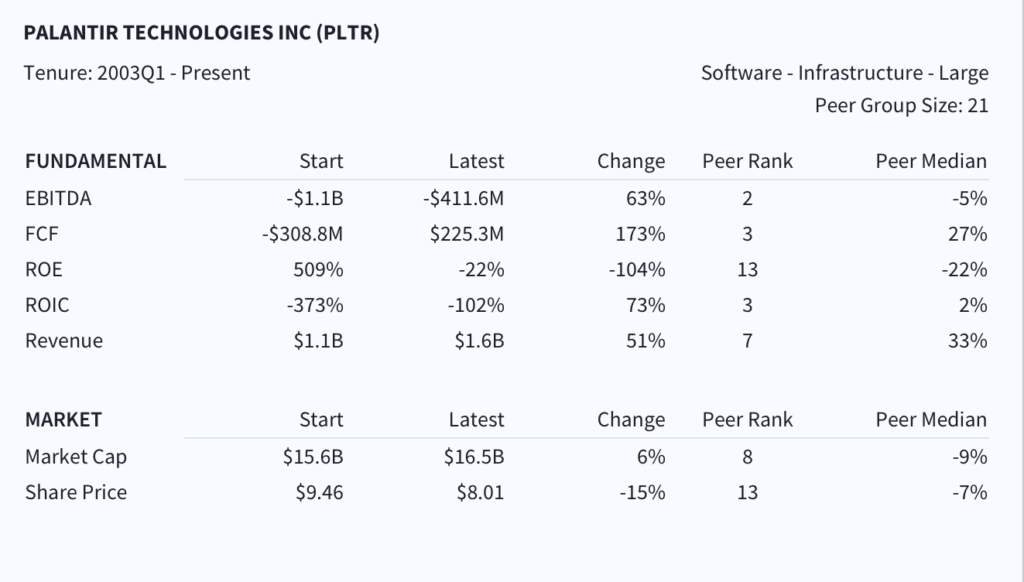

PLTR CEO Alex Karp: Performance scorecard

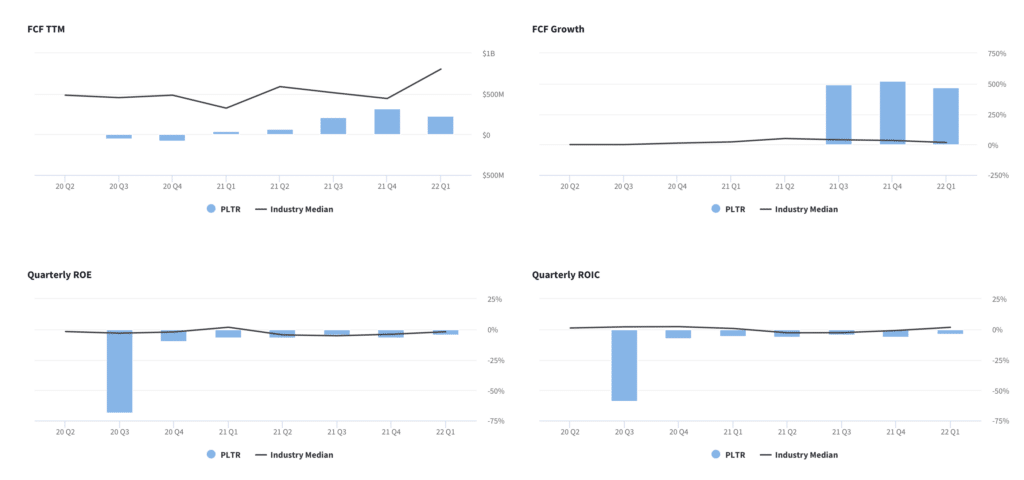

Could use more cash flow to justify the valuation. Despite being operating as a company since 2003, Palantir remains unprofitable, although consensus estimates expect EPS breakeven by 2024. The company generated $225.1 million in FCF in Q1, a decline from $321.2 million in Q4.

Backing out of SPAC investing should un-ruffle feathers. Palantir has been investing in PIPEs for a number of companies involved in SPAC mergers that also committed to buying Palantir software. Palantir generated $326 million in revenue from SPAC-related investments in 2021. Critics view Palantir’s investment strategy as a diversion from the core business and an artificial boost to revenues. Additionally, because Palantir has made investments in companies it also considers customers, this dynamic has a quid pro quo appearance that doesn’t sit well with many investors. The flip side to this argument is that the program has allowed Palantir to test, trial and adapt its software to the needs of smaller companies and early stage start-ups. As of Q1, Palantir had $252.6 million of marketable securities on its balance sheet. Business development chief Kevin Kawasaki indicated that Palantir generated $39 million in revenue from SPAC-related deals in Q1, and that those customers should generate revenue of about $30 million a quarter on a continuing basis. In the latest quarter, those customers accounted for about 19% of Palantir’s commercial revenue. Palantir also indicated it won’t be doing any more SPAC deals. We view this as a positive move that should help improve perception.

Red flag: multi-share-class structure. Palantir has an unusual multi-share-class structure that concentrates control among its founders, including Thiel and CEO Alex Karp. There are 3 share classes. The public has access to Class A shares and is entitled to one vote per share. Class B shares are mostly owned by Palantir founders and receive 10 votes per share; that ownership will likely trend up via the exercise of warrants and stock options and restricted stock units. Class F shares are held in a voting trust established by Palantir founders, further concentrating control of the company. As of May 2, 2022, there were 1,946,706,268 Class A shares; 98,883,190 Class B shares; and 1,005,000 Class F shares.

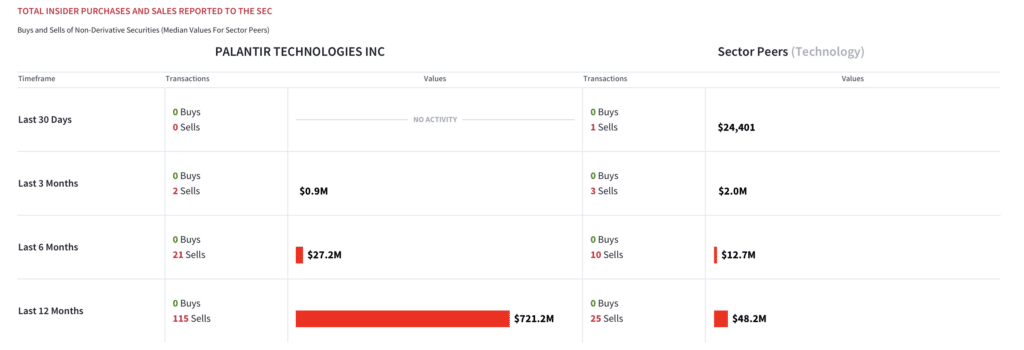

Red flag: insider selling. PLTR insiders sold $721.2 million worth of stock over the last 12 months, well above sector peers. Karp has been a strong seller of stock– $1.1 billion in sales over his tenure. The majority of Palantir’s board have been strong sellers. There has been no inside buying (by directors or officers) in the last year.

Built for danger. As Karp made clear on the company’s Q4 earnings call in February, “bad times are very good for Palantir” because its products are “built for danger.” As the pandemic-related chaos and the Ukraine conflict have shown, we live in a world faced with complex and dangerous geopolitical risks, which increases the need for Palantir’s ability to manage, integrate and analyze highly complex large data sets. In a recent letter to shareholders, Karp’s tone has become more dark. Commenting from World Economic Forum in Davos, Karp said the world significantly underestimates” the threat of nuclear conflict in eastern Europe. “The lesson for every big country is ‘holy s—. We’ve been buying all this heavy stuff and if people are willing to fight as heroes, fight to the last person … they might actually be able to beat us’.”

Without a catalyst, shares appear stagnant for now. Taking an eagle eye view on Palantir, while government revenue has slowed, the company’s long term business strategy — which is supplying the U.S. government and its allies cutting edge tech– remains intact. The question is more what’s the fair value for the stock. The knock on Palantir is that it’s an overvalued defense stock, as opposed to a software technology stock. We disagree with this view. That said, while Karp wants to remind investors that the world is indeed a scarier place, that doesn’t necessarily mean Palantir will get a near-term bump from the recent Ukraine conflict. The slowdown this quarter is particularly noteworthy given that Palantir has been steadily gaining traction in its government segment. The bottom line is that we think it will take time for money to flow from legislators to the Treasury, and ultimately to businesses. We think PLTR shares are fairly valued here at 23x F2024E EPS.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.

Latest Podcast: Pet Care in a Post-Pandemic World

Our latest podcast explores one area of consumer spending that could be a pocket of strength emerging from the pandemic: pet care. To dive into the details, Boardroom Alpha sat down with Garrett Smallwood, CEO of pet services provider Wag Labs. Wag! has a pending business combination with SPAC CHW Acquisition Corp.(CHWA), slated for Q2. Also read our overview here.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.