What are Interlocking Directorates / Board Interlocks?

Board interlocks are where a person affiliated with one organization sits on the board of directors of another organization. For example, if a director sits on both the boards of Tesla (TSLA) and Ford (F) those boards and that director would be considered interlocked.

Why do Board Interlocks Matter?

Typically interlocking directorates are viewed as posing a potential risk of collusion or anticompetitive behavior. These risks rise significantly when officers and directors are serving simultaneously on the boards of competitors.

Are Board Interlocks Legal?

Section 8 of the Clayton Act (Section 8) prohibits directors and officers from serving simultaneously on the boards of competitors, subject to limited exceptions.

On October 19, 2022, the Justice Department released a notice stating that it had required 7 directors across 10 interlocked companies to remove directors that created the interlock.

What Does Section 8 of the Clayton Act Say Regarding Interlocking Boards?

The section of the Clayton Antitrust Act prohibiting any person from simultaneously serving as an officer or on the board of directors of competing corporations (known as an interlocking directorate or interlock). Section 8 prohibits interlocks if the corporations are engaged in commerce and have capital, surplus, and profits exceeding certain thresholds, as revised annually by the Federal Trade Commission. Certain safe harbors and exemptions apply to Section 8, including based on the degree of competition between the corporations.

Source: https://content.next.westlaw.com/practical-law/document/I9c43ebe029b711e798dc8b09b4f043e0/Section-8-of-the-Clayton-Act

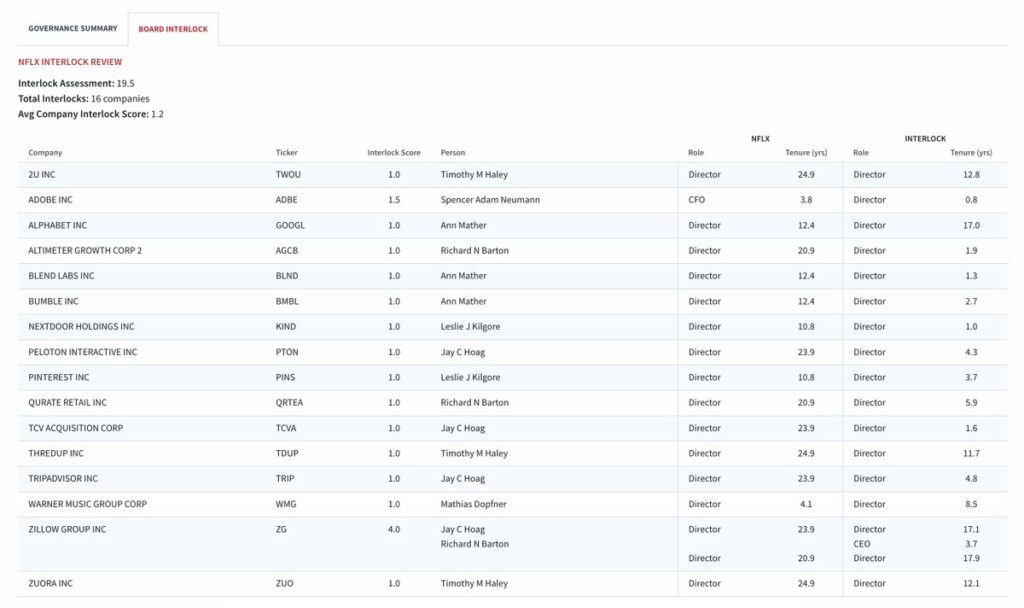

Analyzing Interlocking Directorates

The Boardroom Alpha platform enables users to evaluate all corporate and personal interlocks between companies, CEOs, CFOs, and directors. Learn more about the Governance Analytics Platform here or the Board Interlock Analysis Database here.

Additional References on Board Interlocks / Interlocking Directorates

- Via WilmerHale: Interlocking Directorates Under Section 8 of the Clayton Act: Can an Old Statute Learn New Tricks?

- Via Skadden: Interlocking Boards: The Antitrust Risk You May Never Have Heard Of

- Via Sidley: Interlocking Directorate Considerations in M&A and Proxy Contests

- via Wilson Sonsini: DOJ Launches Enforcement Initiative Against “Interlocking Directorates”

- Via ScienceDirect: The duality of firms and directors in board interlock networks: A relational event modeling approach

- via Federal Trade Commission: FTC Research / Announcements on Interlocking Directorates

- Via Department of Justice: Tullett Prebon and ICAP Restructure Transaction after Justice Department Expresses Concerns about Interlocking Directorates