Elliott pushing for Board refresh and operational improvement as SU underperforms peers

Activist investor Elliott discloses 3.4% stake in Suncor Energy. Elliott Investment Management, which holds ~3.4% economic interest in Suncor Energy (SU), today sent a letter and presentation to the board of Suncor. The firm believes the company must take several courses of action, including:

- Board enhancements: Add five new independent directors to refresh governance and oversee change

- Management review: An objective review of Suncor’s executive leadership by the refreshed board

- Operations: Overhaul the company’s operational and safety culture; deliver on the company’s $2 billion cash flow improvement plan

- Enhanced capital return: Increase capital returns from 50% to 80%+ of discretionary cash flow after capex and dividends

- Strategic review: Explore opportunities to unlock the value of high-multiple assets outside of core Oil Sands business, including a strategic review of retail

Target price of C$60 or higher. Elliott believes the above changes could result in a value unlocking for Suncor shares to C$60 or higher– representing 30% upside from SU’s current stock price (C$46).

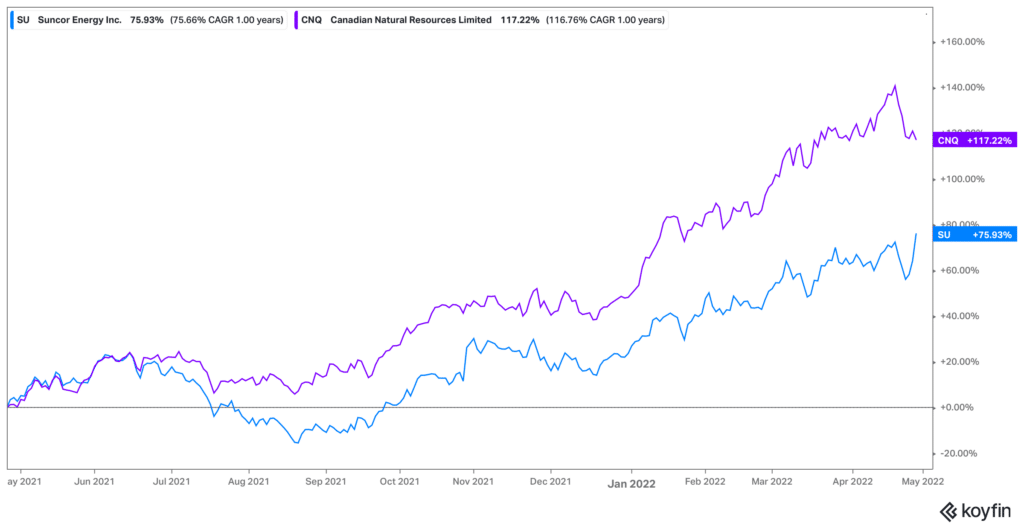

SU stock: Rising commodity inflation and geopolitical tensions have bolstered oil prices

Despite a rising tide, SU stock has underperformed peers. Suncor is an integrated energy company focused on petroleum resource basins in Canada’s Athabasca oil sands. The company markets petroleum and petrochemical products under the Petro-Canada name primarily in Canada. While SU shares have increased 67% over the past 12 months, SU stock has underperformed peers during the current oil price boom. In contrast, peers Cenovus Energy (CVE) and Canadian Natural Resources Ltd. (CNQ) are up 131% and 98% over the same period. Small cap oil sands pure-plays like MEG Energy Corp.(MEGEF) are up 162% over the past 12 months. Suncor is also the only Canadian oil-sands producer to underperform the rise in West Texas Intermediate crude prices.

Safety issues are a big overhang on the stock. Critics sight the company’s checkered operational track record, including a fire that resulted in an injury at a refinery last month and several fatalities in the last two years. Suncor also reduced its production guidance at its Fort Hills oil sands mine in 2021 after finding slopes in the mine were not stable. Last month, Suncor replaced its executive vice president of mining and upgrading, Mike MacSween, with former LNG Canada CEO Peter Zebedee. Suncor CEO Mark Little said on the company’s February earnings call: “As CEO, the accountability for safety and operational excellence is with me, period. Like, I own this. I know we need to do better.” Suncor says it will adopt new equipment over the next 18-24 months to avoid collisions and manage fatigue. But these safety issues are taking longer than many would like– and they’ll need resolution before the stock price can recover.

Mishandled buyback; edged out by Canadian Natural Resources (CNQ). Suncor cut its dividend during the pandemic, although the company has since raised the payout back to 2019 levels. In contrast, CNQ has doubled its dividend since 2019. At a $70B market cap, CNQ has edged out Suncor (~$51B) as the most highly valued oil and gas producer.

Divesting wind and solar assets. Suncor has made moves to try and tighten the business and focus on core operations. Earlier this month, the company announced that after a two-decade foray into wind and solar it would divest these assets to focus on its oil-sands business and hydrogen and renewable-fuels.

Discounted valuation and ‘fixable’ operational issues. SU shares trade at 1.5x book value, well below CNQ at 2.2x book. A re-rating could see SU shares trade in the C$55-$60 range, which conservatively represents ~20% upside from the current share price. We’re inclined to buy at these levels, particularly given the favorable macro.

Canadian Oil & Gas: CNQ is the bellwether

Latest Podcast: The Green Energy Movement will be Digitized, says Voltus CEO Gregg Dixon

Our latest podcast gets an up close look at a company that’s at the center of the green energy movement and an interesting name on our radar as a pure-play ESG investment. Boardroom Alpha sat down with Gregg Dixon, CEO of Voltus.

Voltus recently announced it will go public via a SPAC merger with Broadscale Acquisition Corp (SCLE). The transaction, which is expected to close 1H 2022, values Voltus at an equity value of $1.3B.

Listen to the podcast and read our overview on the Voltus story here.

Want to see more interesting growth companies up-close, hear from industry leaders and learn about the ESG trends driving the markets? Check out our latest Boardroom Alpha podcasts here.

Get in Touch

Your comments and feedback are always welcome. Let’s continue the discussion. Email me at joanna@boardroomalpha.com.