Autonomous Driving (AD) and electric vehicles remain one of the most investable emerging growth themes in tech. Boardroom Alpha had a chance to sit down with Blair LaCorte, CEO of LiDAR technology startup AEye (NASDAQ:LIDR). LaCorte, whose background spans multiple industries including tech, aviation, and private equity, provided a thoughtful take on the evolution of Autonomous Driving and Advanced Safety (ADAS), why a lidar shakeout is coming, and what the carmakers really want.

The Big Picture

- LiDAR, which is short for “light detection and ranging,” allows computerized systems to develop 3D landscape models and measure variable distances.

- While lidar has historically been used for a variety of industrial (engineering and construction) applications, the tech has only recently emerged as an enabling technology for ADAS (Advanced Driver Assistance Systems) and autonomous driving.

- The automotive LiDAR market is estimated at $28 billion by 2032. Key drivers include advent of assisted driving and driverless economy and regulatory and customer demand for safer mobility and transportation.

- AEye is one of a handful of LiDAR companies to go public via SPAC IPO in 2021, including Luminar Technologies (NASDAQ:LAZR). Innoviz (NASDAQ:INVZ), Velodyne Lidar (NASDAQ:VLDR), Ouster (NYSE:OUST), and Aeva (NYSE:AEVA).

- Most LiDAR companies are at least a year away from full-scale volume production. Critics say that both the form factor and price need to come down materially before carmakers adopt the technology at scale.

- While several lidar companies have announced relationships with automakers, these are still in pre-production stages.

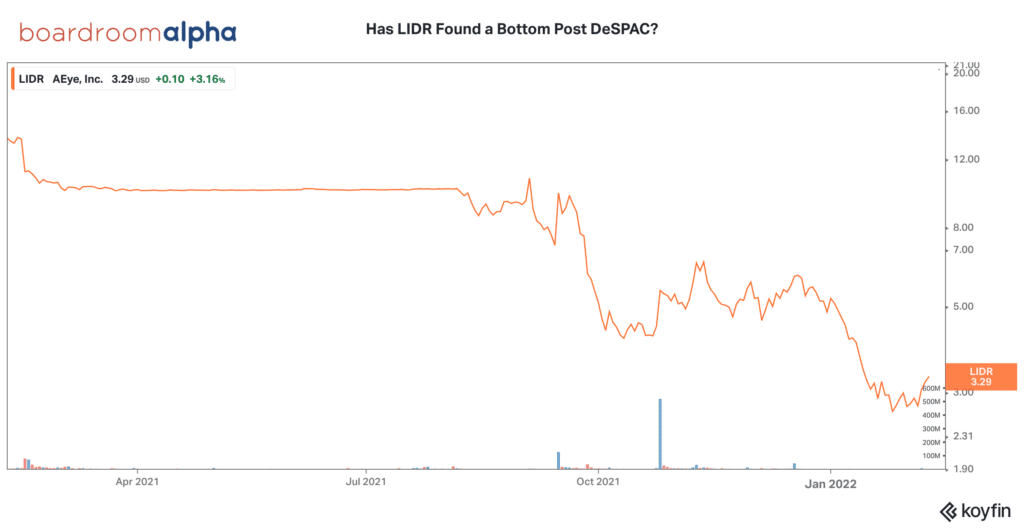

Stock Performance and Recent News

- LiDAR stocks surged in 1H 2021 on the heels of stellar electric vehicle (EV) stock performance. The group experienced a sharp pullback in 2H as revenues and profitability have largely been pushed out to 2023-2024 timeframe. Stocks have largely languished since the start of the year, consistent with the muted earnings profile of these companies and rising interest rate concerns.

- Luminar, which went public via SPAC IPO through parent company Gores Metropoulos in September 2021, is the current leader of the lidar space, trading at a premium valuation relative to the group and a market capitalization of $5.7 billion. The company has announced relationships with Daimler (OTCMKTS:DMLRY), Volvo (OTCMKTS:VLVLY), and Intel (NASDAQ:INTC) subsidiary Mobileye, among others — aspires to become a full-stack technology provider for autonomous vehicles. Notably, Volvo plans to use Luminar’s lidar on self-driving vehicles in 2022.

- Velodyne Lidar (VLDR) had a sharp upward move this week after an 8-K filing disclosed that a wholly owned Amazon (NASDAQ:AMZN) subsidiary has received warrants to purchase nearly 40 million Velodyne shares ($200 million). The warrant agreement follows Amazon’s purchase of Zoox, an autonomous vehicle startup, in 2020 for an estimated $1.3 billion.

AEye (NASDAQ:LIDR) in Brief

- AEye, with a market capitalization of $490 million, went public via SPAC in August 2021 via sponsor Cantor Fitzgerald’s CF Finance Acquisition Corp. III. (NASDAQ:CFAC). The company raised just over $200 million. PIPE investors include GM Ventures, Subaru-SBI, Intel Capital, Hella Ventures and Taiwania Capital. The SPAC had 84% redemptions.

- For Q3 2021, AEye reported revenue of $0.1 million, and a GAAP net loss of $(17.4) million or $(0.15) per share based on 114.9 million shares outstanding. Adjusted EBITDA was $(12.5) million.

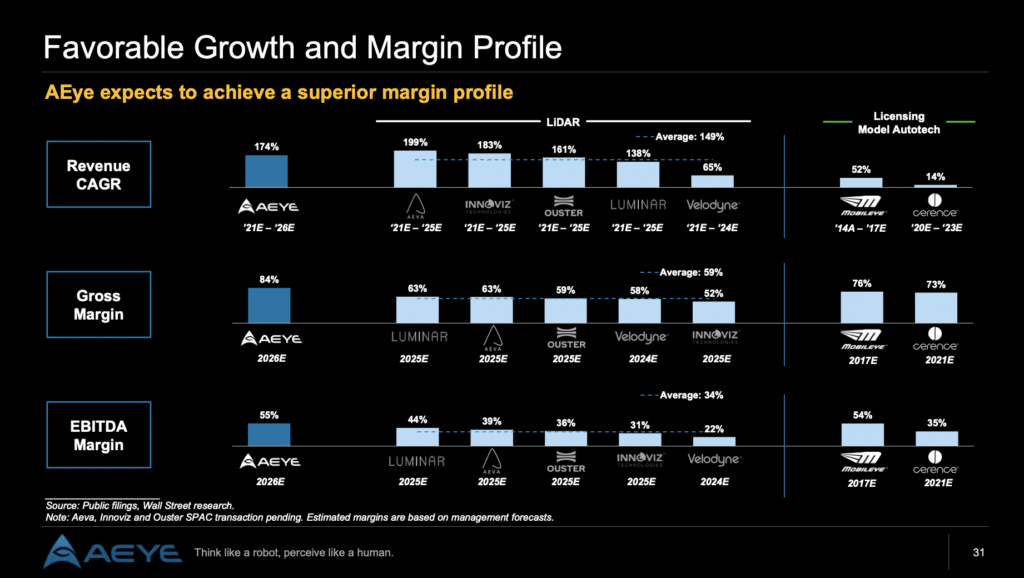

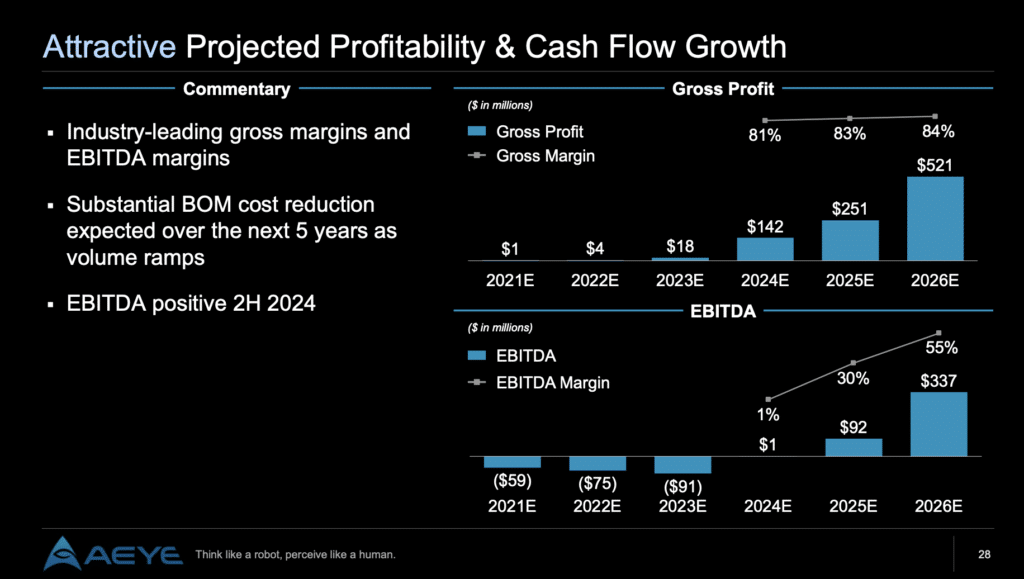

- 2023 guidance: revenue of $18 million on EBITDA of $(19) million. AEye expects to be EBITDA positive in 2H 2024 on revenue of $175 million. Revenue projections call for a CAGR of 174% over the 2021-2026 period.

- Taking a unique approach to LiDAR, AEye has leaned into biomimicry to refine the use of lasers and make lidar sensor data collection more efficient and adaptable.

- The company’s patented “iDAR” (Intelligent Detection and Ranging) technology is a robotic solution using artificial perception that fuses LiDAR, computer vision, and artificial intelligence (AI) to create safer, smarter autonomous vehicles.

- AEye’s board is comprised of executives with backgrounds in technology, aerospace/defense, semis and automotive, but light on proven public company experience. The board is chaired by Carol DeBatiste, previously Chief Legal and Compliance Officer and Corporate Secretary at ComScore, Inc. (NASDAQ: SCOR). Other members include Luis Dussan (Lockheed Martin, Northrop Grumman) Prof. Dr. Gottschalk (Daimler-Benz AG), and Dr. Karl-Thomas Neumann (Motorola, Volkswagen).

AEye (LIDR) Financial Projections and Margin Profile

What’s Next for LiDAR

- Despite some high-profile naysayers, including Tesla (NASDAQ:TSLA) CEO Elon Musk, LiDAR technology and sensors appear well-entrenched in the autonomous car market, with almost every major manufacturer in various stages of deploying the technology to enable advanced safety features.

- After a boom-bust cycle for lidar stocks, the market is now starting to take a much more discerning view about which companies are going to get products finished from a design perspective, manufacture them on time, on budget, and at scale, and find customers to buy them.

- With a dozen or so companies competing for a handful of automotive customers, most lidar companies will fail. We expect the group to consolidate to 2-3 suppliers over time. The recent pullback in valuations sets the stage for potential M&A activity, in our view.

- With automakers still actively exploring various architectures, we don’t see any clear technology winner yet.

- Discounted sector valuations afford patient investors some time to choose a handful of winners in the sector. When evaluating LiDAR stocks, we prefer those with announced and active/operational partnerships.

LIDR Stock: Discounted valuation, but likely to trade sideways amidst cooling macro

- With LIDR shares trading at 2.6x book value, we think the stock could be a buy here for patient, long-term oriented investors. The company has a unique technology approach which should support a higher gross margin profile as volumes ramp. That said, we see little in the way of a catalyst for the shares ahead of the company’s Q4 earnings report (date TBD).

- Investors should note that sentiment around smaller, non-profitable growth stocks remains negative in a risk-off trading environment amidst interest rate sensitivity.

- Thursday’s Consumer Price Index (CPI) numbers show inflation increased 7.5% YoY in January, above consensus of 7.3%– representing the fastest rise since 198 and an acceleration from 7.0% YoY in December.

- SPAC returns have been generally weak since the start of the year. Defiance Next Gen SPAC Derived ETF (SPAK) is down 14% YTD versus a 5% decline for the S&P 500 over the same period. Tech SPACs have been the hardest hit, owing to limited profitability, lack of confidence around aggressive revenue growth projections, and rising interest rate concerns.